Coles, Woolworths leases continue to sway retail buyers

Investors are continuing to open their wallets for the Queensland retail investment market, with two neighbourhood centres anchored by major retailers Coles and Woolworths sold in recent days.

Shopping Centres Australia (SCA) Property Group acquired Greenbank Shopping Centre in Brisbane and a tract of adjoining development land for a combined $33 million, while an undisclosed Chinese investor purchased a shopping centre in Upper Coomera on the Gold Coast for $12.5 million.

Demand: Gold Coast keeps lustre despite stock slowdown

Neighbourhood centre transaction volumes totalled $1.9 billion in 2015, eclipsing the record $1.8 billion reached in 2014.

JLL director of Queensland retail investments Sam Hatcher says the queue of investors waiting to get their hands on retail property will ensure strong sales for some time yet.

Neighbourhood centres with strong underlying retail fundamentals, including long-term leases to Woolworths and Coles … will continue to be highly sought-after

“We expect that transaction activity will remain strong during 2016 as a result of the pent-up levels of demand for prime grade retail assets,” Hatcher says.

“Neighbourhood centres with strong underlying retail fundamentals, including long-term leases to Woolworths and Coles as well as the potential for income growth through specialty tenancies, will continue to be highly sought-after.”

“This demand will be reflected in a continued divergence in the yields for prime and secondary neighbourhood centres.”

In a deal negotiated by Hatcher and JLL’s Jacob Swan in conjunction with CBRE, SCA Property Group purchased Greenbank Shopping Centre for $23 million and executed an unconditional put-and-call option deed to acquire the adjoining 9.96ha development site for $10 million with a delayed settlement of up to five years.

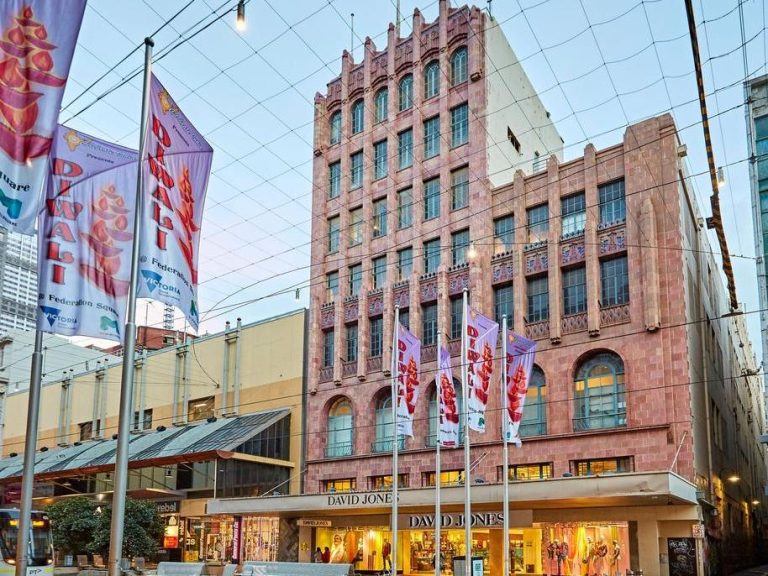

Greenbank Shopping Centre has sold to Shopping Centres Australia Property Group.

The sale of the centre, which is anchored by 3970sqm Woolworths as well as a Woolworths Plus Petrol and 17 specialty stores, reflects a net passing initial yield of 6.61%.

“The strong yield of 6.61% was reflective of the strategic asset with a highly desirable long term lease to Woolworths, the reversionary income potential of the specialty tenants and the long term weighted average lease expiry for the centre of 10.77 years (by area),” Hatcher says.

Current planning regulations provide for a possible expansion of Greenbank Shopping Centre of up to 2.20ha of additional GFA.

Meanwhile, the Upper Coomera centre was sold by an Adelaide-based private consortium on a yield of 6.7% in a deal negotiated by Peter and Jon Tyson of Savills.

We expect that transaction activity will remain strong during 2016 as a result of the pent-up levels of demand for prime grade retail assets

Developed in 2005, the Upper Coomera centre is located on the northern end of the Gold Coast and comprises a 2,500sq m Coles supermarket supported by three specialty shops.

“With only three speciality and major supermarket anchor, the centre has always been 100% leased. As an offshore owner, the combination of the low leasing risk and ease of management had instant appeal to the buyers,” Peter Tyson says.

Savills also brokered the sale of two other Coles-anchored shopping centres on the Gold Coast after expressions of interest campaigns.

Banora Central Shopping Centre was sold for $19 million to a Sydney-based private buyer at a yield of 6.5%, while Bell Central Shopping Centre at Mudgeeraba was acquired by Clarence Property for $13.5 million.