$140m Collins St tower trades apartments for offices

Melbourne’s apartment market is showing further cracks with a Charter Hall fund snapping up a $140 million site that had been slated for a residential tower and hoping to turn it into an office building.

The site at 555 Collins St was originally offered to the market close to three years ago after Singapore’s Fragrance Group struggled to win planning approval for its skyscraper.

But the group later gained approval for a tower slightly more than half the size of its original proposal and began marketing apartments, although unit sales were slow.

Commercial Insights: Subscribe to receive the latest news and updates

Melbourne’s unit market has seen a wave of new supply in recent years and a regulatory clampdown on lending to investors and interest-only borrowers, as well as higher taxes for foreign buyers, have slowed demand for new projects.

Developers around the country have been shifting focus to owner-occupier grade product, while others have been turning residential projects into office uses or offloading sites. Cbus Property earlier this year spent about $180 million to amalgamate four sites at nearby Queen St, including from Singapore’s Chip Eng Seng, which had planned a residential tower.

The Charter Hall Prime Office Fund has now snapped up the 555 Collins St site, home to the vacant office tower Enterprise House, for $140 million.

Knight Frank Australia directors Paul Henley and Scott Newtown brokered the deal.

As the fund owns the adjacent 55 King St, the combined site of 4620sqm gives the new owner a strategic holding on the corner of Collins and King streets and the opportunity for a major office development.

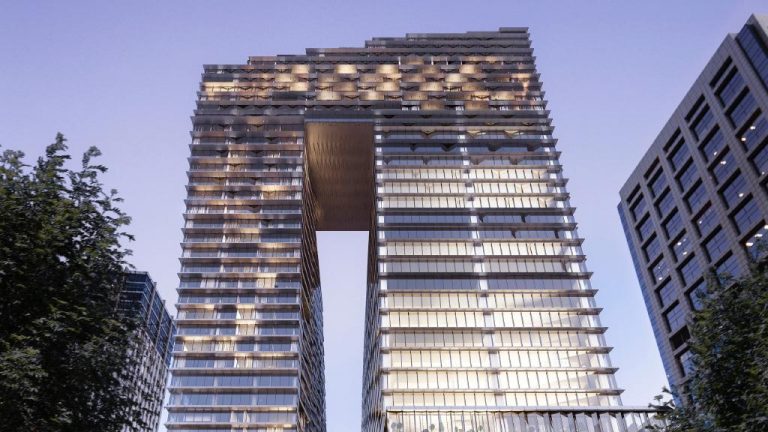

Melbourne’s west end has been busy. The site is sandwiched between the Rialto tower and Mirvac’s Olderfleet development at 477 Collins St to the east, and Lendlease’s mixed-use Melbourne Quarter tower to the west.

The fate of apartment buyers who have paid deposits for units in the planned 555 Collins St residential development was not immediately clear. The Australian has contacted Fragrance Group for comment.

Charter Hall office chief executive Adrian Taylor says the price is favourable to recent comparable deals.

“We see this investment as an exciting opportunity to create and hold another landmark office tower providing our capital partners with access to sector-leading institutional grade property investments,” Taylor says.

The fund has been bulking up its balance sheet, with a US private placement of $413.3 million completed in full-year 2018 and a recent $460 million equity raising. It has a $4.5 billion portfolio of 24 office properties, 98.7% occupied, and is tilting its portfolio to be overweight the Melbourne CBD given its relative affordability and likely growth prospects.

CPOF fund manager Matthew Brown says the acquisition was consistent with the fund’s strategy of buying sites in tightly held markets.

This article originally appeared on www.theaustralian.com.au/property.