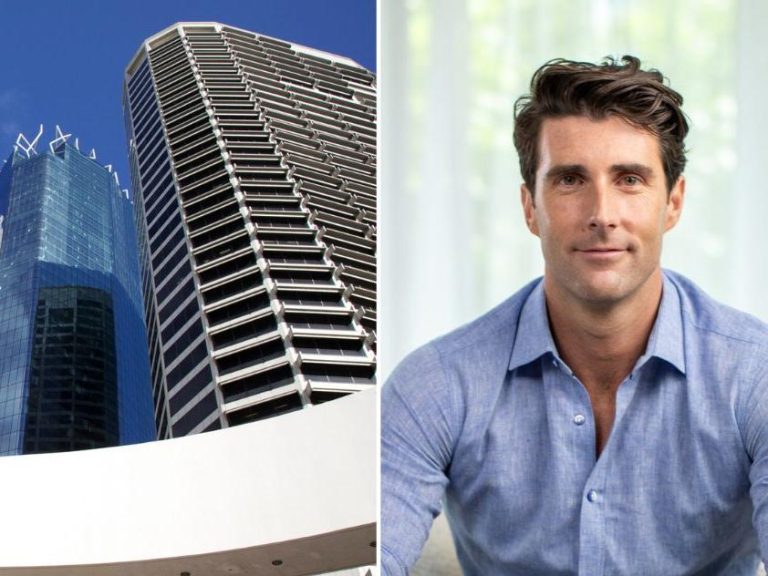

Propertylink passes CEO baton to Stuart Dawes

Float candidate Propertylink has elevated chief operating officer Stuart Dawes to chief executive, with business founder Stephen Day shifting to become vice-chairman of the group as it heads towards a $900 million listing on the Australian Securities Exchange.

When it floats later this year, Propertylink will be a $2 billion funds manager with high growth potential and ambitions to fill a critical gap in the market for an internally managed industrial Australian real estate investment trust.

Day, who will be returning to the public markets after his pre-global financial crisis days at the helm of Valad Property Group, will be an executive director and will employ his knowledge of the listed arena as Propertylink steps up from its seven years as a private entity.

Eight properties: Propertylink picks off $135m Charter Hall portfolio

Potential investors have likened the group to the early days of Goodman Group and Charter Hall.

“Being just outside the ASX 200 is a good place to be,” Day says, noting the group could expand in future. “It’s almost where Goodman was 15 years ago,” he says.

Now is the time to pass the leadership baton at Propertylink to Stuart

The executive move formalises the role of Dawes in running the company’s operations while Day has been focused on strategy and deepening ties with Propertylink’s heavyweight institutional backers.

“While I will remain actively involved in the business at board and management level, now is the time to pass the leadership baton at Propertylink to Stuart. He is the right person to guide the business through its next stage of growth and I know Stuart will be an excellent CEO,” Day says.

Both men believe that a float will assist them in winning further mandates from the investment groups they have tapped in Europe, Asia, the Middle East and the US, as their $1.7 billion funds empire grows.

Day says a listing is viewed as important by foreign groups and will boost the firm’s standing.

Dawes confirms that, subject to final hurdles, the listing is on track.

The pair have just returned from a successful non-deal roadshow marketing the company to about 50 prospective Australasian and Asian investors, handled by JPMorgan, Credit Suisse and Goldman Sachs.

Being just outside the ASX 200 is a good place to be. It’s almost where Goodman was 15 years ago

Dawes, a former Lend Lease funds executive who has been at Propertylink for seven years, says that feedback has been positive, noting that investors were drawn to growth in both the company’s funds management unit and embedded in the industrial property portfolio.

Propertylink moved early in the cycle to secure key industrial and office assets but believes that public investors can still reap the benefits from the value-add approach applied to its mainly lower-grade portfolio.

Dawes says the firm is not heavily exposed to the premium grade towers and industrial complexes where yields have plunged, making it harder for owners to reap good returns, and has instead bought shorter-leased properties and then reworked them to boost incomes.

He says the group will have good opportunities no matter how the property cycle shifts.

This article originally appeared on www.theaustralian.com.au/property.