Checking out: Pro-invest to sell $800m hotel portfolio in year’s largest deal

Fund manager Pro-invest is readying to offload one of the largest hotel portfolios to ever hit the block, with the eight Holiday Inn Express hotels expected to reap about $800m.

International fund manager Pro-invest is readying to offload one of the largest hotel portfolios to ever hit the block, with the eight Holiday Inn Express hotels expected to reap about $800m.

The move comes amid a primarily domestic-led recovery in tourism markets as hotels stand out as offering growth prospects while office markets are still under pressure and the economic slowdown hangs over retail spending.

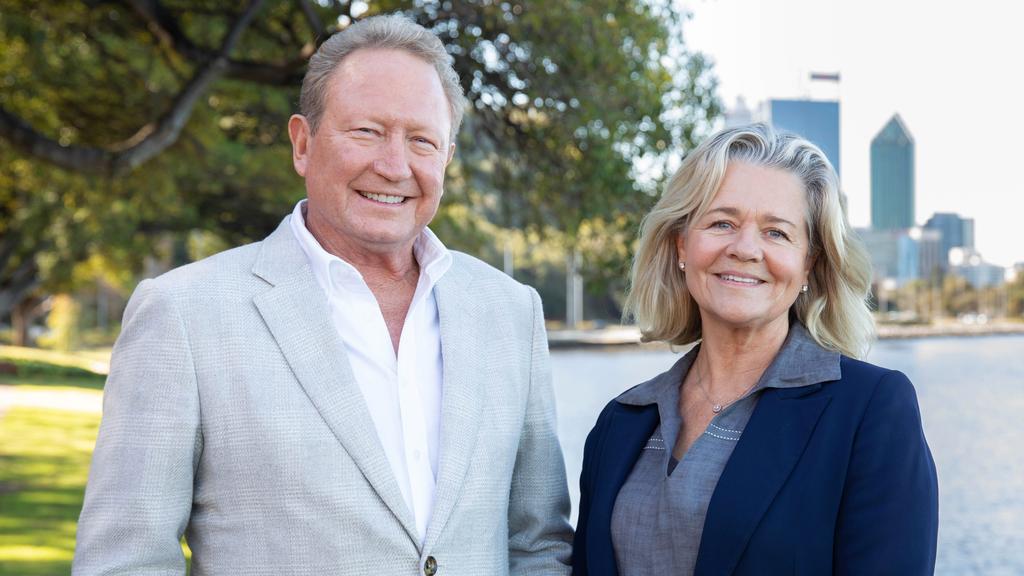

The hotel market has been buoyed in recent time with big investments made by billionaires Andrew and Nicola Forrest, who bought Australia’s first Waldorf Astoria, which is under construction at Sydney’s Circular Quay.

Andrew and Nicola Forrest.

The interest of local billionaires and fund managers, alongside Asian hotel investors and sovereign wealth funds has kept the sector active with close to $3bn of hotel deals, well above the normal $1.8bn worth each year.

Pro-invest is planning to offer up the strongly trading assets housed in its first hotel fund, which include properties in major cities along the eastern seaboard, as well as a property in New Zealand.

The offer is a slightly trimmed down version of a $1bn portfolio it marketed last year that had eight hotels run under a franchise agreement with IHG Hotels & Resorts, as well as some out of a second fund.

Pro-invest developed the hotels in its first Australia Hospitality Opportunity vehicle that raised $300m from international players in 2016, with additional co-investors adding to the quantum.

Backers included Pro-invest itself, Citibank’s private wealth division, a Thai group, IHG, and smaller investors.

Pro-invest declined to comment on the plans or potential valuation with industry players saying that the portfolio could reap $800m.

“Acquisitions, enhancements and well-timed exit scenarios are key to our strategy and a clear expectation of our investors. This means being ready to act when market conditions align with our objectives,” a Pro-invest spokeswoman said.

“We are preparing our highly efficient Fund I Holiday Inn Express portfolio for recapitalisation, to ensure we act prudently and at the most opportune moment.

Holiday Inn Express at Sydney Airport.

“Most importantly, we are focused on the right opportunity rather than a fixed timeline, to ensure the best outcome for our stakeholders,” the Pro-invest spokeswoman said.

The fund manager has successfully bet on the expansion of the three-star business hotel segment and has followed up with later funds that have built up its overall holdings to about 6000 rooms. Pro-invest also has a major office project in North Sydney and has flagged a push into build-to-rent.

It already has more than $3bn worth of assets under management across discretionary funds, joint ventures, and managed accounts and has 32 hotels open and a development pipeline across 15 markets.

Up for sale are eight hotels sporting 1964 rooms. The hotels on offer are Holiday Inn Express properties including Sydney’s Macquarie Park, Brisbane, and Melbourne’s Southbank and Little Collins St, properties in Adelaide, Newcastle, Sydney airport and another property in Queenstown, New Zealand.

Real estate agency CBRE will run a global campaign, but it declined to comment. The portfolio is likely to draw bids for the entire collection in one line, and also for individual assets.

Last year’s offer also included Holiday Inn Express hotels held in Pro-invest’s second fund, which is backed by a Middle East investor, and has six assets with about 1400 rooms.

Pro-invest has also kicked off a third fund which the manager was hoping to grow to about ten10 properties, with more than 1600 rooms. The fund had its first closing in November 2022 and Pro-invest said it was continuing to raise capital despite reports that it had paused.

The first hotel bought purchased for that vehicle was The Sebel Canberra Campbell and the second, Hotel Indigo Melbourne on Flinders, opened in August after a $20m renovation.

Hotel rates have surged as the industry recovered after the Covid pandemic and hotels are part of the broader “living sector” that property investors are targeting, as it has held up despite the falling values of office blocks and shopping centres.

Their values have been driven by both the recovery in tourism and the comeback of corporate travel, which is being bolstered by the increasing return to work in offices.

But the market is thin for such large portfolio transactions, with some traditional foreign buyers no longer having the cost of capital to purchase Australian hotels.

The Great Room at Holiday Inn Express in Melbourne’s Southbank.

Hopes of reaping a “portfolio premium” may have diminished due to the tougher financing conditions, which has meant many private equity buyers interested in hotels are unable to raise large-scale debt.

But hospitality markets are still active. International developer Far East Consortium this year put the up-market Ritz-Carlton hotels in Melbourne and Perth on the block with hopes of reaping $500m.

And other properties have already changed hands with pub tsar Arthur Laundy and business partner, Sydney’s Karedis family buying the Sheraton Grand Mirage resort on the Gold Coast for $192m.

A hospitality fund run by the Salter Brothers also bought the Sofitel Adelaide Hotel for $154m, and Worldwide Hotels bought the Ibis & Novotel Melbourne for $170m.

The returns from hotels are also not correlated too much of the share market or even the broader economy, but instead by the supply and demand equation for hotel rooms.

There are some new hotels in the pipeline in Melbourne and there are proposals in Sydney and other cities, but there is unlikely to be a surge of new rooms due to high building costs and the difficulty of financing new projects.