Coronavirus hits hotel occupancy hard

Macau’s hotels are running at a paltry 3% occupancy while Hong Kong’s resorts and hotels are down to 25%.

Taiwan’s hotels are faring only slightly better with occupancies of 26%, thanks to the coronavirus and the Hong Kong protests, according to latest research from international data house STR.

Australia’s hotel market has been rocked by the exit of major international conferences and tour groups from city hotels in the wake of the coronavirus, but hoteliers do not think the virus will cause property developers to switch from hotels to other classes of development, despite the plethora of projects planned in Melbourne.

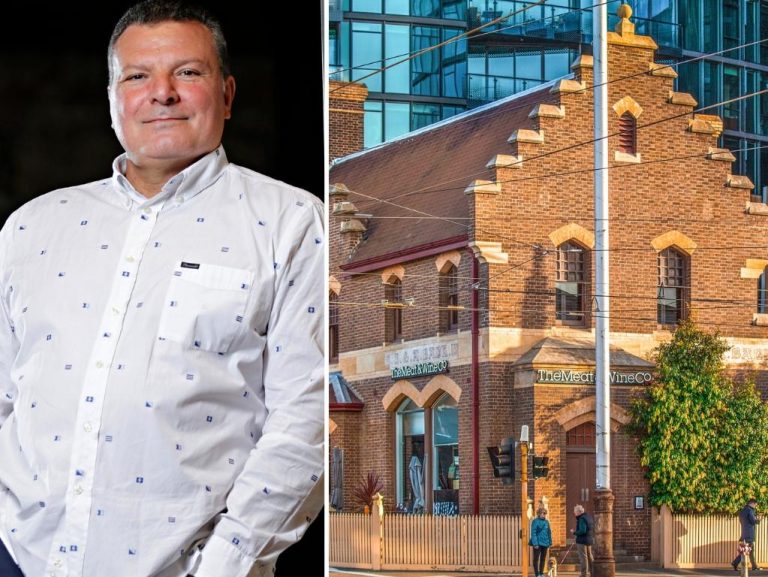

Simon McGrath, the chief operating officer of Accor which operates more than 400 hotels, says the coronavirus has obviously impacted the hotelier’s February and March trading conditions.

McGrath says the effects of the virus have developed from a medical issue to a tourism issue and there was now concern for Australia’s borders and its economic impact.

“It’s very hard to get any insight further out from March onwards … forward bookings have softened.

“It started with the Chinese market and then it has created some caution in the wider economy,” McGrath says.

However, the federal government’s $76m tourism stimulus package was starting to work.

“With the tourism stimulus from the state and federal governments we are starting to see from the last fortnight booking activity start again.”

He said campaigns promoting the Gold Coast and South Australia were gaining traction but he added that most of the fallout from the virus had centred on Sydney, Melbourne and Queensland hotels, where the mainland Chinese inbound market most dominated. “We had the bushfire impact and the virus came over the top — it’s a combination of the two,” McGrath says.

But he says there is a great willingness among Australian travellers to help out.

JLL Hotels executive vice-president Peter Harper says developers will not stop developing hotels.

“If you look at how our market has responded to 9/11, SARS and the GFC it has shown its resilience,” Harper says.

“Everyone is looking at this as a short-term glitch and it will be a V-shaped recovery. The market is tracking normally. We are still getting the same levels of inquiry even from our Asian clients.

“Australia is a flight to quality market in times of global uncertainty.”

Harper says that while conferences and travel were being put off, they still needed to occur, so a surge in pent-up demand was likely once the world returned to normality. “This will help with the expected V-shaped recovery that we’ve seen during other similar events historically.”

But another hotel industry executive, speaking on condition of anonymity, says Australia has incredible amounts of new hotel supply to absorb and unfortunately the first thing major hotel owners and operators did in these situations was discount room rates. “So Cairns and the Gold Coast will be compromised, particularly Cairns with all the new hotel supply available. I think Brisbane is going to be the strongest performer out of all these hotel markets because most of the new supply has been absorbed.

“And I think Melbourne will be in incredible trouble with all the new supply. I think banks will certainly start to want to review valuations.

“Prudent hotel owners and managers will need to be managing their relationships with their banks extremely well and ensuring their loan to valuation ratios are in check because a potential review of financials in the 2020 financial year could see a drop in hotel valuations.”

This article originally appeared on www.theaustralian.com.au/property.