From cemeteries to man caves: Quirky asset types become the norm for real estate investors

A number of previously overlooked assets have become popular and profitable.

Over the past decade, a growing number of buyers have sought out commercial assets that were previously deemed unsavoury or unusual.

Several unorthodox asset types have been snatched up by investors since the pandemic, as investors looked to secure high quality investments that would bolster their portfolios.

One of the main assets that have seen a spike in popularity are car parks, which offer the flexibility to be used as a single space or as part of a multi-level facility.

Experts say the low-maintenance nature and heightened demand in car-dependent hubs, makes it an appealing prospect for passive income.

Ray White’s head of commercial Vanessa Rader said that despite being predominantly privately owned, car parks often attract both local and international investment due to the land space they occupy.

“The longer term development potential is often a motivator for the parking sector, however, robust returns, particularly in major cities, make parking an attractive investment option, albeit often attracting high levies and taxes imposed by state or local governments recoverable by occupiers.”

Freestanding multi-level car parks are often ripe for redevelopment into high-density accommodation.

Brothels have also been a highly sought after asset in 2023, with a number listed for sale earlier this year.

Rather than being an asset class in their own right, brothels are used within a zoning area.

Ms Rader said that while brothels do require approvals to be licensed and operated, they are unique due to having high returns but low yields.

Brothels attract higher premiums due to the nature of the service provided as a commercial business.

“Issues of insurance, security, and safety may deter some buyers, depending on borrowing levels, which may impact values. Investment is dominated by the private sector and despite their current use, there have been many examples of the redevelopment or positioning of brothels to other commercial uses which may be more attractive to a broader range of investors.”

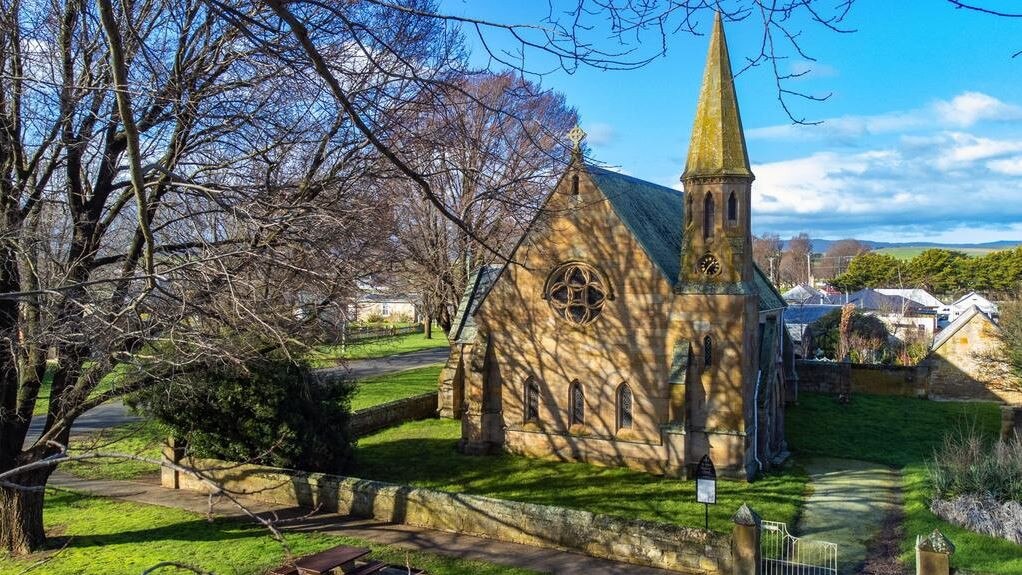

Churches and cemeteries were also considered popular assets, particularly for private buyers looking for land that is unable to be built upon.

The critical shortage of cemetery permitted land has led to exponential growth in capital values.

When a buyer purchases a cemetery, they are given the responsibility of caretaking and making the property available for public access – in addition to cataloguing for record keeping.

Churches, on the other hand, may have local zoning restrictions.

“There have been many redevelopments of churches into residential or commercial premises, with those older properties maybe having heritage considerations when seeking redevelopment approval.

MORE:

Alarming housing shortage figures revealed by 2028

Foreign buyer demand spikes for regional NSW

‘Worse than it looks’: Abandoned home to sell for $2.5m+

Investors who purchase the cemetery are also given the responsibility of caretaking and record-keeping for its inhabitants.

“The architecture and story attached to the property is often a drawcard for those looking to occupy or purchase existing or redeveloped church facilities.”

Small storage facilities can offer potential returns for investors looking to profit off of stored goods.

These small facilities often offer an easier step to enter the commercial space with strong returns, similar to a “man cave”.

Small industrial facilities also have the potential to be transformed into man caves.

Prior to the pandemic, the smaller sub-200 sqm industrial units had a high volume of owner occupier activity.

“These units were dubbed “man caves” as they were considered storage facilities for “toys” such as cars, boats, caravans and other non-business uses which was an issue for some complexes as this often is in conflict with allowable use within an industrial zoning.”

MORE: New twist in fraudster’s home sell off