Aveo attempts to put RVG retirement plans to REST

Retirement group Aveo is understood to be in talks with REST Industry Super as it chases long-held plans to gain a 100% stake in the unlisted retirement group RVG.

Aveo, which also manages RVG, more than doubled its stake in the 29-village portfolio in a surprise share raid culminating last week, lifting its holdings to 73% from a previous level of 38.8% in transactions valued at more than $110 million.

The move has left REST as the only other remaining shareholder, retaining a 27% stake.

Yet Aveo continues to eye off full control.

“We bought out everyone but one investor and the aim remains, as always, to acquire all outstanding interests as long as they are (earnings per share) accretive,” Aveo chief executive Geoff Grady says.

We proposed an almost identical strategy for RVG that we were doing at Aveo to the investors in the fund, and they chose to not adopt that, and I just think that’s going down the wrong path

Aveo declined to comment on opportunities for corporate activity within the RVG portfolio, yet industry sources have confirmed Aveo and the $37 billion REST are in negotiations concerning the remaining 27% stake.

Relations between Aveo and REST have not always been rosy.

REST in past months has taken legal action to oust Aveo as RVG’s asset manager, citing returns below industry benchmarks and a failure to meet performance thresholds.

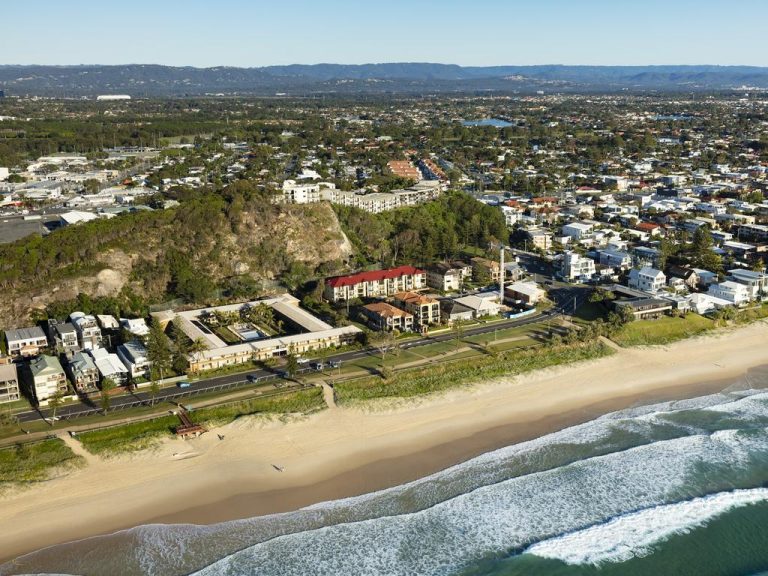

Aver owns 48 retirement villages across Australia.

RVG posted an $8.1 million profit for the financial year ending June, compared with losses of $80.1 million and $15.2 million in the two previous corresponding periods.

REST had hoped to put the resolution to a vote in early September, but was delayed by a Federal Court challenge launched by Aveo, which was later dismissed.

Aveo has fought actively in the past year to implement a development program, in addition to a host of care initiatives at RVG, in line with a similar program being rolled out throughout the broader Aveo portfolio, in which it’s targeting 5500 new units a year by fiscal 2019 and an enhanced range of care services.

“We proposed an almost identical strategy for RVG that we were doing at Aveo to the investors in the fund, and they chose to not adopt that, and I just think that’s going down the wrong path,” Grady says.

We bought out everyone but one investor and the aim remains, as always, to acquire all outstanding interests as long as they are (earnings per share) accretive

“What we can now do with our 73% stake is get to work doing all those value accretive things, with more care (initiatives) and development, because that’s what we think residents want long term.”

RVG was established more than nine years ago by Telstra Super and Macquarie Capital, which became the fund manager, while Aveo — then known as FKP Property Group — was appointed as the asset manager.

Aveo now manages a portfolio of 48 retirement villages across Australia under its own banner, with a further 29 villages operated by RVG, for which it acts as both a fund and asset manager.

The group, which is chaired by Mulpha head Seng Huang Lee, last year took out Macquarie’s investment, along with another stake held by Telstra Super, in a $55.8 million deal.

This article originally appeared on www.theaustralian.com.au/property.