Nick DiMauro’s rags-to-riches story and why he wants other migrants to be given a chance

Nick DiMauro, as a young man and now, against the backdrop of his home town in Italy.

He’s the rich lister most people outside of property circles haven’t heard of, and that’s the way Adelaide’s Nick DiMauro likes it.

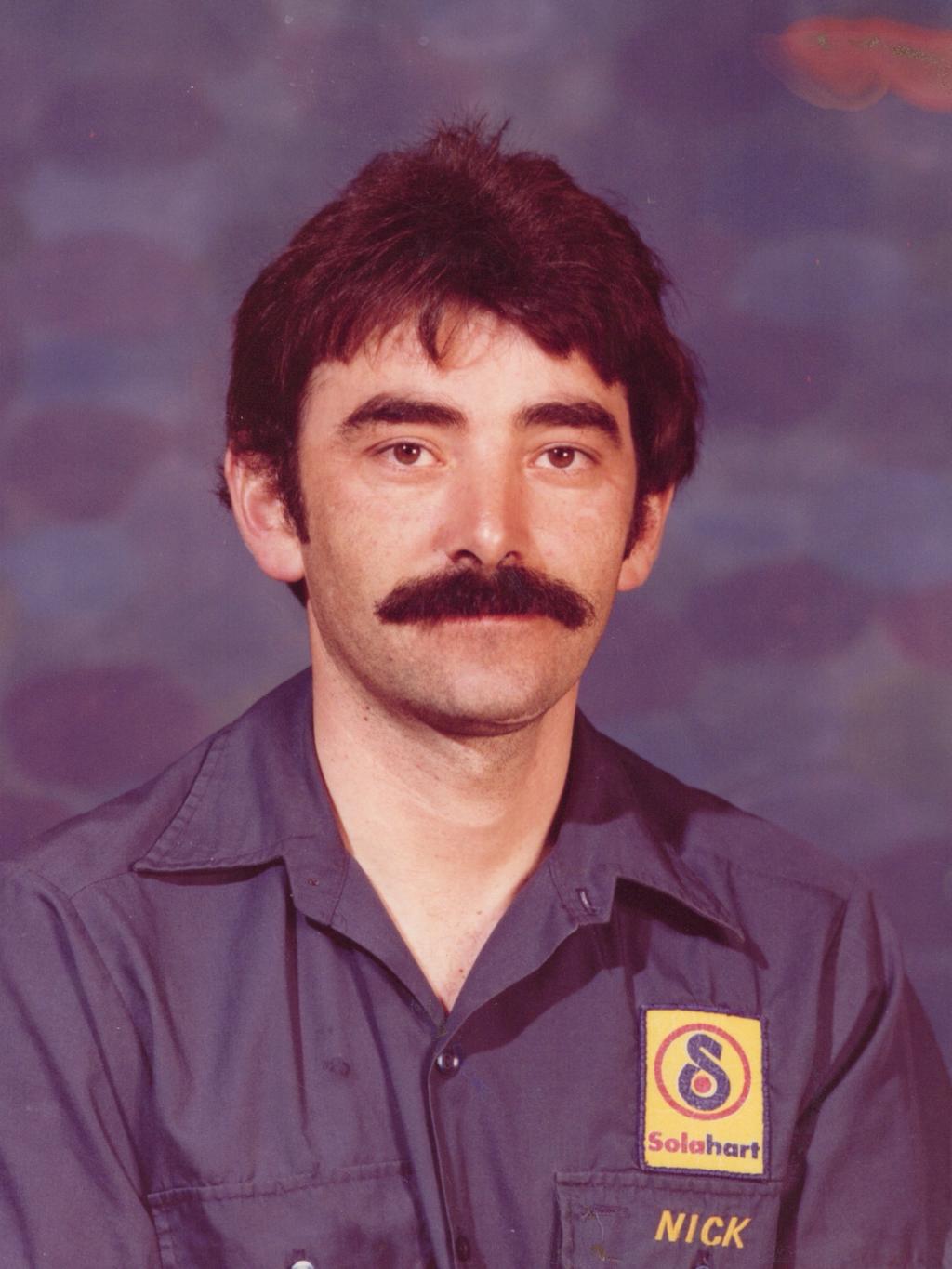

But having quietly amassed a $1.3bn fortune through investment in shopping centres and office buildings across Australia and New Zealand, the plumber-turned-property magnate has become one of Australia’s wealthiest real estate investors and a migrant success story.

After buying his first shopping centre in his home city of Adelaide in 1995, DiMauro has gone on to add 15 more to his portfolio – most recently in Tasmania where he spent $82.5m to acquire one of the state’s largest shopping centres, Channel Court on Hobart’s southern outskirts.

According to The Australian’s latest Richest 250 list, DiMauro now ranks as the third wealthiest South Australian, and comes in at 125 on the national list of Australia’s wealthiest people.

DiMauro puts his success down to years of hard work and a simple philosophy to investing in shopping centres; lock in the big-name anchor tenants and the rest will follow.

Channel Court in Hobart is Nick DiMauro’s latest acquisition.

Three decades of economic growth in Australia, fuelled by waves of migration, strong relationships with major trading partners and political stability, have made the country a “beautiful place to invest”, according to DiMauro, who arrived in Australia from southern Italy as part of the post-war immigration drive.

And while many fear the impact of a new wave of migrants into the country, DiMauro welcomes it, saying the country will benefit from the ambition that many bring with them in search of a better life.

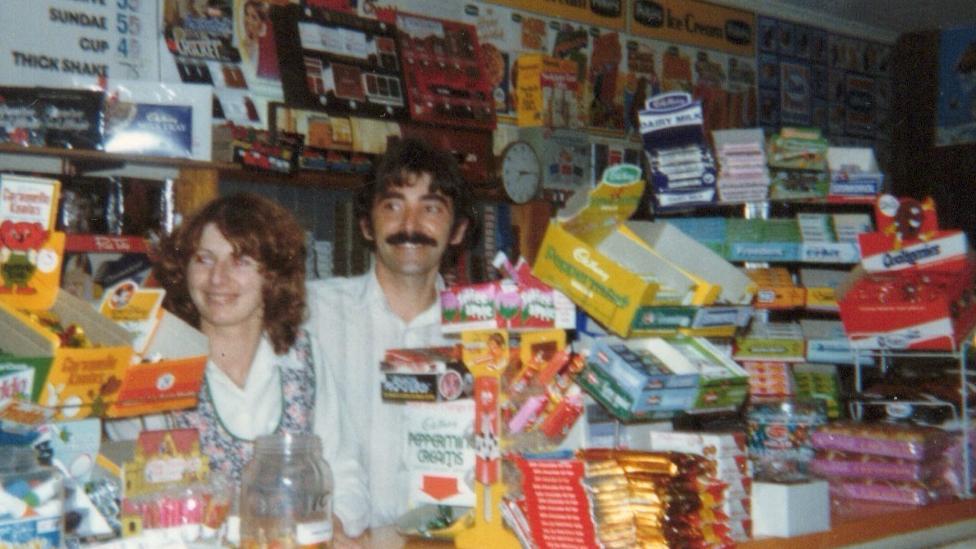

Nick DiMauro in the late 1970s with late wife Angela at their first business – a deli in Salisbury, Adelaide.

“I came from Italy as a seven year old. We had nothing and I worked very hard, myself and my late wife, and I’m very proud of what we’ve achieved in this country,” he said.

“You could never do that anywhere else in the world. You’re free here and it’s just a lovely country to do business in.

“I think immigration is good – I’m not worried about it in the slightest. I think the people that come over here are genuine people that want to do well here. And I think we have the opportunity in this country so why not? We were given the opportunity, why can’t we give them the opportunity?”

DiMauro arrived in Australia from Vieste, pictured above, in 1961. Picture: Getty Images

DiMauro and his family arrived in Adelaide from Vieste, a small town on the Adriatic coast of Puglia, in 1961.

A former telegram boy for the old Postmaster-General, DiMauro started out as a plumber before running a small suburban delicatessen in Adelaide in the early 1970s.

The venture was a success and DiMauro started buying residential blocks and small retail outlets before making his first major acquisition in 1995 with the purchase of Sefton Plaza shopping centre in Adelaide’s inner north.

Through the family’s Angaet Group, DiMauro and son Michael now oversee a portfolio of more than 20 shopping centres, office buildings and development sites across SA, Queensland, Western Australia, NSW and New Zealand.

DiMauro said he dabbled in the sharemarket, but property’s the main game, and specifically shopping centres, which have benefited from decades of rising economic prosperity in Australia.

“The best investment, as far as I’m concerned, is real estate,” he said.

“We do our due diligence. Everyone does it a bit differently. I’m not too worried about small things. I’m more worried about the major covenants. All your big guys – Coles, Woolworths, Big W, Kmart, Target – have to have a good term lease, and make money, and if they make money that means people are coming into the centres and then everything else will fall into place.

“If you’ve got the fundamentals right, which is the big boys, then everything else will follow, and that’s been my approach all the way through.”

Shopping centres have emerged as the surprise packet of commercial real estate this year with several big malls changing hands as investors jump back into the market following the Covid-19 crisis which crunched values and rental levels.

Recent sales in DiMauro’s home city have included Westfield centres Tea Tree Plaza and Westfield West Lakes – the latter attracting a bid from DiMauro before he walked away from a potential deal.

Parabanks shopping complex in Adelaide. Picture: Mike Burton

Both 50 per cent stakes ended up going to a joint venture between Scentre Group and Barrenjoey.

While the cost of living has hit discretionary spending, DiMauro said his centres continued to trade well, and he continued to be on the lookout for more acquisitions.

“We haven’t really seen any major hardships that you read about; no more than normal,” he said.

“When times are tough retailers like Coles, Kmart and Big W – their turnover goes up which they have done – and our foodies have gone up something astronomically too.”

Upgrades are also in progress across several of DiMauro’s centres, including major upgrades at the Raintrees shopping centre in Cairns, at Armidale Plaza in NSW and at Logan City Centre south of Brisbane.

Nick DiMauro pictured during his time working as a plumber.

Outside of work, DiMauro describes himself as “a real boatie”, spending much of his time aboard his boats based at Outer Harbor in Adelaide’s west.

But the 70-year-old has no plans of slowing down, working closely with son Michael to oversee the family’s portfolio.

“I don’t know what else I would do,” he said.

“People say, ‘When are you going to retire?’. But retire from what? You can’t retire from life – you’ve got to keep going.

“I enjoy my work and I’ve got tremendous pride in what I’ve accomplished. It’s as simple as that really.”