How Chemist Warehouse became a commercial property game-changer

The bright yellow facade of a Chemist Warehouse is a pot of gold in the eyes of investors.

Since the pharmacy franchise was founded 20 years ago, Chemist Warehouse (famous for bargains as bold as its colour scheme) has come a long way, with more than 350 stores now spread across the country.

Along with changing how we shop, the ever-expanding franchise has shaken up the commercial property market.

The company’s low-cost business model isn’t just a favourite among shoppers hunting for some half-price vitamins or beauty products while they pick up their prescription – it’s also just what the doctor ordered for commercial landlords.

Dubbed the ‘Bunnings of chemists’ and even the ‘McDonald’s of pharmacies’, the shops have become a target for investors in recent years.

The Ashfield Chemist Warehouse sold for almost $9 million.

In 2019, Cushman and Wakefield sold a Chemist Warehouse in Sydney’s inner west for $8,888,880 with a yield of 4.73%.

The Ashfield property, which Chemist Warehouse had signed a lease on until at least 2027, attracted huge interest the moment it hit the market.

Cushman and Wakefield director of sale and investments, Anthony Bray, says that investors are hungry to snap up commercial properties leased to the chemist chain.

“We’ve got people (wanting to buy) and we’re constantly trying to advise and take to market assets with good quality leases, because the appetite from investors is huge, particularly the likes of Chemist Warehouse, with their brand, national recognition and the good work that they do,” he says.

Bray adds that there’s a growing trend of retirees who aren’t earning good interest on their bank savings, looking for stronger returns.

Instead they are turning to commercial properties and brands such as Chemist Warehouse to find a cash cure.

“There are a lot of people who are self-funded retirees that aren’t getting any return on their investment in the bank,” he says.

“They are strongly pursuing, in quite significant numbers, assets like Chemist Warehouse and other national brands as tenants with long-term leases.”

Burgess Rawson’s Graeme Watson, who sold a Chemist Warehouse in Launceston in 2016, agrees that investors are willing to pay top dollar for properties with a Chemist Warehouse lease.

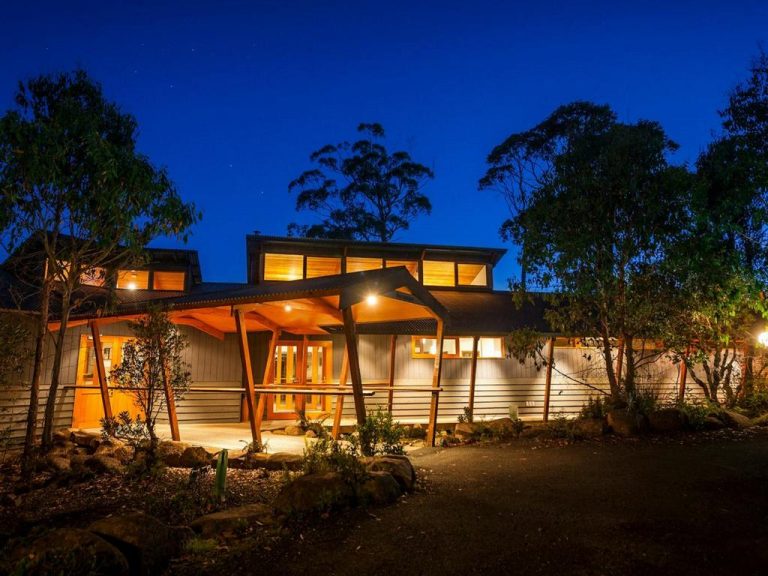

A Sunbury property including a Chemist Warehouse also sold this year.

“They’re a destination retailer so they don’t have to be in prime positions,” Watson says.

“They’re in a strong position to negotiate lease terms. The lease terms, from an investor’s point of view, you know they’re not going to be over market.

“Similarly with the rent, it will be at market, if not below market, so you know you’re buying real value.

Watson compares the chain’s cult success to another Aussie icon.

“It’s like the days of when Bakers Delights were really popular – everyone knows them and they go nuts for them,” he says.

“You’ll have at least 50 enquires, maybe even going towards 80.”