Institutions target private healthcare properties

An exponential rise in the number of older Australians and the gradual privatisation of the health sector is attracting investors to this property sector, Paul Thornhill finds.

That old cliché has never been truer – we’re all getting older. With baby boomers entering retirement and life expectancy shooting up, the proportion of Australians aged 65 and above is set to double in the next two decades.

Australians spend the bulk of their lifetime medical bills after retirement, which makes this demographic wave a boon for the health sector but a potential fiscal tsunami for the public sector.

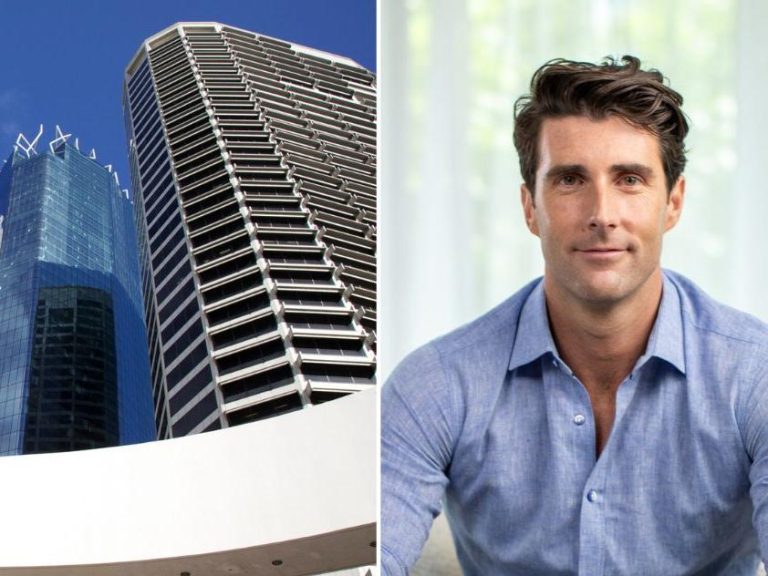

Enter a new Federal Government with a preference for private market solutions and you can quickly see the reason for the renewed interest in health property, according to Knight Frank Associate Director Leigh Morris.

“There’s little doubt that health is being slowly privatised and this has been the trigger for large overseas players, coming out of Asia and the US, and local institutions like super funds, to fill the investment gap,” Morris said.

“The government sector is clearly struggling to gear up for the oncoming demand and realises that the best way to fund growth is by turning to the private sector.”

This environment makes healthcare attractive for investors but buying a quality asset can prove a difficult proposition as the right properties tend to be tightly held and located within clusters around major hospitals.

The lowest entry point is small properties adapted as medical suites and located within a few hundred metres of a hospital, but for the most part, these are tightly held by resident practitioners and attract yields of just 5%-6%.

A more attractive option for well-financed players is to acquire office space close to a health precinct and adapt it so it’s suitable for suites or clinics.

But the real waves in this sector are set to be made by the larger institutional investors now circling the market. “After some reluctance over the last two years we’re now seeing interest spread right across the sector, particularly for larger private hospitals with good covenants which are paying yields in the 7%-8% range,” Morris told RealCommercial.

These institutions are not interested in building a portfolio full of small properties with all the acquisition and management costs – instead they are focused on large acquisitions.

“The local players have a much better understanding of this market and often see the emerging opportunities around core CBD markets first. Their focus is on maintaining their portfolio’s performance and building it over time.”

“By contrast, the larger overseas players are new to our market and are more likely to look at developing new properties from the ground up. I would think that some of this interest will find a home in new developing clusters in urban growth corridors.”