Chinese buyers seize control of hotel market

Chinese investors are swarming over Australia’s hotel market, accounting for almost half of hotel purchases so far this year.

Of the $1.7 billion in hotel properties sold in 2016, Chinese buyers have made plays worth $715 million, or around 42% of all deals, according to CBRE research.

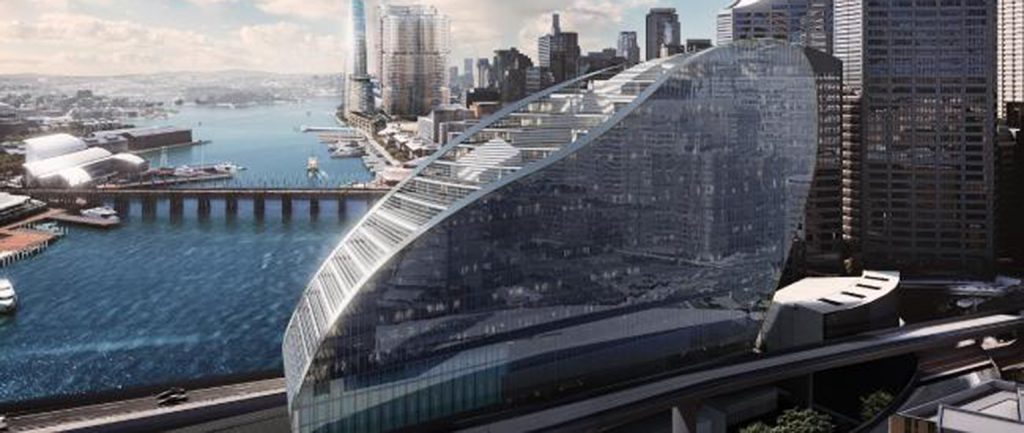

Among the purchases made already in 2016 are Grocon’s ‘The Ribbon’ at in Darling Harbour, bought by a Chinese-backed development and investment group, as well as the sale of Sydney’s Park Regis to a Chinese private capital group.

Two offerings: Prime Hotels in line for double deal

China Capital Investment Group also finalised a $25 million deal to buy South Molle Island in the Whitsundays, 18 months after snaring nearby Daydream Island Resort and Spa for $30 million.

CBRE Hotels national director Wayne Bunz says the ability to purchase freehold properties in Australia is proving increasingly desirable for Chinese buyers, who are restricted to leasehold ownership in their homeland.

South Molle Island is among a string of hotels sold to Chinese investors this year.

“Many Chinese investors are seeking generational buying opportunities, acquiring assets that they can hand down to their children, not just for one generation but for several generations to come,” Bunz says.

“They are also showing strong interest in Australian leisure assets in order to capitalise on the current strength in the tourism sector, which is benefitting from record inbound and domestic tourism.”

The increase in Chinese interest comes amid a slower year for hotel sales, with 28 properties worth $1.7 billion sold nationally by the end of September, compared to 41 assets worth $2.3 billion at the same time last year.

Bunz also says hotels in regional locales are increasingly in vogue as investors seek better returns than what they can achieve on in-demand city-based hotels.

Rydges South Park in Adelaide is expected to attract interest from foreign investors.

“The shift involves the growing volume of capital that is being invested in regional locations,” he says.

“In 2014 and 2015, transactions in regional areas comprised around 20% of total sales by value. Year to date, that figure has grown to 24% and when you look at the data by number of sales the change is even more dramatic, up from 40% to 60%.”

The news comes just days after Prime Hotels put a pair of hotels it owns – The Reef House Palm Cove MGallery by Sofitel and the Rydges South Park Adelaide – on the market.