New world, new deals to come for property players

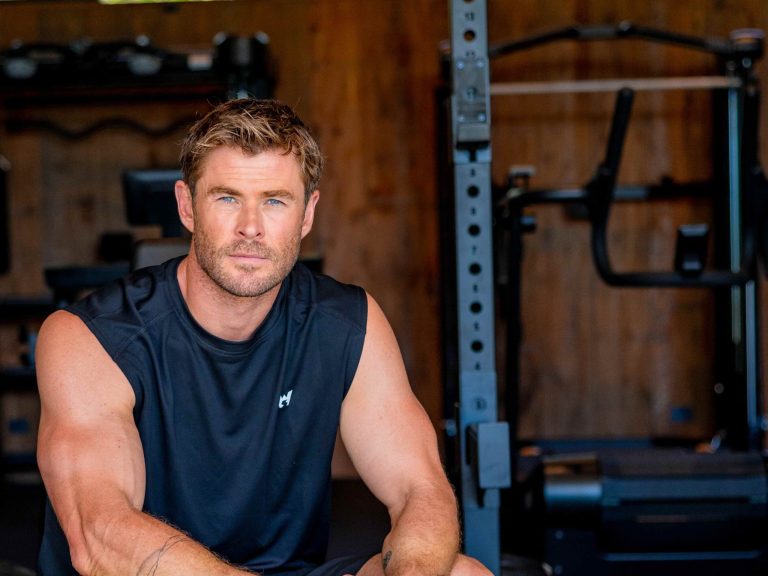

JLL chief executive Stephen Conry: ‘Next year the return to office, and beyond, will be far better than people think.’

After a year marred by lockdowns and now a new variant of the coronavirus, real estate chief executives are confident that 2022 will be a record breaker.

The opening of borders and the appetite of international capital for top class destinations will elevate Australia to the upper ranks of property globally, according to the agencies which marshal these flows.

The dramatic shifts prompted by the virus are likely to intensify and have prompted hopes that new vistas will open up for property companies in areas ranging from build-to-rent to life sciences.

JLL Australia chief executive Stephen Conry sees the positive market momentum continuing as business confidence further rebounds next year.

The veteran chief executive is a big believer in office demand returning, citing positive drivers including financial services, technology, healthcare and the public sector.

The jobs spurt at financial services firms is a telling sign.

“That will be an occupancy story, not just a work from home story,” Conry says. “Next year the return to office, and beyond, will be far better than people think.”

CBRE CEO Phil Rowland. Picture: Michele Mossop

The return of the population to CBDs will be another spark, as first international students and then overseas migration return, despite border restrictions imposed this week.

The chief executive is predicting a record year, with the investment surge in the first three-quarters of 2021 to roll into next year, with a renewed focus on alternative investments like student accommodation, build-to-rent, life sciences, and more sales as borders reopen.

Conry emphasises the rebuilding of cities after lockdowns. “If you want to have strong economies, you’re going to have dynamic CBDs,” he says.

Next year brings a federal election and while the campaign season can produce uncertainty, he says a decisive outcome is critical. “The worst outcome for the election would be a hung parliament,” Conry argues.

The Reserve Bank has indicated that interest rates won’t increase next year but Conry acknowledges the global view that the inflation genie is “out of the bottle”.

“That is on the minds of investors around the world. But there’s no sign that’s going to the impact on global capital coming into Australia,” he says. “There’ll be some investors who will now think even more about coming to Australia next year because of the borders opening up.”

He is keen for a bounce back in Melbourne, where returning students could provide a boost that spills over to other cities. “When that comes back, that’s a very big positive boost, ” Conry says.

The chief executive of CBRE’s Pacific Advisory Services business, Phil Rowland, says the environment has turned positive in the wake of lockdowns that struck NSW and Victoria. Major economies are living with the virus even as new variants emerge.

“Most of the policy settings suggest that we’re going to be able to live and operate with Covid,” he says.

Rowland says consumer confidence is strong and cites the pent up demand driving a spring back.

Cushman & Wakefield chief executive, Asia Pacific, Matthew Bouw.

He cites strong corporate earnings offshore and locally as drivers of activity, along with the low interest rate environment, which should see “full employment” return by late 2022.

“That plays into really good thematics for office, industrial and retail,” he says. ”We’re expecting increasing levels of investment activity across all those asset classes.”

Each area will be different. “There’s a number of investors that are recycling capital out of office to redeploy, but then there are also a number of investors who are continuing to double down,” he says.

Australia remains attractive. “If you look at the ongoing infrastructure spending and development of the major gateway cities the long-term thematic for Australia and New Zealand, despite borders still being closed, that’ll play well,” Rowland says.

Rowland cautions one constraint could be opening borders too slowly.

“The pace at which immigration starts to pick up I think is going to have an impact on the pace of recovery,” he says.

He wants to see a faster return of students and skilled workers. “That pace is probably still a little bit unclear,” he says.

Meanwhile, the headline-grabbing disruptions to global supply chains could play in favour of the local industrial market. Rowland sees transportation costs and difficulties with manufacturing offshore continuing. “That’s going to stick around, because Covid hasn’t disappeared,” he says and local logistics could be a winner.

Knight Frank chief executive James Patterson.

Cushman & Wakefield chief executive, Asia Pacific, Matthew Bouw, cites the large amount of activity across the regions as they experience a “confluence of tailwinds”.

With an estimated $US20 trillion of fiscal and monetary stimulus washing around the global system he says the “wall of pent up institutional capital” is chasing local properties.

He expects data centres, distribution centres and storage to keep rising, along with once alternative asset classes like medical centres, petrol stations and hotels.

Bouw says retail will split between preferred locations and secondary sites, as spending moves back towards services as it opens up. This could see a slight drop in the rate of online sales growth but he says e-commerce is here to stay.

Reopening, however, is not to be underestimated. “There’ll be people flooding back as things open up to more bricks and mortar retail, but that is not to say that there won’t still be an escalation of online,” he says.

He is most bullish about multifamily and particularly the potential portfolios to trade and for debt to become a greater service in years ahead. “We certainly see multifamily as very much an emerging asset class in the Australian market.”

Knight Frank chief executive James Patterson says that while the new Covid variant poses risks, the “base case” is for a bright outlook for 2022 as the economy resumes a rapid trajectory.

“The new variant is a reminder that the pandemic is not over and its emergence brings renewed risks to the outlook, particularly for offices, hotels and retail,” he says. Risks are more acute in Sydney and Melbourne given their exposure to international travel, which could hit tourism and prolong the labour squeeze.

He says it is hard to go past industrial and logistics as again being the fastest growing sector. Patterson says the drivers of growth will gradually shift away “from yield compression and towards rental growth”.

Savills, CEO Australia & New Zealand, Paul Craig.

And he expects offices to perform as business gets back into gear, with the leasing veteran acknowledging debate about workplace strategies but tipping this will play out over a long period.

“We see no widespread trend toward corporates downsizing and the greater impact is likely to come through changes to the form and function of offices rather than the quantum of space needed,” Patterson says.

And developers will gear up to bring the next generation of buildings out of the ground that cater to the post-pandemic world. Some will be for the rapidly expanding medical research industries.

Savills CEO Australia & New Zealand Paul Craig says that even now there is a shortage of genuine opportunities and record pricing is being achieved.

He is optimistic about the return of old money. “We suspect there’s going to be a return of the high net worth capital and the private money, with offshore money in particular interested in the Australian market.”

He says that healthcare and life sciences will definitely feature next year.

Colliers chief executive, Australia, Malcom Tyson

Colliers chief executive, Australia, Malcom Tyson, predicts diminishing levels of stock will run up against record levels of investment capital and rising demand to occupy property.

The industrial property veteran calls out the surge in cold storage assets. “The increase is logical given the rise in pandemic-driven food and medical logistics,” he says.

Looking ahead, Tyson is optimistic about a return of migration, which he says will result in an increase in population growth which could help accelerate the build-to-rent sector, as the sector spreads from its Melbourne base along the eastern seaboard.

Plenty more is to come with new data centres to spread across the nation in areas where they can be hooked up to renewable energy, he says.

Real estate may just be on the cusp of its next big shift.