Island life awaits as Dunk Island hits the market

An idylic tropical island — and it could be yours.

Once synonymous with upmarket island holidays in Australia, Dunk Island has been put on the market.

The island, off far north Queensland’s sleepy Mission Beach, just south of Cairns, had of late been promoted as the centrepiece of a $1.5bn tourism mecca promoted by investment fund Mayfair 101. But the company’s failure to complete the $31m island purchase has sent the cyclone-ravaged island back into the hands of its former owner, Brisbane’s Bond family, of Linc Energy fame. As mortgagees in possession, the Bond family yesterday put the island back on the market.

The island resort was a mainstay of 1980s tourism but was later hit by cyclones, leaving it in a state of disrepair.

JLL Hotels & Hospitality Group has been tapped to offer Dunk Island and is pitching it as one of only three freehold islands on the entire Great Barrier Reef.

The move comes just days after another of Mayfair’s senior lenders, finance house Napla, put the first tranche of 107 Mission Beach properties, which it has taken control over, on the block.

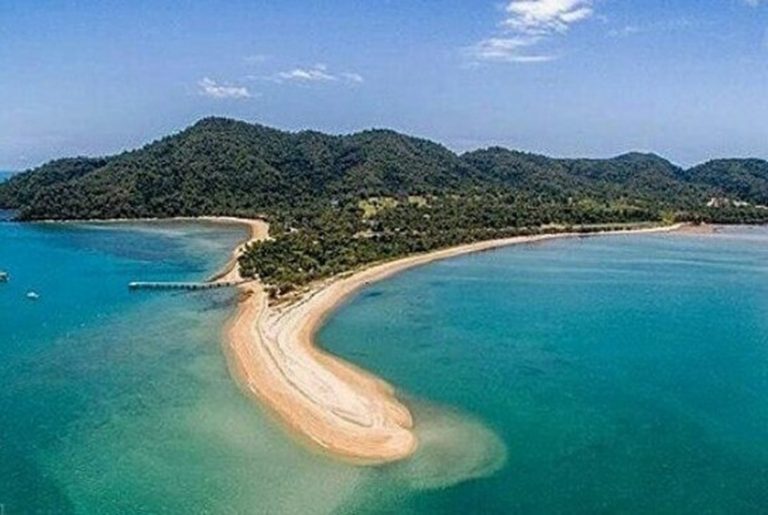

Dunk Island. PICTURE: ANNA ROGERS

Dunk Island comprises 135 hectares of freehold developable land along with a mainland power connection, supporting utility infrastructure and a commercial grade airstrip.

Once owned by Qantas and international cruise line company P&O, the former “Dunk Island Resort” operated as a four-and-a-half star family resort featuring 160 guest rooms, a 9-hole golf course, multiple food and beverage outlets, tennis courts and day spa.

The agents have not given up on hopes of restoring the island resort to its former glory — albeit in different hands. “Dunk Island provides the perfect opportunity to deliver an all-encompassing holiday destination akin to the enormously successful Hamilton Island, ideal for establishing a wide range of accommodation offerings, leisure activities and a self-sufficient ecosystem,” JLL’s Nick Roche said.

The coronavirus pandemic has decimated Queensland tourism but other groups have been investing in the region, including Hayman Island’s conversion to an InterContinental, Daydream Island’s refurbishment and Lizard Island’s renovation.

“We are currently seeing a surge in domestic travel across Australia and anticipate this demand will only accelerate as state borders open and a trans-Tasman bubble is established,” JLL’s Andrew Langsford said.

“Given the impact of COVID-19 and restrictions on international travel in the near term, we anticipate the Great Barrier Reef accommodation market to be a strong beneficiary of Australia’s high overseas spend, much of which is expected to be diverted to high-end resort locations,” he said.

Dunk Island from above. Picture: Isabelle Dore

Mayfair 101 founder James Mawhinney has claimed that a rescue plan is in the works, but losing control of the major assets makes his plans less likely to succeed.

Mayfair has warned against a fire sale of assets and warned that even investors in its secured funds could face heavy losses if this occurs.

The corporate regulator is trying to wind up Mayfair’s M101 Nominees unit which backed the firm’s tourism plans.

Mr Mawhinney vowed on Wednesday night to continue his plans to redevelop Dunk Island.

He said the Bond family, as the mortgagee in possession, were always entitled to follow through with the sales process.

“(But) It does not change our strategy which was to refinance it out so we can continue with our new plans for Dunk Island,” he said.

Meanwhile, in the Top End, Melville Island Lodge has hit the market.

– with Lisa Allen

This article originally appeared on www.theaustralian.com.au/property.