Licence to print money – the most lucrative commercial property investments

Skyrocketing interest rates, reduced borrowing capacities, softer price growth and limited supply are seeing some residential real estate investors jump into the commercial space – and some deals offer a licence to print money.

But not all opportunities are the same, with leading experts lauding industrial assets, neighbourhood centres, and quick service restaurants as the best types of assets to deliver good yields.

“In high-level areas, there is a flight towards yield right now, which is caused by interest rates going up, and so people’s lending costs are higher,” Scott O’Neill, director of commercial property buyer’s agency Rethink Investing, said.

“So, more than ever, investors need a better yield and that’s creating a bit of a two-speed market in the commercial property world.”

Conversely, investments where there are 6%, 7% or even 8% yields are experiencing more demand than ever, Mr O’Neill said. while those with yields less than 6% are seeing minimal interest.

Industrial property investment in Perth, Brisbane, and major regional centres are also performing well, he added.

“Rents are growing at the quickest rate they’ve ever grown since records started, with double-digit rental growth rates,” he said.

“That’s definitely a license to print money if you buy into a good growth market when the day one yield is good, and all this inflation is really good for rent because it flows back into the lease at the end of the day.”

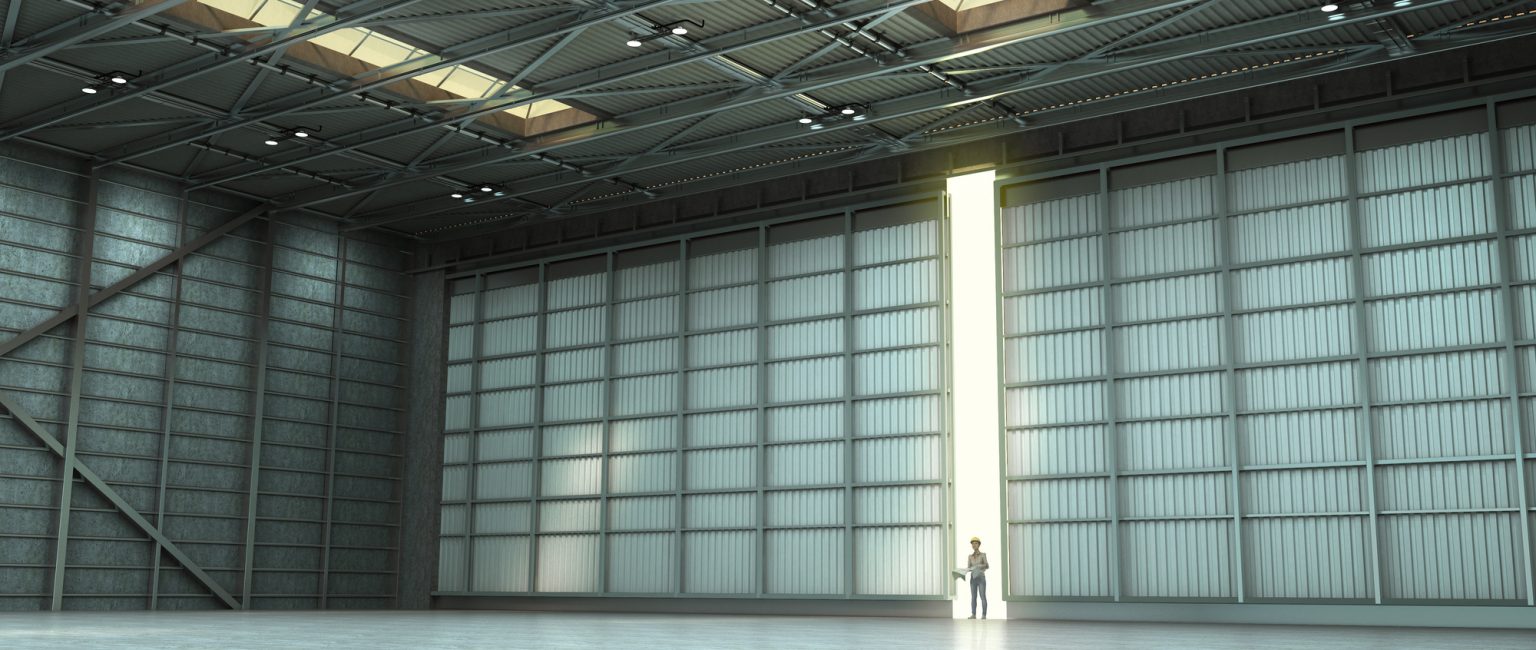

Industrial properties in certain cities are performing particularly well at the moment. Picture: Getty

Rich Harvey is a buyer’s advocate and chief executive of propertybuyer.com.au and said industrial property is his number one investment pick on the back of an ecommerce and logistics boom.

Neighbourhood shopping centres, or high-end retail, are a good buy for those investors with a bigger budget, Mr Harvey added.

Mr O’Neill agreed that shopping centres offer good prospects, especially if the property has a diversity of tenants – like a suypermarket and a selection of smaller retailers.

“The small shops are where you get your yield because the supermarket might have a lower square metre rate,” he said.

“The supermarket is the anchor and underpins the security of the centre, but then all those others really get that yield up into the six and seven percent and beyond – especially if you go regional.”

Neighbourhood centres, or multi-tenanted places, are good choices due to their varying lease expire terms, Mr Harvey said.

“A lot of the neighbourhood centres, I think if they’re a good well managed facility, I think they’ve got good uplift in them,” he said.

Smaller neighbourhood-style shopping centres can tend to be cash cows. Picture: Getty

Quick service restaurant (QSR) sites such as Hungry Jacks, McDonalds, KFC, or Subway also tend to be safe investment choices, Mr Harvey added.

“They’ve got high demand and long leases. The leases on those things are often 10, 15, 20 and even 25 years.”

Mr O’Neill said a property that doesn’t have a “perfect lease” of 10 to 15 years can still be a good investment prospect.

“If you buy a property, let’s say it’s a Chemist Warehouse, and it might have three years or less left on it, you can get a very good deal with slightly shorter leases, because there’s a little bit more implied risk,” he said.

“A lot of the smartest investors, that’s how they invest. They go into assets where there’s a value and opportunity – they can buy better because of the implied weakness of it.

“It might be a shorter lease, or it might be under rented or something like that.”

Current opportunities on the market

KFC site in Bundamba, QLD

Set to go under the hammer at auction this month, this freehold KFC opposite a Costco in Bundamba in Queensland has a 10-year lease with options to 2051.

The high exposure 2073sqm corner site has a dual lane drive-thru with on-site parking for 21 cars.

This KFC in southeast Queensland is currently on the market. Picture: realcommercial.com.au

The listing states it’s a “highly desirable freestanding fast food investment, constructed in December 2021, offering outstanding tax depreciation benefits”.

Warehouse factory in Moss Vale, New South Wales

Leased to one of Australia’s leading manufacturers, Enretech Australasia, this investment opportunity is selling for $3,095,000.

It features a 1000sqm warehouse and an office building spanning 247sqm, sitting on a 4471sqm site.

This warehouse site comes with a tenant on a five-year lease. Picture: realcommercial.com.au

The current tenancy is five years from 2021, with an option for another five years.

Woolworths Shopping Centre in Gubuda-Gordonvale, Queensland

A new 3880sqm neighbourhood shopping centre anchored by a 10-year lease to a Woolworths occupying 3315 sqm is being sold by an Expressions of Interest campaign until 30 March.

Supported by five specialty stores, the centre is situated 18km south of Cairns.

The net return on this asset is $1.3 million a year. Picture: realcommercial.com.au

It offers a fully leased net income of $1,306,000 per annum.