Chinese led international property buyers back in Sydney

The pace of deals on office buildings is picking up, with two deals struck by international buyers on properties worth more than $220 million in total.

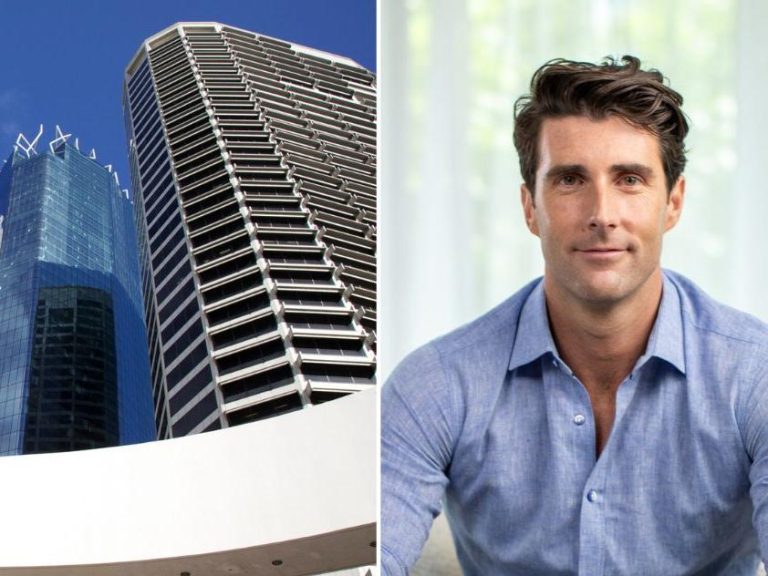

The most telling transaction was in Sydney’s central suburb of Haymarket, with a Chinese buyer showing its keenness for local assets, with a company securing a tower for about $75 million that it was last year deterred from purchasing.

In that play that also showed the shift in the market, the private LLSZ Holdings bought the building at 191 Thomas Street in Haymarket, paying $76,798,396.

The Chinese group had agreed to buy the office block in Sydney’s central precinct for just over $80 million before the pandemic struck.

But its application to the Foreign Investment Review Board went unaddressed for months and it eventually stepped back from making the initial purchase, and the building came back on the market.

Its most recent play for the building succeeded as it was not subject to FIRB rules that had crimped the market last year.

The Morrison government brought in significant changes to its foreign investment review framework but the major focus is on stricter review of acquisitions which are sensitive to Australia’s national security.

The Haymarket office block was not sensitive and the acquisition was also below the monetary threshold for scrutiny, which was restored this year after being cut to nil when the pandemic struck.

The building sale was brokered by teams led by Vince Kernahan of Colliers International and Tim Grosmann of Savills Australia, but they did not comment.

The purchase of 191 Thomas St in Haymarket, a touch below the initial pricing, is a pointer to the pools of private capital that are waiting to pounce following dislocation from the coronavirus.

The Chinese group has picked up an eight-storey office building, with ground-floor retail and basement parking for 16 cars, that spans a net lettable area of 4797sqm.

The buy is partly predicated on the longer-term trend for investors and tenants to buy at the southern end of the CBD as the area is redeveloped.

Charter Keck Cramer’s Bennett Wulff was transaction adviser for the vendor. The block is fully occupied, providing a current net passing income of $2.7 million.

Meanwhile, funds manager Savills Investment Management is in due diligence to buy a major block in the Sydney suburb of Mascot for more than $150 million – ahead of expectations after six buyers chased the building.

It is being sold by Fort Street Real Estate Capital, which has added value to the building since it picked it up for $128.4 million in 2017.

JLL agents Simon Storry and Luke Billiau and Colliers International’s Adam Woodward and James Barber are handling the deal but they and the parties did not comment.

The prominent A-grade building sits near Sydney Airport and has strong tenants, including the NSW government, which occupies 44% of the building.

The building comprises 19.2777sqm and spins off a passing net income of $9.71 million and has a short three-year lease term.

This article originally appeared on www.theaustralian.com.au/property