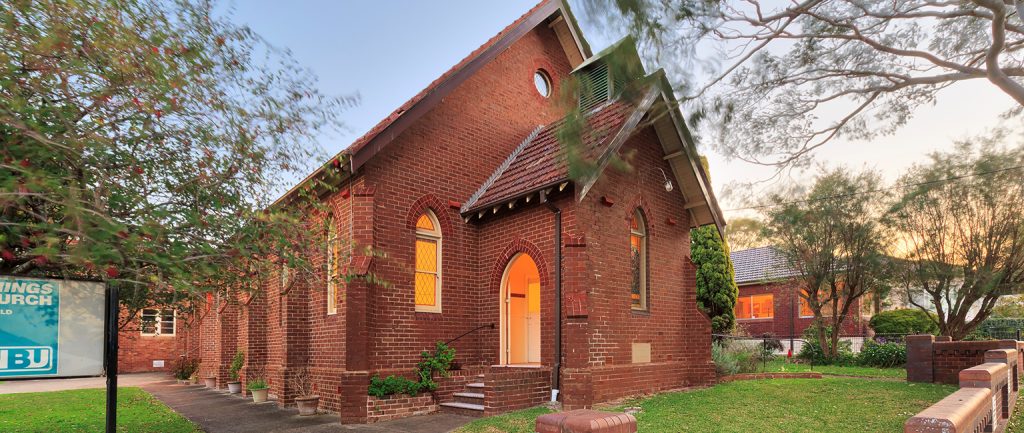

In brief: Uniting Church to sell Cronulla holy land

The Uniting Church is set to offload an ex-church and adjoining residence in Cronulla that have stood since the 1920s.

The properties at 12 and 14 Wilshire Ave will be sold either separately or in one line and are being touted as versatile sites with the potential to become childcare or medical facilities, or potentially be converted or redeveloped into residential.

The church and house sit on identical 891.6sqm blocks, with the church also featuring a rear hall, while the residence has five bedrooms and a detached building currently set up as classrooms.

CBD development: Charter Hall buys Melbourne’s Uniting Church headquarters

CBRE’s Simon Lytton and Peter Vines have been appointed to steer the expressions of interest campaign in conjunction with Peter Starr of McGrath.

The properties are situated in a highly sought after location, close to Shelly Park and Cronulla Beach,” Lytton says.

“Given the size of the land and the exclusive location we are expecting overwhelming interest from both local investors and from buyers Sydney wide.”

Melbourne: $4m-plus tipped for Yarra River site

Properties with Yarra River frontage are as rare as hen’s teeth in the commercial property market, so buyers are expected to pay a hefty price for a riverside block in Hawthorn.

The property at 96-98 Morang Rd, just 6km south-east of Melbourne’s CBD, comprises a two-level commercial building with four separate tenancy spaces spread over 870sqm.

It also has 19 car spaces included on the 1180sqm site, which is residential-zoned, and currently attracts a rental income of $150,000 per annum, with the potential for up to $200,000 when fully leased.

Teska Carson’s Tom Maule and Michael Taylor have been appointed as marketing agents, with Maule saying riverfront sites with development potential are exceedingly rare.

The Hawthorn site is zoned for residential and lies alongside the Yarra River.

“This is an exceptional property in the midst of some of Melbourne’s finest homes with Yarra River frontage and superb access to every desirable amenity including transport, education, shopping and leisure facilities,” he says.

“It is essentially a blue chip property which will provide a wide array of options to potential purchasers from owner occupiers to developers to investors. A truly rare opportunity.”

The property will be auctioned on site at 1pm on Thursday, October 20.

Victoria: Lake Marmal to bear fruit for Kingston Estate

The Moularadellis family has expanded its Kingston Estate Wines footprint after buying Lake Marmal Vineyards in central Victoria for $3.575 million.

The 298ha vineyard at Boort, 250km north-west of Melbourne, is planted to 172 hectares of Shiraz and Cabernet Sauvignon and is a major supplier to Treasury Wine Estates.

Kingston Estate Wines has bought Lake Marmal Vineyards.

Phil Schell and James Beer from CBRE negotiated the sale on behalf of Lake Marmal Vineyards Pty Ltd.

“Lake Marmal is a highly productive vineyard that was established in 1998 with the objective of supplying a substantial quantity of fruit to Treasury Wine Estates,” Beer says.

“The site was originally selected for its favourable climate, soil profile, ability to be managed efficiently, expansion capabilities and its strategic location with regard to numerous processing facilities.”

Sydney: Leda buys Smithfield site

Sydney investment company Leda Holdings has grabbed a slice of the Western Sydney industrial market with the purchase of a significant block of land at Smithfield.

The 8053sqm site on the corner of O’Connell St and Horsley Drive sold at auction for $4.25 million at a land rate of $529 per square metre.

CBRE’s Elijah Shakir and Peter Blade handled the sale, with Shakir saying Smithfield continues to be firmly in investors’ sites.

Leda Holdings bought this Smithfield industrial site.

“As one of Western Sydney’s most well-established and revered industrial hubs, Smithfield remains a key market for owner occupiers,” Shakir says.

“The opportunity to acquire such a significant parcel on a prominent corner site attracted buyer interest from both local and interstate groups. The end purchaser – a leading industrial developer – plans to develop a high profile unit complex incorporating both retail showroom and industrial units, which will be released to the market for presale in Q4 of this year.”

Melbourne: Soaring tower tipped for western CBD site

A site with a permit for 255 apartments and ground floor retail in Melbourne’s CBD is expected to ignite investor and developer interest.

The potential project, nicknamed “Lower West Village”, lies at 9 Downie St in the south-west corner of the city and is slated for 30 levels of apartments, and will also feature 294sqm of retail space on the lower level.

The site at 9 Downie St in Melbourne’s CBD comes permit-ready.

Colliers International’s Bryson Cameron, who is marketing the 1187sqm site with Trent Hobart and Daniel Wolman, says its sale will continue the renaissance in the western part of the CBD.

“This is one of Melbourne’s most exciting permitted development opportunities which is ready for immediate development,” he says.

“Situated in a prime location between Flinders St and Flinders Lane, the development is set to continue the swell of popularity in the CBD’s western precinct.”

The property is for sale via an international expressions of interest campaign, which closes on October 28.

South Australia: Mt Bera Vineyards seizes neighbouring land

Boutique Adelaide winemaker Mt Bera Vineyards has jumped on a tract of farmland next door to its operation in the Adelaide Hills.

The 80ha property near Gumeracha is owned by Hills Fresh and is currently home to a Murray Grey cattle breeding operation, as well as a large vegetable producing business, and was quickly snapped up by Mt Bera for $1.06 million after being floated onto the market.

The farmland near Gumeracha is expected to significantly expand the winery’s operation.

“Mt Bera Vineyards saw an ideal opportunity to expand its current vineyard operations with the addition of a circa 80 hectare landholding immediately next door,” selling agent Phil Schell, from CBRE, says.

“The property will significantly expand Mt Bera’s footprint in this fertile region.”