Boomed more than Byron: Aussie farmland prices triple in 10 years

Farms are one of Australia’s best performing real estate assets, with prices growing just as fast as in some of Australia’s strongest residential real estate markets.

The value of farmland has tripled in the past decade, outpacing residential real estate prices in all the capitals and at the national level, a new report shows.

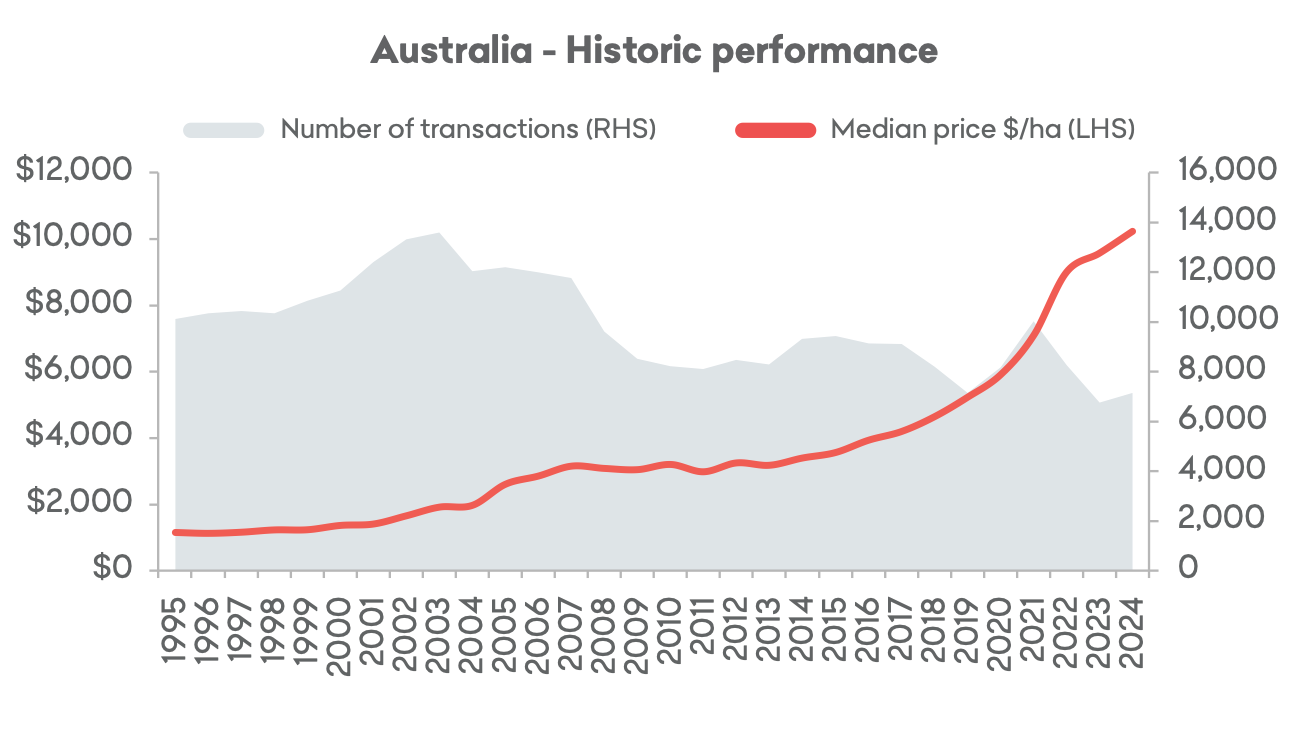

The national median price per hectare of farmland grew by 6.9% last year, according to the Bendigo Bank Agribusiness Australian Farmland Values report, released on Tuesday.

While this growth was a little slower than the previous year, on a 10-year timescale the growth rate of a typical Aussie farm is just as strong as some of the best-performing residential real estate markets in the country.

The median price per hectare of Australian farmland has grown faster in the past decade than residential real estate values in sea change hotspot Byron Bay, which was one of the nation’s best performing property markets. Picture: Getty

The national median farm value has tripled across the past decade, rising by 201% in 10 years, according to the report. This represents a compound annual growth rate of 11.6%.

By comparison, the national median home price grew by 58% in the past decade, equating to an annual rate of 4.7%, PropTrack data shows. Home prices in the best-performing capitals in that period, Adelaide and Hobart, were also off the pace of farmland, growing at just over 7% per year.

The data shows farmland values even outpaced property prices in some of Australia’s strongest markets, including sea change hotspot Byron Bay where property prices rose faster than the vast majority of Australian suburbs, growing at an average annual rate of of 11.4%.

The Australian farmland market has grown for 11 years straight, with the median farmland value now sitting at a record high of $10,231 per hectare.

Farm values in south east Queensland jumped by almost 21% last year. Picture: Getty

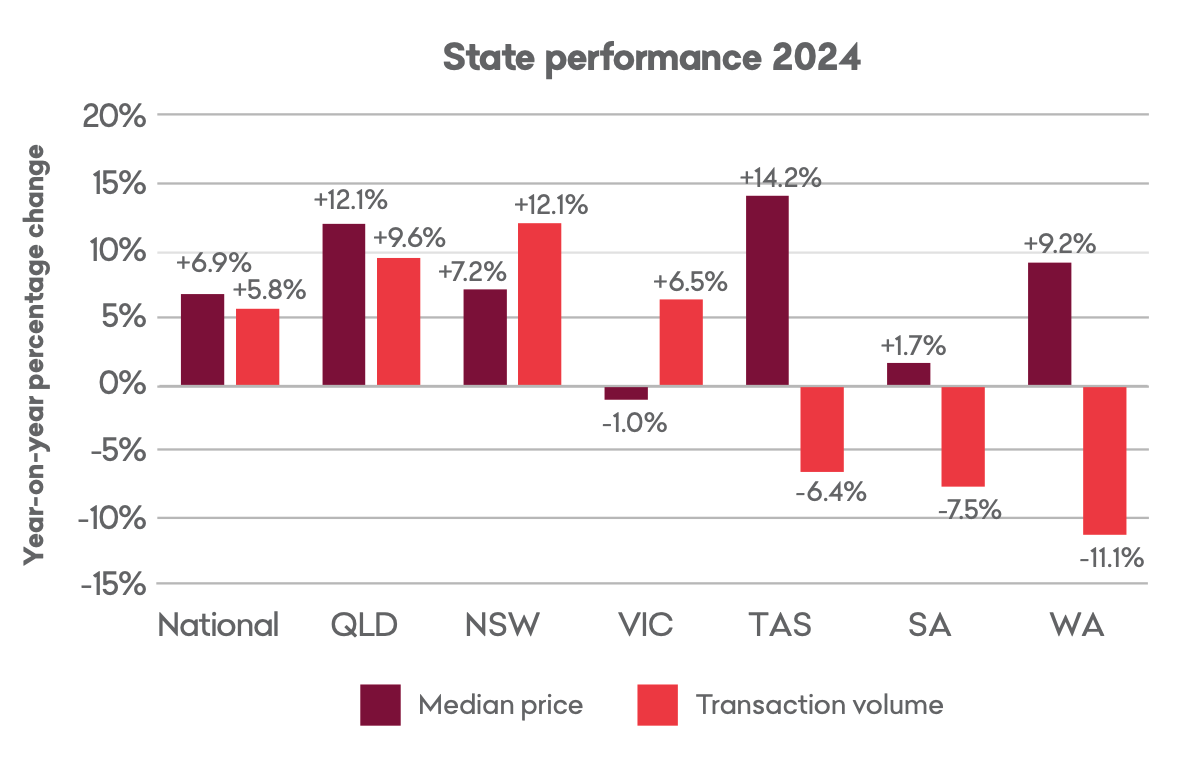

Farmland prices grew fastest last year in Tasmania (14.2%), Queensland (12.1%), Western Australia (9.2%) and New South Wales (7.2%).

Prices in South Australia were relatively flat (up 1.7%) and declined a little in Victoria (down 1%).

The number of farmland sales in Australia rose 5.8% in 2024 to 7,154, following an 18.2% decline in 2023. However, this was still the third lowest number of national farmland sales in 30 years.

Farm price growth slows as high interest rates bite

Farmland prices have moderated for the second year following the huge lift in values from 2019 to 2022, the report found, with high interest rates weighing on demand.

“While farmland remains a desirable asset, the pace of growth remains constrained, having plateaued since 2023,” said Bendigo Bank Agribusiness senior manager of industry affairs Neil Burgess.

Source: Bendigo Bank Agribusiness Australian Farmland Values 2025 Report

Conditions in the farmland market were more varied in 2024 compared to previous years, resulting in slower price growth than previous years, Mr Burgess said.

“Favourable weather in NSW and Queensland has been in stark contrast to the significant lack of rain experienced in southern regions, which has been reflected in farmland prices,” he said.

“The sharp rebound in livestock prices across late 2023 and into 2024 drove a substantial improvement in buyer sentiment, particularly across New South Wales and Queensland, with demand for farmland in grazing regions surging after an underwhelming performance throughout 2023.”

National farm sales volumes increased by 5.8% in 2024, but high price expectations from sellers meant properties remained on the market for extended periods, the report found.

Source: Bendigo Bank Agribusiness Australian Farmland Values 2025 Report

Mr Burgess said further interest rate cuts this year would support growth, but would be unlikely to drive a widespread resurgence in demand.

“While farmland availability remains tight, the mixed seasonal conditions across the country combined with ongoing uncertainty surrounding global trade and commodity markets are expected to limit the prospect of substantial growth in 2025,” he said.

Where farmland is most valuable

Tasmania has the nation’s most valuable farmland, with a median value of $23,202 per hectare.

Victoria came in second place at $14,848 per hectare, followed by Queensland ($9,870 per hectare) and NSW ($9,459 per hectare).

The region with the most valuable farmland was South and West Gippsland in Victoria at $29,335 per hectare, followed by Tasmania’s northwest ($27,019) per hectare, and the Adelaide and Fleurieu region in South Australia ($22,488 per hectare).

The northwest is Tasmania’s most valuable farming region, based on the price per hectare. Picture: Getty

The most valuable farming region in NSW was the Hunter ($13,481 per hectare), followed by the north coast ($12,956).

Queensland’s most valuable region was the south east ($15,376 per hectare), where values jumped 20.6% last year.

This growth rate was only outpaced by South Australia’s Yorke and mid-north region, which recorded a 25.9% increase to $12,386 per hectare.

Victoria’s Mallee region recorded the highest 10-year compound annual growth rate at 16.3%, followed by the neighbouring Wimmera region (15.8%), the Riverina Murray in NSW (15.4%) and Kangaroo Island (15%).

Big rebound in farm production anticipated

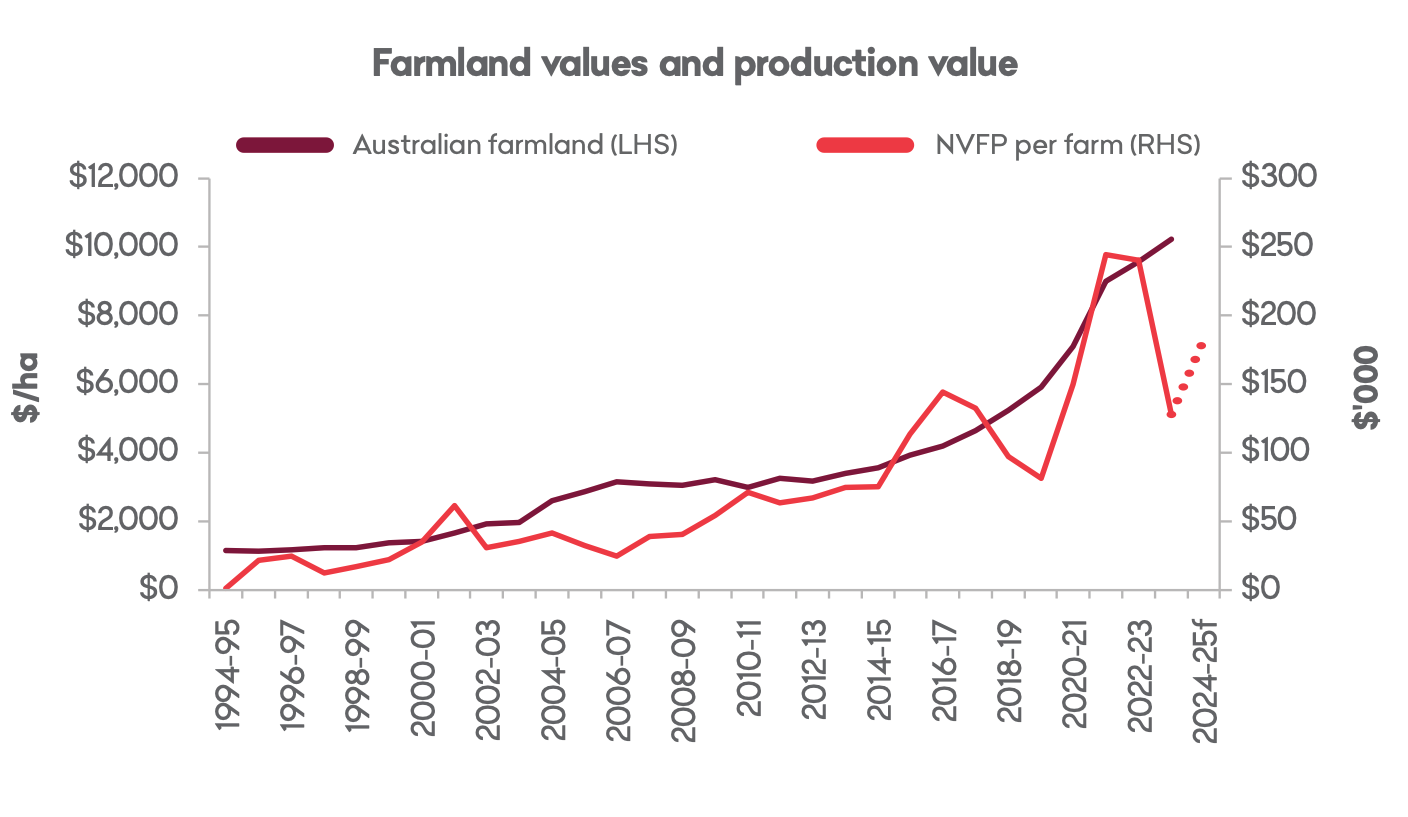

Farm production dropped last financial year to its lowest level in five years, however this followed a strong run of growth in production.

Farmland prices are closely correlated with the net value of farm production per farm, according to the report, with a big jump in production in previous years driving strong growth in farm prices.

Source: Bendigo Bank Agribusiness Australian Farmland Values 2025 Report

“This exceptional run of high earning years fuelled a period of extremely strong appetite for farmland purchases while also creating very little pressure to sell,” the report stated. “As such, farmland values were driven higher at a rapid pace.”

Higher costs as a result of higher interest rates and farm values kept input costs elevated last financial year, dragging down net production.

Rising crop production is expected to boost the net value of farm production per farm, which would support farm values. Picture: Getty

However, a rebound is anticipated for this financial year due to stronger livestock prices and rising crop production, with the net value of farm production per farm expected to rise to 31% above the 10-year average.