How investing in funeral homes can give you certainty

As niche property investments go, they don’t come more reliable, or stable, than death. Long-term tenants, steady income, an essential service during COVID uncertainty – a conversation about adding funeral homes to a portfolio is therefore in order.

Too soon?

Not really, if the interest shown in at least one suburban Melbourne funeral home which went to auction recently is anything to go by. The Kingston Funerals premises in Cheltenham attracted 14 buyers and had 69 bids before being sold to a Melbourne-based investor for $3.8 million last month.

As Burgess Rawson partner Billy Holderhead said after the sale, funeral homes are the ideal “set and forget” investment.

In this case, the property came with a fixed 10-year lease and the option to extend twice, with compounding, annual 3% rent increases. Net annual income was around $141,000.

“A buyer didn’t have to think too hard about the value,” Mr Holderhead said. “The returns, low maintenance tenant and the underlying land value all add up.”

Funeral homes do not come up for sale that often – Mr Holderhead said his agency has sold just three around Australia since 2018. At time of writing there were at least three on the market – two in regional Victoria in Horsham and Nhill and one in Sydney’s west, which goes to auction on October 15.

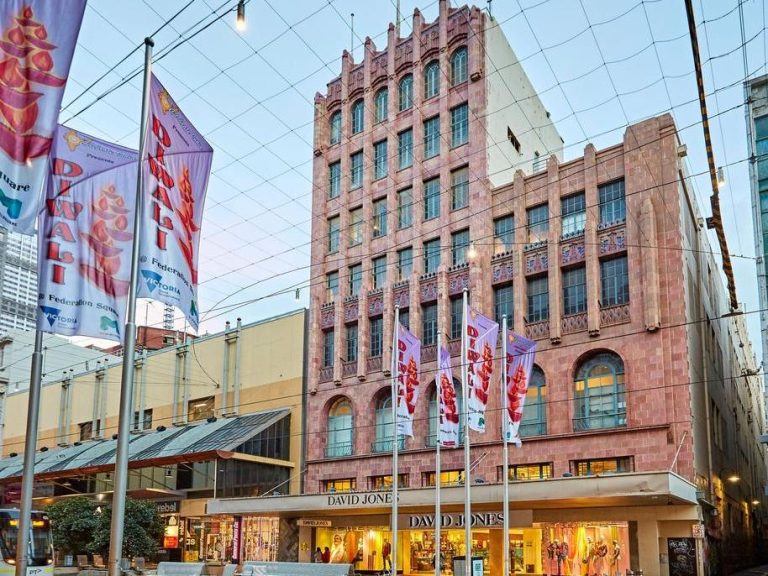

Experts say funeral homes are a ‘set and forget’ style investment. Picture: realcommercial.com.au/sold

But the Cheltenham sale may be a turning point.

“There were a lot of investors with funeral freeholds watching the Cheltenham campaign very closely and every single one of them was blown away with the result,” Mr Holderhead said.

“So, it’s fair to say we expect to be offering at least one more before the end of the year and a few more following in the first half of 2022.”

It’s the kind of activity unseen in the funeral homes market since the 1990s, when long-established family businesses started selling up to cashed-up corporate investors.

Immediate past president of the National Funeral Directors Association, Nigel Davies, said funeral homes tend to stay in the one family for three to four generations and are only sold when there is no viable succession plan.

“The only options then are staff buyouts – which are difficult – or selling to the one of the big corporations,” he said.

The “big corporations” usually means ASX-listed Invocare, which owns three national brands and almost 300 funeral homes across Australia, New Zealand and Singapore and has an annual turnover of around $400 million, or Propel, which controls around 108 funeral homes in Australia and NZ. Between them, they account for 40% of Australia’s $1.5 billion funerals industry.

Does the property have a mortuary?

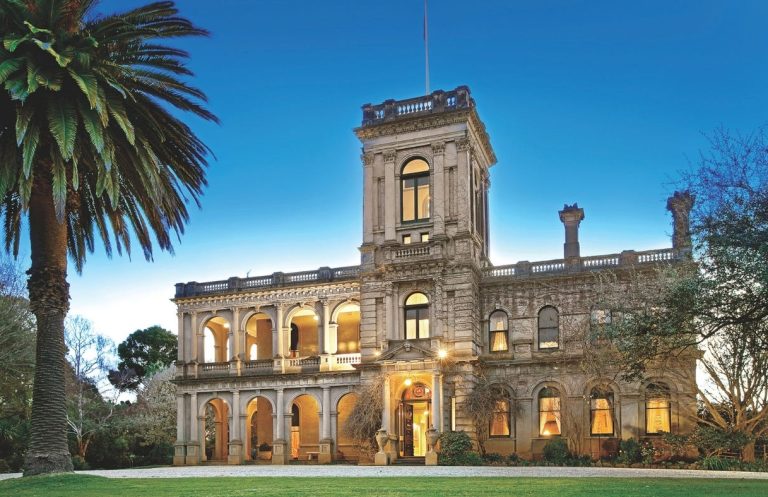

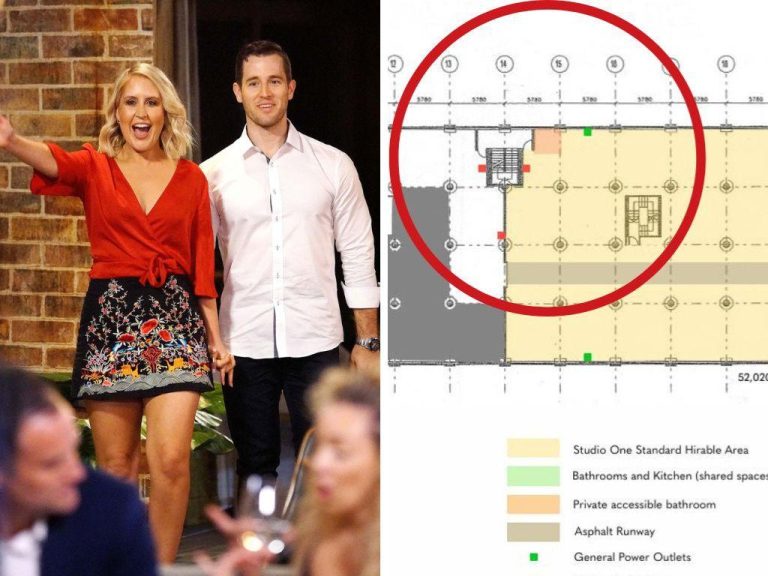

While funeral homes have traditionally been in high-traffic locations such as main streets or arterial roads, there has been movement toward business parks. Industry insiders agree warehouses are more flexible than old Federation-style shopfronts. In Perth one canny investor transformed a machinery-hire warehouse into a funeral home, while in Melbourne, one business set up in an industrial park in the city’s west.

Mr Davies’ advice to anyone looking at funeral homes as an investment is to consider whether the premises include a mortuary.

He said it’s very difficult for operators to get council permission for a mortuary, so these now tend to be situated in outer-suburbs and shared. Inner-city funeral homes tend to just have a chapel and catering facilities.

“An all-inclusive property is much more valuable,” he said.

As for the future, even allowing for COVID restrictions which have affected the business model by restricting mourner numbers and catering, industry insiders all agree: death isn’t going anywhere soon.