‘Category killer’ stores to tighten grip on retail market

Australia can expect more “category killer” large format retail stores like Harvey Norman and Bunnings in the coming years, putting further pressure on smaller retailers, an expert says.

Colliers International’s head of large format retail Tony Draper says the number of competing brands will continue to shrink as demand from major investors helps big-box stores tighten their stranglehold on the market.

According to Draper, Australia is mirroring the United Kingdom, which has seen a steady decline in retailer diversity.

“Similar to the UK, over many years the sector went from lots of smaller retailers and many competing brands (to fewer retailers),” Draper says.

There is significant upside in dominating a category and having less competition

“Over time the store footprints became larger and the amount of competition became less and I predict more ‘category killer’ stores.”

“There are now many centres with only a handful of large scale boxes, which previously could have been many more smaller tenants, larger stores and more consolidation of brands.”

The comments come as demand for larger retail centres intensifies, with facilities that bring multiple major retailers together under the one roof increasingly sought after.

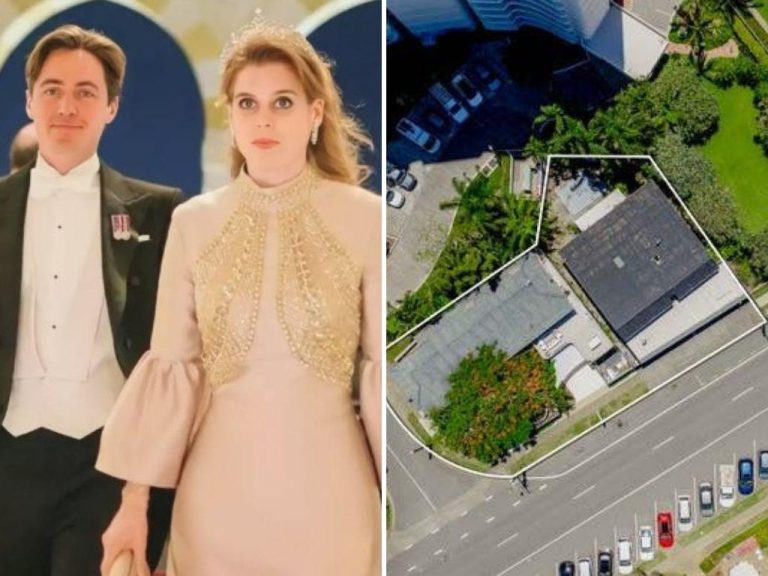

Large format retail outlets are becoming increasingly sought after.

Three Queensland Direct Factory Outlets stores have been sold in recent months, while another is being built at Perth Airport.

And Bunnings Warehouse outlets continue to be among the most prized retail assets in the country, with a Western Australian store selling last month on a record low yield of 4.65%.

Draper says the higher returns for large format retail will see investors continue to throw their money behind it, rather than supporting smaller enterprises.

Over time the store footprints became larger and the amount of competition became less and I predict more ‘category killer’ stores

“There is significant upside in dominating a category and having less competition. There are also quite a few private equity groups looking to capitalise on retail success in the same way,” he says.

“The likes of Harvey Norman prefer to own than lease and are the largest owner of large format retail. Then other groups such as Aventus Property have heavily invested into the sector (and) are now listed on the ASX, creating more appetite to grow the fund.”

“Low interest rates have seen investor returns shrink and large format retail still provides reasonably high returns compared to the rest of the market, making it become a more stable and accepted sector.”