Coles to go it alone with demerger from Wesfarmers

Wesfarmers has announced it intends to demerge its Coles grocery division to create a new top 30 company on the ASX.

The demerger, which is subject to shareholder and other approvals, comes amid increasing competition in the supermarket sector.

“A demerger of Coles will facilitate greater focus by Wesfarmers on growth opportunities within its remaining businesses,” Wesfarmers managing director Rob Scott says.

Commercial Insights: Subscribe to receive the latest news and updates

The spin off is expected to be completed in the 2019 financial year.

Wesfarmers, which owns hardware chain Bunnings, department stores Kmart and Target and office-supply retailer Officeworks, says it will seek to maintain a 20% stake in Coles.

Wesfarmers shareholders will receive shares in Coles proportional to their existing Wesfarmers holdings, the company says.

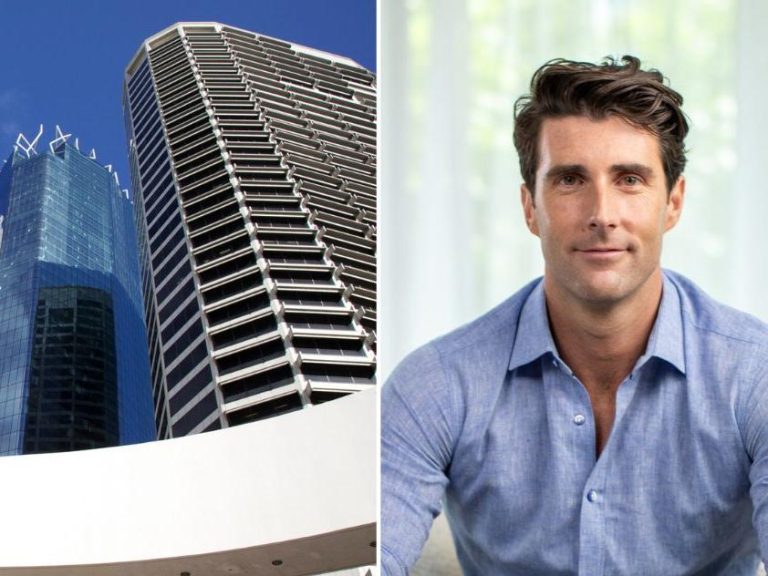

Coles is set to separate from parent company Wesfarmers.

In addition, Wesfarmers says that Steven Cain will be the new managing director of Coles, succeeding John Durkan, who will step down later this year after 10 years in senior leadership positions at the grocer.

Cain is currently chief executive of supermarkets and convenience at Metcash, which supplies the IGA supermarket brand.

It’s a return to Coles for Cain, who in 2004 was ejected as the supermarket group’s food, liquor and fuel boss after only a short stint in the role.

The new Coles company will include more than 800 supermarkets nationally, as well as liquor stores, Coles Express convenience stores, a financial-services unit and hotel chain Spirit Hotels.

“We believe Coles has developed strong investment fundamentals and is of a scale where it should be operated and owned separately,” Scott says. “It is now a mature and cash generative business.”

Coles had previously been Wesfarmers’ top earner, but it was overtaken by Bunnings in Australia and New Zealand in the company’s recent half-year result. Wesfarmers said the earnings decline at Coles in the half year reflected planned investment in price and service, but some analysts have said that Coles has struggled to compete with chief rival Woolworths Group and new entrants like Aldi. Amazon.com, which recently launched in Australia, could eventually add a grocery component.

Metcash supermarkets boss Steven Cain.

Wesfarmers had been focusing lately on its retail chains, agreeing in December to sell its Curragh coal mine to a US coal producer.

Wesfarmers bought UK hardware chain Homebase in recent years, but the company’s ownership of that unit has been troubled and Wesfarmers booked a major writedown on the UK and Ireland business at its half-year result last month.

Scott says the group is repositioning its portfolio to target a higher capital weighting toward businesses with strong future earnings growth prospects.

“Wesfarmers acquired Coles as part of Coles Group in 2007 and since then has successfully turned around the business and restored its position as a leading Australian retailer,” Scott says.

“Coles will be well positioned to continue to deliver long-term earnings growth, with an earnings profile that is expected to be resilient through economic cycles.

“A demerger of Coles will facilitate greater focus by Wesfarmers on growth opportunities within its remaining businesses and the pursuit of value accretive transactions. The capacity to act opportunistically will be retained through a strong balance sheet and a cash generative portfolio.

Wesfarmers intends to retain a 20% stake in Coles.

“The group expects to retain its current strong credit ratings and the dividend policy will remain unchanged.”

Coles is one of Australia’s largest retailers, operating about 2,500 stores and employing more than 109,000 people across Australia.

Wesfarmers says businesses to be included in the proposed demerger will include a national network of 806 supermarkets as well as Coles Online; 8941 liquor stores nationally through Liquorland, Vintage Cellars and First Choice Liquor; Coles Express, which operates 712 fuel and convenience store outlets under an exclusive alliance with Viva Energy; Coles Financial Services, which offers general insurance and credit cards; and Spirit Hotels, a chain of 88 hotels predominantly in Queensland.

As well as retaining a minority interest ownership in Coles, Wesfarmers proposes to retain a substantial ownership stake in flybuys to support continued access to the loyalty program and continued investment in data analytics capabilities.

Announcing the leadership changes at Coles, Scott says Durkan has decided it is the appropriate time for a leadership transition as Coles enters its next chapter.

Outgoing Coles managing director John Durkan.

He will remain in an advisory capacity following the leadership change to ensure a seamless transition, Scott says.

“John has made an enormous contribution to the successful turnaround of Coles under Wesfarmers’ ownership and we look forward to him continuing to lead the business as we prepare for demerger,” Scott says.

Durkan says: “After 10 years at Coles, including the past four as managing director, it’s the right time for Coles to move to a new leader prepared to commit to long-term tenure and navigate this great Australian company through the next chapter of its history.

“This is a move I first discussed with former Wesfarmers CEO Richard Goyder 18 months ago and then our new Wesfarmers CEO Rob Scott when he assumed the role.

“Proper, considered succession planning is critical for large companies and Coles is no exception.”

Cain began his career with Bain & Co before moving into retail with UK retail group Kingfisher, later helping to transform supermarket chain Asda.

Later roles included CEO of FTSE100 media group Carlton Communications, managing director of food, liquor and fuel at Coles Myer, and operating director and portfolio company chairman at private equity firm Pacific Equity Partners, before joining Metcash in 2015.

He was also an adviser to Wesfarmers on its takeover of the Coles Group in 2007.

– with Mike Cherney.

This article originally appeared on www.theaustralian.com.au/property.