Coca-Cola pops lid on $156m Brisbane sale

Listed beverages company Coca-Cola Amatil has cashed in on the industrial property boom by selling a major Brisbane facility to fund manager Charter Hall Group for $156 million and will reap a $100 million pre-tax profit on the deal.

The lucrative play has shown the industrial property market is running hot after a hiatus early this year and more companies could look to free up cash by selling assets as they face a low- growth environment.

The Amatil sale will settle on December 1, delivering the beverages company the one-off gain that it will recognise in the second half of 2017. Amatil chief financial officer Martyn Roberts says the company has been delighted with the level of interest in the property and flagged more sales.

Commercial Insights: Subscribe to receive the latest news and updates

“We said in October 2016 that we would review and optimise our approach to property assets and will continue to explore opportunities similar to the Rich-lands sale and leaseback with other property assets nationwide,” Roberts says.

Colliers International agents Roger Miller, Simon Beirne and Tony Iuliano handled the Richlands sale.

Charter Hall’s $2.4 billion wholesale Prime Industrial Fund will hold the property. Amatil has an 81,008sq m complex on the site, which it sold on a 20-year lease back.

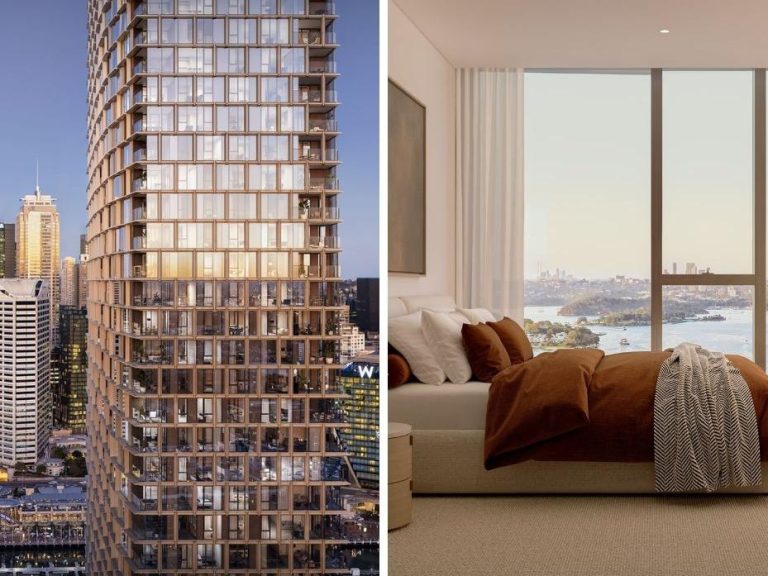

The Coca-Cola facility in Brisbane.

Charter Hall said buying the 24.89ha property strengthened its ties with Amatil. The complex has a triple net lease structure with 3% annual rental increases.

“The acquisition … demonstrates our ability to partner with existing customers across our industrial platform, which has … $5 billion of assets under management,” Charter Hall chief investment officer Sean McMahon says.

The property is in the established industrial suburb of Richlands, about 15km southwest of the Brisbane CBD. Major retailers, corporate transport and logistic operators in the area include DHL, Toll, Iron Mountain, Target, Steinhoff and Myer.

The site comprises an existing 50,414sq m warehouse and manufacturing facility with an ancillary office. Amatil had recently commenced the construction of a new distribution facility of 30,594sq m, which will be mainly completed by December.

“The highly sought after property is one of the single largest industrial investments offered in Queensland and provides CPIF with an attractive investment proposition to secure a high quality facility,” CPIF fund manager Richard Mason says.