Chinese tower to become Crown Casino’s new neighbour

A Chinese development syndicate is set to storm into the Melbourne development market, with the group eyeing the purchase of a Southbank site that could sustain a $500 million-plus apartment and hotel project.

It is understood Singaporean business heavyweight Michael Kum has agreed to sell the site to a Chinese group for nearly $65 million.

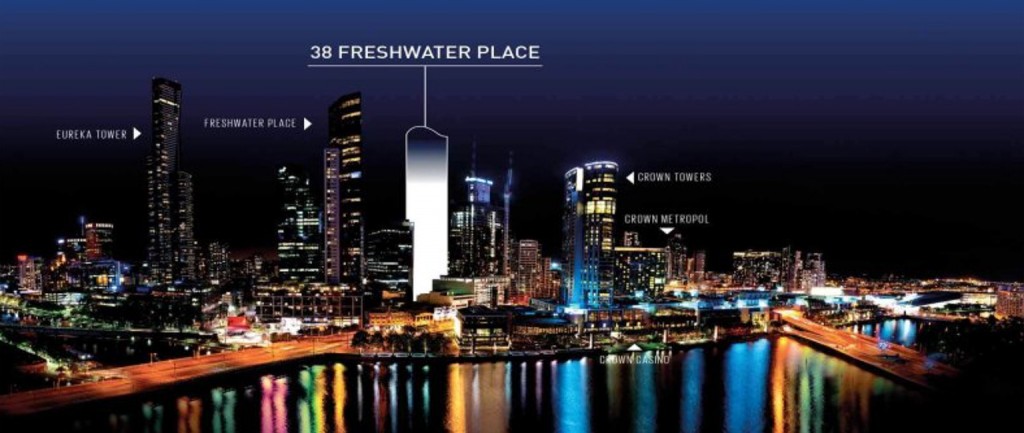

Kum, who owns hotel investment company M&L Hospitality Group, bought the site in 2013 for just $30 million. The 4000sqm parcel, at 38 Freshwater Place, has approval for the construction of a 73-level, 280m-high tower.

The Victorian government has approved plans to build 496 apartments and a 390 hotel rooms. The planned project, called Ultimus Tower, is close to Crown Resorts and the site that Crown and Schiavello Group hope to construct a 90-storey apartment and hotel tower worth about $1.5 billion.

The building will be among a host of other tall towers slated for Southbank, which is Australia’s highest density suburb.

A six-level office building next to the Freshwater Place site is set to be converted into a 66-level apartment tower, while on the other side of the site is the recently built 72-level Prima Pearl apartment tower.

The Southbank site lies opposite Crown Casino.

Kum’s site would have attracted premium offers given that a project of this scale would struggle to gain the approval of planners due to the year-long interim controls that will be in place in Melbourne until August.

After August, State planning minister Richard Wynne will announce a long-term policy for plot rations in the city. There is no certainty a project of this scale would be allowed in the future.

The deal was brokered by agency CBRE, which declined to comment.

But the Melbourne site sale could be overshadowed by M&L Hospitality’s efforts to offload its $1.5 billion-plus Australian and New Zealand hotels arm.

There is no certainty a project of this scale would be allowed in the future

The Kum family placed a string of landmark hotels, including Sydney’s Sheraton Four Points and Melbourne’s Hilton DoubleTree, on the market in early December.

It is the largest hotel portfolio sale process in more than a decade and is being handled by Rothschild and UBS. They are marketing the six hotel assets in one line with bidding extended to close later this month.

At least five global institutions are chasing the portfolio, which includes Melbourne’s Travelodge Docklands, the Hilton Auckland, Christchurch’s Chateau on the Park and Sydney’s Swissotel.

M&L last year confirmed it was running the hotel process, but maintained it was not set on a sale. It also remains an active developer in Sydney, buying a hotel project in Sussex Street near Barangaroo, and undertaking the One Wharf Lane tower adjoining the Sheraton Four Points.

This article originally appeared on www.theaustralian.com.au/property.