IP Generation strikes $315m deal for Stockland Glendale as retail investment surges

IP Generation has bought Stockland Glendale for $315m.

The demand for large shopping centres has been confirmed with funds house IP Generation settling on its $315m purchase of Stockland Glendale with the deal also showing the slim discounts at which institutions are now selling.

The retail market has led the reset of commercial property values and private equity real estate investor IP Generation, along with funds groups Fawkner and Haben, has led the way in buying assets.

The sale of the NSW centre was the largest retail transaction to settle this year – although it could be surpassed by other deals that are in train – and will feed into Stockland’s annual results.

Colliers agent Lachlan MacGillivray brokered the transaction for Stockland, which held the centre at $320m last June.

The centre, anchored by Kmart, Target, Coles, Woolworths and Event Cinemas, traded in the mid 6 per cent range, and was Stockland’s largest town centre sale after it exited Townsville and sold a series of neighbour centres. It also sports 10 mini-majors including TK Maxx, Rebel Sport and JB Hi-Fi, 66 specialty and kiosk retailers and 11 pad sites.

IP Generation has been one of the sector’s most active buyers and the purchase signals it is still keen on the area after Scentre Group and investment bank Barrenjoey swooped on a half interest in Adelaide’s Westfield Tea Tree Plaza which IP Generation came close to buying in April.

IP Generation said the Glendale centre suited its requirements.

“The compelling forecast returns and IP Generation’s track record has underpinned strong demand for this opportunity from our stable of investors,” IP Generation chief executive Chris Lock said.

“This landmark transaction of Stockland Glendale is a reflection of the incredible demand for assets that boast both scale and convenience, as well as a comprehensive offering of both discretionary and non-discretionary retailer categories.”

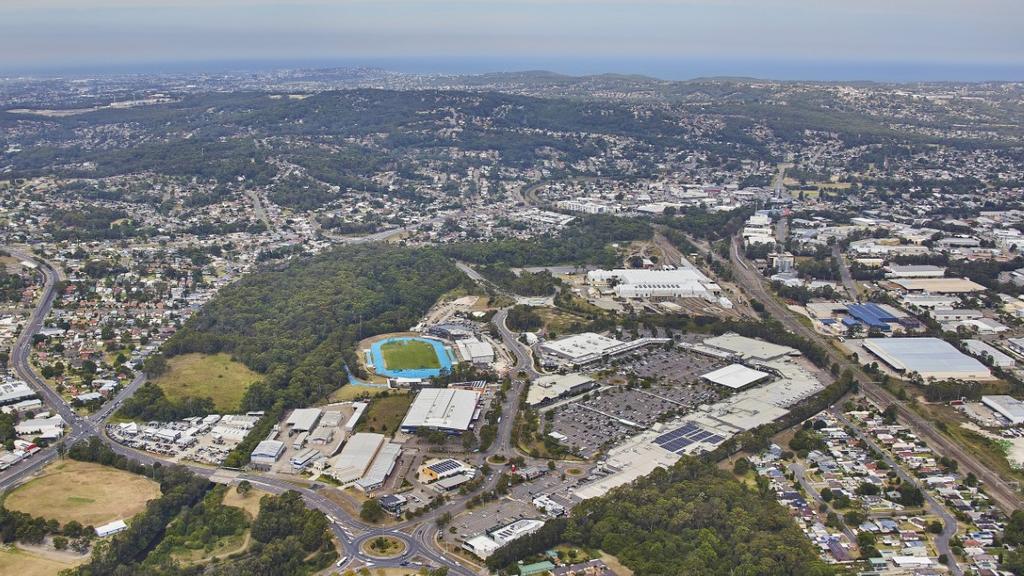

He noted the 18.6ha Stockland Glendale site was land-rich and the site coverage ratio of 28.2 per cent offers potential for lease remixing and expansion. A proposal has been lodged to develop vacant land next to the centre with a residential or mixed-use focus.

IP Generation is targeting dominant retail assets with attractive return profiles. Other big purchases include Craigieburn Central in Melbourne and a 50 per cent interest in Rockingham Centre in WA. “Our focus has been on taking advantage of unique investment opportunities within the market to acquire high quality, income producing assets with significant value-add potential,” Mr Lock said. Mr MacGillivray said fund investors such as IP Generation were increasingly interested in and buying into the retail sector.

“The confidence they have shown is a testament to the strength of the retail investment market,” he said.

Stockland Glendale’s annual sales hit $366m in February and it had strong sales productivity of $10,553 per sq m. The centre attracts annual foot traffic of more than 4.8 million, and customers spend $76 per visit on average.

Mr MacGillivray said the subregional sector was attracting strong capital demand, fuelled by an appealing spread to the risk-free rate and borrowing costs. “Private investors and syndicators looking for attractive income yields have emerged as the dominant players. We expect this trend to continue,” he said.