Asia’s PAG circles CBD tower

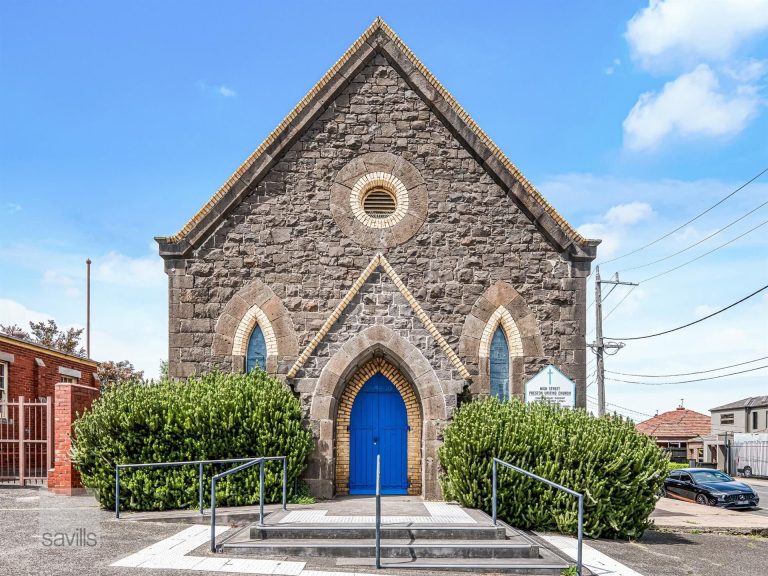

367 Collins St. Commercial property in CBD.

Asian private equity and real estate company PAG is looking to again put its stamp on local office markets with the purchase of a Melbourne tower for about $340m.

The group is in due diligence to buy the tower at 367 Collins St from Mirvac after an earlier transaction that would have seen it sold to the Goldfields Group did not proceed.

The sale would be another marker for the dramatic fall in the value of office properties, but would also show that there is demand for higher-quality properties at a price.

The Asian manager is likely to seek to raise capital to back its move, which comes after earlier purchases, including an office building picked up from Dexus in Sydney and a shopping centre bought from Vicinity funds in Perth. Each of these deals has been seen as a crucial marker of changing property values.

Asia’s PAG is set to buy the tower at 367 Collins St in Melbourne from Mirvac. Picture: Supplied

Mirvac started to make progress on its $1.3bn office disposal program last year, with Sydney’s 60 Margaret St and MetCentre going into due diligence to Ashe Morgan and Japanese trading houses including Mitsubishi and later selling for about $780m.

The Australian reported in April last year that Goldfields Group was in exclusive due diligence on 367 Collins St, but it had trouble raising capital as interest rates soared and sentiment towards offices slid.

CBRE and Cushman & Wakefield are handling the offer of the Collins St building, which was seen as likely to sell in the tough environment for larger stock, given its unique position and strong tenancy profile.

Refurbished in 2018, 367 Collins St is in the centre of the Melbourne CBD. Lobby and retail upgrades have added to its amenity, and the tower has views of the Yarra River.

The A-grade building spans 37,809sq m and has 196 car spaces. It last traded when Mirvac bought it for $228m in 2013 and was held on a capitalisation rate of 5.25 per cent.

PAG in September last year teamed with local funds house Fawkner to acquire Midland Gate shopping centre in Perth for about $465m.

That move capitalised on the dramatic shift in shopping centre values since the coronavirus crisis, as malls have been marked down heavily as big companies look to exit and opportunistic buyers emerge.

The centre was sold by a mandate client and an unlisted partnership run by the listed Vicinity Centres, which was backed by the Future Fund and Canada Pension Plan Investment Board.

PAG earlier paid $393m for a tower in Sydney’s Market St sold by Dexus. The deal on the city block showed at about a 17 per cent discount to earlier values. Office values appear to have dropped further.

Morgan Stanley analysts said profits from Mirvac’s commercial development unit in this half would be headlined by its 55 Pitt St tower in Sydney and the Aspect project in the industrial hot spot of Kemps Creek, as well as build-to-rent.

The overhaul of Sydney’s Harbourside centre and the lease-up of offices at 7 Spencer St in Melbourne’s Docklands could also provide a boost next financial year.