Office assets in CBD fringe markets set to shine

For office market investors, the best opportunities can be found in CBD fringe areas like North Sydney, Paul Thornhill finds.

With the mining sector slowing down and the global economy heading up, the outlook for the office market is in transition.

After a decade in the doldrums, Australia’s biggest property market, Sydney, suddenly has a spring in its step. Housing construction, consumer spending and the global economy are all tracking better, so is the office market next in line to recover?

“Over the last 6 months, we have seen a rebound in Sydney”, says Knight Frank National Director, Matt Whitby, “but the real story is the different outlook for the suburban, fringe and CBD office markets.”

“We’re seeing the best opportunities emerge in A Grade properties in fringe areas like North Sydney. With yields in the 7-8% range and vacancy rates less than 5%, investors find themselves being rewarded for a risk that isn’t really there.”

The emergence of fringe offices is also apparent in areas like Melbourne’s Southbank, where major tenants are finding large floor plate, modern offices at significantly lower rents than prime CBD buildings.

In Brisbane, the Bank of Queensland’s recent move from Queens Street in the CBD to nearby Newstead epitomises the trend.

Office parks also have momentum as governments push population growth out to the suburbs. Employers in the engineering, healthcare and R&D sectors are opting for low rise, campus style developments, popular with employees wanting to avoid a long commute to the city.

Claire Cupitt, Senior Research Manager at CBRE is closely following CBD vacancies, telling realestate.com.au “CBDs properties are expensive and increasingly we’re seeing corporates consolidate to prime and A Grade, away from B and C grade properties.”

“We keep a close eye on space advertised for lease, rather than vacant space, and this highlights the effect of outsourcing and downsizing in the finance and insurance sector. There is now 91,000 square metres advertised for lease in Melbourne and 50,000 in Perth, compared to 72,000 square metres in Sydney.”

“I would also highlight the amount of stock coming onto the Brisbane market in 2015 -16. Much of it is speculative and it’s hard to pick where the required increase in tenant demand is going to come from. In this market, we could see vacancy rates go up and rental growth flatten.”

With the economy shifting away from resources, market watchers are keeping an eye on the Perth office market, increasingly seen as expensive, and Darwin, which has enjoyed a boom for the best part of a decade.

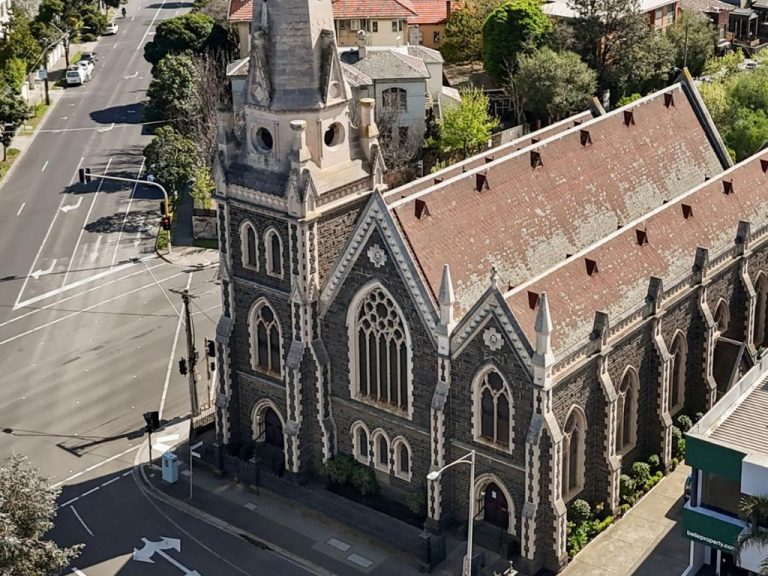

In Adelaide, the deferral of the Olympic Dam project and staff cutbacks at Holden have brought a holt to the enthusiasm running through the city of churches 12 months ago.

“For investors looking for opportunities across Australia, it’s a case of having to pay close attention to recent developments in the market,” Whitby says.

“When you combine corporate consolidation, the influence of NABERS (Australia’s rating system for the environmental performance of commercial and residential buildings) and the search for value by major tenants, what we see is some great prospects for CBD fringe offices, particularly in Sydney, and some challenges ahead for B and C grade properties in smaller cities.”