Buyers to ride wave of online shopping boom in Geelong

The freehold to Quiksilver’s national distribution hub at 75-105 Corio Quay Rd, North Geelong, was put on the market this year.

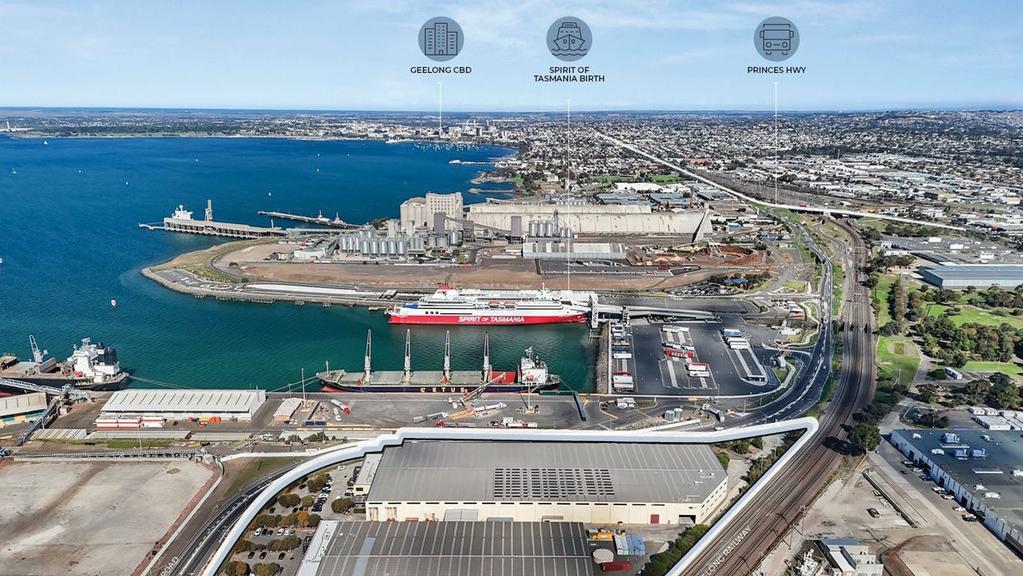

The growth in online sales and Geelong’s proximity to transport links is underpinning an institutional property investor’s move to acquire Quiksilver’s national distribution hub in North Geelong.

Trilogy Funds has revealed it is buying the 3.8ha complex next to the Port of Geelong.

The fund manager and property investor has taken out several full-page advertisements in the Geelong Advertiser recently, spruiking for investors to buy in to its industrial property fund, which is purchasing the asset.

RELATED: Shining Geelong office conversion, rehab centre on the block

Large format retail boom rolls on as tax cuts boost sales

Geelong buyer lands supersite in biggest CBD sale for two years

Centuria, which paid $22.8m in 2019 for the complex at 75-105 Corio Quay Rd, appointed JLL Melbourne’s Ben Hegarty and Joel Scully and Chris O’Brien and Andrew Bell of CBRE the handle the sale of the property.

The asset is leased to Quiksilver Australia, a subsidiary of Liberated Brands, a global leader in the sport, outdoor and lifestyle apparel industry including some of Australia’s most recognised surfwear brands Roxy, Billabong and Quiksilver, generating a passing net income of almost $2.25m a year. The lease is seven years, plus another seven-year option.

The freehold to Quiksilver’s national distribution hub at 75-105 Corio Quay Rd, North Geelong, was put on the market this year.

Strong fixed 3 per cent annual increases for the remainder of the long-term lease will grow the dividend for investors, while the location and quality of the amenity would make it easy to find a new tenant or reposition the asset, should Quiksilver ultimately vacate when its lease expires.

Centuria last had the property independently assessed last December, returning a book value of $33.8m.

Trilogy property funds manager Laurence Parisi said the distribution centre occupied a standout location, while the Geelong region offered a ready-made workforce to drive the asset’s operation.

The freehold to Quiksilver’s national distribution hub at 75-105 Corio Quay Rd, North Geelong, was put on the market this year.

Mr Parisi said a State Government 50 per cent stamp duty concession for commercial and industrial property investments in regional Victoria also offered a significant incentive to purchase the asset.

“Should the tenant vacate in 7-plus years, the asset is readily re-lettable in its current format or could easily be divided into two large warehouses which are both serviced with office and amenities and good ingress and egress,” he said.

Mr Parisi said the Geelong region had natural advantages that were attractive to industrial property investors.

The freehold to Quiksilver’s national distribution hub at 75-105 Corio Quay Rd, North Geelong, was put on the market this year.

Quiksilver isn’t the only global player to host a distribution centre in Geelong, with Cotton On occupying a 37,375sq m complex at Avalon Airport, while Amazon has established a hub next to the old Ford factory.

“Industrial real estate is our focus at present given the number of tailwinds which will continue to support occupier demand and rental growth,” he said.

These include the growth in e-commerce and online sale, in part driven by population growth.

National infrastructure projects on roads and rail have improved and opened up new development precincts, he said, while favourable lease terms have embedded growth which should underpin capital growth.”

Mr Parisi said the region’s high quality lifestyle and position close to the Bellarine Peninsula and Surf Coast ensured residents and tourists would boost the local economy.