Commercial property: Hotel sales volumes surge 84 per cent

Life is returning to Australia’s hotel and student accommodation industries following two years of closed borders while the industrial sector has started to cool after a record period of growth.

Data from investment insights provider MSCI Real Assets shows deal volume across commercial property transactions was up 84 per cent year-on-year in the hotel sector during the first half of 2022, which was driven by buyers headquartered outside Australia.

It comes after the return of overseas travel following two years of closed borders in which many hotels were used as quarantine centres.

The Sofitel Sydney Wentworth recently sold after being used as a quarantine centre.

MSCI’s Capital Trends Report Australia highlighted the resurgence of the Sydney hotel market in particular.

MORE: $175m Oaks Hotel sale to spark pub tsar bidding war

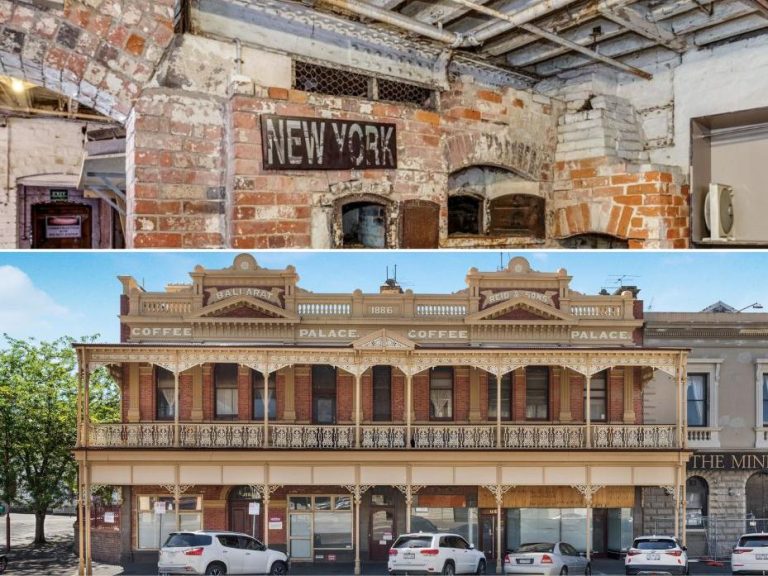

Iconic cafe that changed Sydney up for sale

This has seen several significant assets change hands since late last year, including the Sofitel Wentworth and seven of the assets in the Travelodge portfolio, which sold to Salter Brothers and GIC.

Several Travelodges also exchanged hands. Picture Katrina Bridgeford.

The data didn’t include the Barings PE Asia purchase of the Hilton Sydney for $530m, which is due for settlement later this year.

Student accommodation was also up, while the industrial sector was down 31 per cent year on year after its strongest reporting period in the first half of 2021.

In terms of quarterly results, industrial deal volumes in the three months to June were 63 per cent less than the same period last year.

Offices continued to do well following last year’s recovery, with second quarter transactions worth $5.4 billion.

Hotels took on a whole new purpose during the pandemic. Photo: Tim Pascoe.

The retail sector recorded $3 billion in sales for the quarter and $6 billion for the first half of 2022.

Large format and neighbourhood centres remained the most popular among investors, but there was also renewed interest in large shopping centres and CBD retail.

MSCI head of Real Assets Research David Green-Morgan said offshore investors were largely focused on the office and industrial sectors, the decline of the latter representing a normalisation of the market after recording such strong results last year.

A 50 per cent stake of Commonwealth Bank Place was sold this year.

“Pockets of the retail sector have seen some robust demand but deal activity across the sector has dropped 28 per cent in the first half of the year,” he said.

“Overseas investors have leaned much more to the office and industrial markets.”

Some of the largest transactions so far this year include the sale of a 50 per cent stake of Commonwealth Bank Place in Sydney to NPS of Korea and Germany’s Allianz for $610m and Pau Jar Group’s purchase of Milton Green in Brisbane for about $426m.

MORE: Risk of return to ‘bad old days’ for homebuyers

Rent and construction crisis sparks surge in business owner-occupiers