Demand spikes for medical centres

A flourishing healthcare property fund has added three medical centres worth $22 million to its portfolio.

The acquisition of Eastbrooke Medical Centre at Carlton, south of Sydney; Vasse Medical Centre at Busselton in Western Australia and a brand new medical development in Perth’s northern suburbs, takes to 13 the number of assets Barwon owns.

The portfolio is valued at $114 million and includes properties in every mainland state, housing general practitioners, dentists, radiologists and community care services.

Commercial Insights: Subscribe to receive the latest news and updates

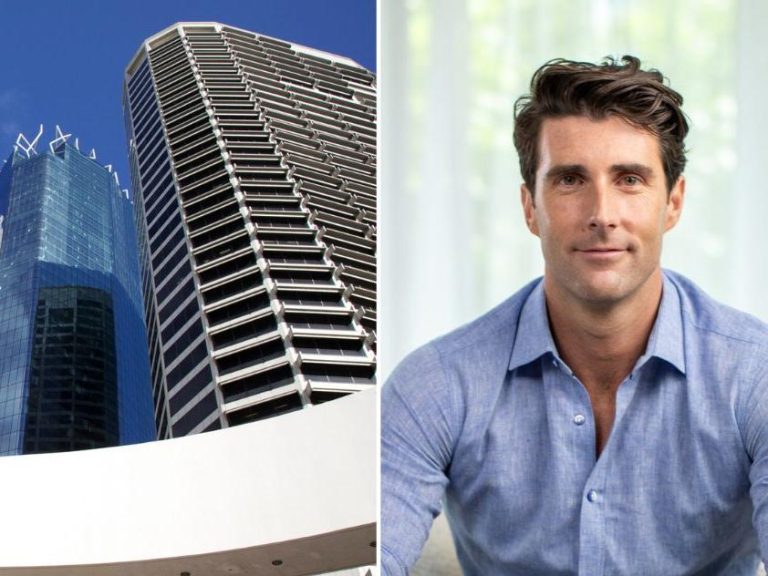

Barwon partner Robert Morrison says medical centres represent a “low risk sector of the property market” due to their long-term leases of seven to 15 years, quality tenants and good revenue streams.

“The healthcare sector is becoming of increasing interest to investment and super funds, because people recognise that healthcare is one of the fastest growing sectors of the Australian economy,” Morrison says.

“Healthcare is now 10% of the GDP and because of the ageing population we’re going to see more demand for better healthcare properties.”

It follows a trend in the United States, where superannuation funds in particular are very actively investing into healthcare property

It follows a trend in the United States, where superannuation funds in particular are very actively investing into healthcare property

He says rents from the properties coming into Barwon are distributed out to wholesale investors quarterly, with reinvestment in the properties to improve the quality of the buildings and upgrade the services.

“We’re not only buying existing properties, we’re also working with developers to be a capital partner and to be able to develop properties in and around healthcare hubs,” Morrison says.

“We see our role as an important funding source in the growth of the Australian healthcare system. What I think we’ll find in coming years, is property health funds like ours will play an increasing role in developing and owning healthcare facilities across Australia.”

The Barwon Healthcare Property Fund opens for investment periodically as new properties are secured, and forecasts regular distribution yields per annum of 7-7.5%.

Although there is currently only a small number of property fund managers working in the healthcare sector, Morrison expects that will increase as investors understand the returns.

“It follows a trend in the United States, where superannuation funds in particular are very actively investing into healthcare property,” he says.

“We’re likely to see more investment from super funds in coming years.”

This article originally appeared on www.theaustralian.com.au/property.