Mixed messages from buyers at portfolio auctions

Australia’s commercial property market might be as hot as ever, but vendors and buyers often have wildly different expectations of property values, according to some agents.

While buyers cherrypicked nine of the 11 properties on offer at Burgess Rawson’s Sydney portfolio auction last week, at the agency’s Melbourne auction a record crowd of more than 300 remained largely quiet, with just five of the properties on offer selling under the hammer.

A number of unsold properties were subject to post-auction negotiations.

Commercial Insights: Subscribe to receive the latest news and updates

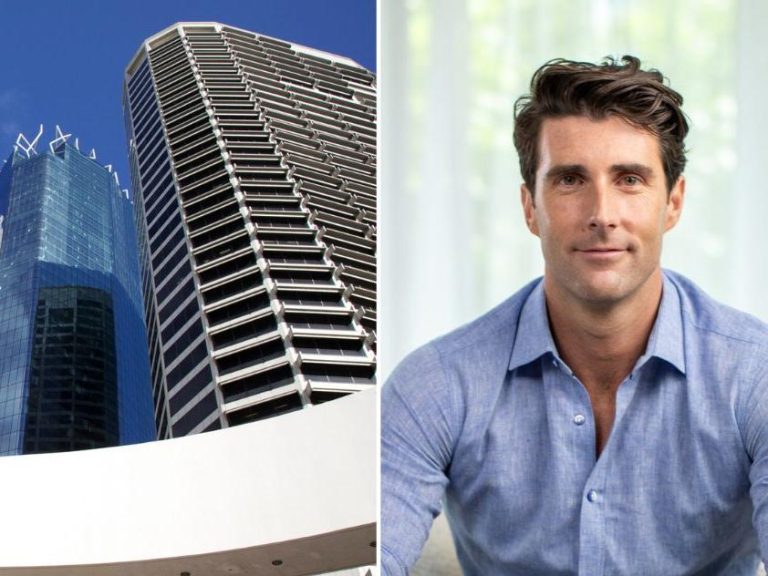

Burgess Rawson Melbourne director Shaun Venables says while there remains significant interest in commercial property, investors and vendors don’t always see eye to eye on value.

“While we didn’t sell all our auction properties under the hammer, we had near record attendance with more than 300 people packing the auction floor and a dozen more on the phones from interstate and overseas,” he says.

A childcare centre in Glen Huntly sold at Burgess Rawson’s most recent Melbourne auction.

“Overall, we are very pleased with how the property market is performing in 2018, particularly with Sydney achieving a clearance rate of 82% yesterday.”

A childcare centre at Glen Huntly was the prized offering in Melbourne, selling to a local investor for $7.35 million on a 5.38% yield, while an IGA supermarket at Somerville in the city’s outer south sold for just over $3 million on a 6.92% yield.

But buyers were less buoyant about other retail properties, with an Aldi supermarket at Seville in Melbourne’s Dandenong Ranges passed in, as was an IGA supermarket in Port Melbourne and a Reject Shop outlet in regional Cobram.

Queensland properties performed well, with a 7-Eleven store at Coolangatta sold for $1.22 million and a Bridgestone tyre outlet near Cairns offloaded for $1.6 million.

Agents were buoyant after the Sydney auction on Tuesday, with childcare and retail again featuring prominently as 82% of the properties sold.

The Priceline pharmacy at Concord was the standout result in Sydney.

But it was a Priceline pharmacy at Concord in Sydney’s inner west that stole the show, grabbed for $7.25 million on a 4.25% yield.

Burgess Rawson Sydney associate director Kieran Bourke says pre-auction interest was telling.

“The Priceline Pharmacy at Concord was a standout performer on the day – we had half a dozen bidders who were very keen to secure the property. This was on the back of more than 158 enquires,” he says.

“The Priceline location could not be more ideal, with Concord an established, affluent cosmopolitan suburb and this site amongst the best retail positions in Sydney’s inner west.”

“In addition to this, we sold four childcare properties throughout metro and regional New South Wales with a long established centre at Alfords Point selling for $3.27 million on a 5.2% yield.”