Lease to Buy Commercial Property

Getting your foot in the door can be challenging for growing businesses and budding developers.

So being able to lease a property before eventually purchasing it can be very appealing.

In a nutshell, a ‘lease to buy’ agreement allows a tenant to lock in a property for the future and gives a vendor a long-term tenant who will eventually purchase the building.

“It’s simply a legal arrangement whereby a lessee, at least for a defined period of time, has the first right of refusal to purchase the property,” Propertybuyer managing director Rich Harvey says.

“They have the ability to purchase that property outright for an agreed price at a predetermined date in the future.”

The concept is not new to those in the commercial property market, however Harvey says it is not widespread, unlike the residential sector where rent-to-buy schemes are becoming increasingly common as first home buyers find new ways to enter the market.

It is also similar to a lease option, which gives the renter the option of purchasing at the end of the rental term.

What are the pros and cons?

“In terms of weighing the scales, whether it’s more advantageous to a vendor or to tenant, I would say it’s far more advantageous to a tenant because it gives them the flexibility and the option to either decide, ‘Do I continue leasing or do I buy?’” Harvey says.

But there are also upsides for vendors.

“The benefit for the owner is that (the agreement) puts someone in there that’s genuinely interested in staying long term,” he says. “So it gives the owner an increased level of security.”

Whether a lease to buy scheme is a good choice will come down to individual circumstances. Here are some of the pros and cons.

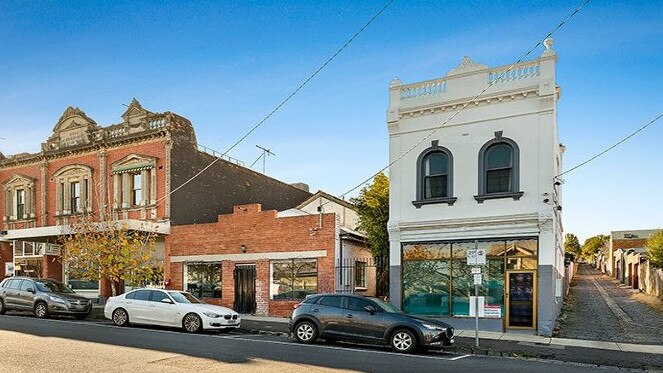

Leasing to buy can be a good option for tenants, as well as owners.

Pros of leasing to buy commercial property

- The price is predetermined

- It allows the buyer time to prepare finances

- If the price is lower than market value it will result in a low tax bill when the transaction is processed

- Tenants can move in and get development approvals and council permits for building improvements in the lead up to the purchase

- Businesses can effectively ‘try before they buy’ to make sure the building is fit for purpose and in the right location

- Tenants can typically make additions to the building, with the owner’s approval

Cons of leasing to buy commercial property

- If the market declines the price is predetermined and the property will be overpriced

- The tenant’s name is not on the title, so there is some risk involved

- It can give a seller a false sense of security. The tenant is still able to terminate the agreement

- There is a risk the buyer may not be able to obtain finance and the deal falls through

Leasing to buy allows tenants to ‘try before they buy’.

Steps to take if you want to enter a ‘lease to buy’ scheme

Setting up a ‘lease to own’ agreement is fairly simple, as long as the current owner is agreeable to the concept.

Here are some basic steps to follow:

-

Find and research the property

The search for a suitable property will include all the normal considerations, but finding a potential seller open to negotiating a lease to buy scheme may take time and effort.

Once you find a potential property, carry out all the due diligence, including getting a commercial building inspection, so you are aware of any potential pitfalls.

-

Research the seller

Once you find the right asset it’s crucial to make sure the vendor is trustworthy, to minimise the potential risk of the deal falling over later on.

Make sure the seller is financially secure and has a good reputation.

-

Get legal advice

If you wish to proceed Harvey, recommends getting an experienced commercial lawyer to draw up the contract.

“Someone who knows the ins and outs of lease agreements and options to buy,” he says.

Also consider whether you want to set a predetermined “strike price” in the contract or choose to purchase the property at market value on the specified date.

-

Start the lease

Once the deal is done you can move in as planned and lease the property until the time to buy comes.

It’s important to keep up with the lease payments and seek approval for any changes made to the property.

Keep in mind that if the deal does not go ahead you may not get back any of the money you have invested in improving the property and in some cases you may be held liable to fix any changes you have made.

-

Close the deal

In the interim period the tenant should begin approaching lenders to make sure finances are locked in.

Once this occurs it is time to carry out the transaction on the set date. Typically the pre-existing contract makes the settlement process fairly quick and simple.