Industrial vacancy spike to hit as slow economy affects key precincts

The sector was transformed by the rapid growth of e-commerce during the pandemic

The vacancy rate in the once-hot industrial sector is headed higher as the economy slows and the sector gets back to pre-pandemic conditions, but it won’t double this year, a leading forecaster says.

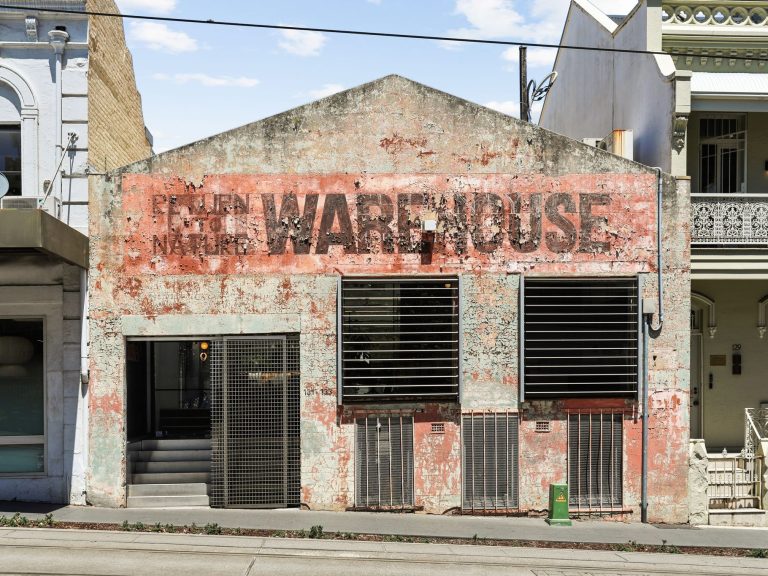

The sector was transformed by the rapid growth of e-commerce during the pandemic, but developers are now building a series of new warehouses in major markets and many large tenants are also looking to sublease space.

While pressures are expected to rise as the economy slows, Australia remains among the most attractive markets in the world due to its relatively tight metrics.

The national average vacancy rate in the industrial and logistics market was the lowest globally at 1.9 per cent, and Perth had the lowest vacancy rate in the country at 1.2 per cent, according to commercial real estate services and investment firm CBRE.

CBRE’s latest sector report shows a lift in vacancy rates for most markets across Australia, particularly Sydney, Brisbane and Melbourne, however overall vacancy remains at sub-2 per cent.

Cushman & Wakefield confirmed the shift back to normalised levels of demand for warehouse space after three years of unprecedented growth. Picture: Jenny Evans/Getty Images

“We are witnessing a rise in the vacancy rate across most cities, as demand normalises, and greater sublease space is being added to the market,” said Sass Jalili, CBRE head of industrial and logistics research.

“Despite the rise in space availability, we still do not expect to see the national average vacancy rate surpass 4 per cent in 2024.”

The report notes that national net absorption has fallen to the lowest level on record, with notable decreases across all eastern seaboard cities.

Gross take-up of floorspace in the first half reached 0.9 million square metres as occupier demand began to normalise, and only 50 per cent of take-up was the result of tenant expansion.

“Sublease activity has multiplied across the market but has not significantly affected the vacancy rate,” Ms Jalili said.

“Over the past six months, sublease activity has been most prominent in the Sydney market, accounting for 50 per cent of vacant floorspace.”

CBRE reported that rental growth had slowed during the past 12 months, and incentives began to rise in the first half.

The current year-on-year growth rate for national super prime grade face rents was 12 per cent. But rent growth is expected to further reduce in 2024, with incentives to rise across all markets.

CBRE industrial and logistics regional director Michael O’Neill said first-quarter transaction activity was slow, but that was not surprising given the incredible rental growth of previous years due to low vacancy.

“High prevailing rents, softening consumer demand, higher outgoings, and reduced sense of urgency all contributed to a slower start for all markets,” Mr O’Neill said.

“This has resulted in vacancy approaching or exceeding 2 per cent in nearly all markets. “Overall, we’re seeing the market begin to normalise to pre-pandemic conditions.”

Sydney’s vacancy levels bumped up from 0.5 per cent at the end of 2023 to 2 per cent due to vacancy rises in the city’s outer western markets.

Vacancy in infill areas in Sydney remained extremely tight, but there was a softening in outer ring markets, such as the outer northwest and outer southwest, due to more speculative projects and sublease space hitting the market.

Leasing volumes were down in the city this year due to weaker occupier demand, but the CBRE reported a lift in leasing activity in the last eight weeks, with many heads of agreements signed, which should result in vacancy stabilising in outer-ring markets.

Melbourne’s vacancy rate lifted to 2 per cent, with rises in most precincts except the western area, which showed a marginal decline.

The city’s occupier demand was subdued in the first half, with leasing absorption down on the previous five-year average, driving higher vacancy rates.

CBRE reported that Melbourne’s face rents had held, but effective rents reduced slightly owing to incentives trending upwards. There was about 140,000sq m of sublease space available in the city’s western markets.

A report by commercial real estate services firm Cushman & Wakefield confirmed the shift back to normalised levels of demand for warehouse space after three years of unprecedented growth, and also cited the impact of rising debt costs, and stickier-than-expected inflation.

“Notably, this has resulted in some occupiers taking a more cautious approach in committing to new space, worsened by uncertainty surrounding inventory management levels,” said C&W head of logistics and industrial research Luke Crawford.

Mr Crawford said demand remained well above pre-pandemic benchmarks, and stemmed from a broader pool of occupiers.

C&W forecast warehouse gross take-up was expected to total 3 to 3.2 million square metres in 2024, before picking up to 3.5-3.7 million square metres in 2025.

It expects demand over the next 12 months to be underpinned by everyday consumption and sector structural trends, including e-commerce, while leasing demand from businesses tied to cyclical spending would pick up in 2025 in line with higher consumer consumption.