Logos joins Partners Group to buy $60m Port of Brisbane site

Logistics real estate company Logos Property has teamed up with Swiss investment house Partners Group in the $60 million purchase of a major site at the Port of Brisbane, as more international players chase Australian industrial properties.

Foreign groups are behind a series of pending purchases with portfolios being offloaded by JPMorgan Asset Management and Charter Hall in due diligence.

Demand grows: Why industrial is Brisbane’s new buzz word

The Australian reported earlier this month that Logos is buying the new warehouse and logistics complex in Queensland for more than $60 million.

Partners Group is a private investment manager listed on the SIX Swiss exchange with $US50 billion ($66.6 billion) under management in private equity, real estate, infrastructure and private debt.

Australia’s industrial market features strong demand for well-located distribution facilities in proximity to port infrastructure and this site in Port Brisbane is perfectly positioned to cater to that

The two are buying the site at 1-5 Bishop Drive on Fisherman’s Island near the Port of Brisbane from IPS Logistics, which consists of five buildings totalling more than 90,000sqm of gross leaseable area, as well as 30,000sqm of vacant land for new development.

IPS, a logistics services provider, will continue to be a tenant in the facilities after the sale.

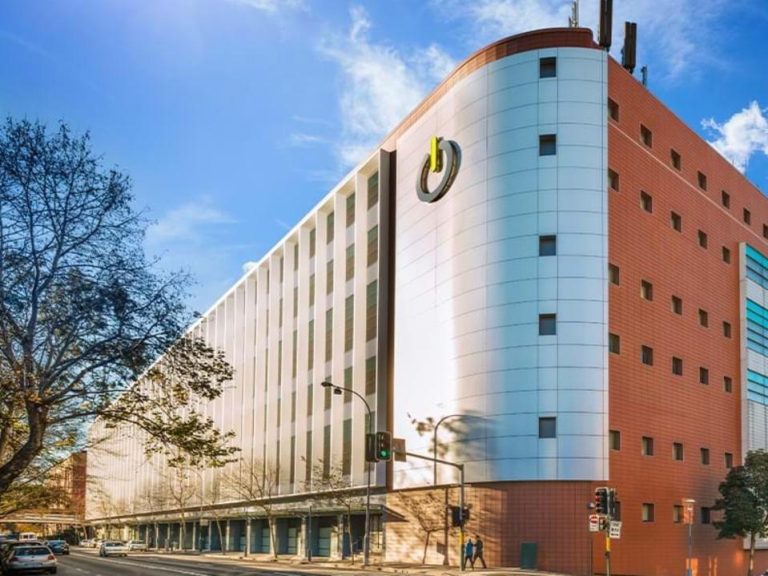

The Fisherman’s Island site at the Port of Brisbane has sold for $60 million.

Partners Group says it is buying on behalf of its clients, with the intention of “actively managing and developing the site for logistics use”.

“Australia’s industrial market features strong demand for well-located distribution facilities in proximity to port infrastructure and this site in Port Brisbane is perfectly positioned to cater to that,” says Bastian Wolff, Partners Group managing director and head private real estate Asia.

This investment is the second acquisition by Partners Group into Australian industrial property within the last six months

It is the second time that Partners has joined Logos in acquiring industrial properties. Last year the two bought a 32ha industrial site in Yennora, west of Sydney, from global aluminium producer Alcoa.

“This investment is the second acquisition by Partners Group into Australian industrial property within the last six months and is in line with our strategy of targeting smaller-scale industrial assets in supply-constrained areas,” Wolff says.

Partners has stated previously that it us spurning the competitive office market to chase industrial property and could spend up to $200 million to make acquisitions in the space.

This article originally appeared on www.theaustralian.com.au/property.