Office space hits final frontier as vacancy levels show signs of improving

The vacancy rate across the nation’s office towers has tightened overall, but Melbourne is lagging behind as the slow down in some CBDs catches up to it. Picture: Vince Caligiuri/Getty Images

The vacancy rate across the nation’s office towers has tightened overall, although some buildings in some key cities are lagging behind as the CBDs’ economies slow and many tenants move to the best office offerings and precincts.

A split picture is emerging of national office markets in the wake of the coronavirus crisis, with hard-hit Melbourne struggling, while space in Brisbane is tighter than ever and the best parts of Sydney have come though the worst.

While landlords face the prospect of a wave of new buildings, many developers have pushed their plans back into the next cycle, giving them time to deal with the structural shifts towards working from home for many employees.

The national office vacancy rate tightened in the first half of the year, with more than half of the capital city CBDs recording a reduction in the number of vacancies, according to new data from the Property Council of Australia.

The group’s latest report shows office vacancies across Australia fell from 14.8 per cent to 14.6 per cent over the six months to July.

But in a sign that conditions remain tough, this level of vacancies was lodged 4.2 percentage points above the historical average.

While vacancy in CBD office markets stayed relatively stable, marginally increasing from 13.5 per cent to 13.6 per cent nationally, non-CBD areas recorded a fall from 17.9 per cent to 17.2 per cent.

But it was the split between the cities that was most notable.

Melbourne’s vacancy rate has jumped to 18 per cent as the city was slugged by the shift to working-from-home and empty blocks in the Docklands. Picture: William West/AFP

Queensland is showing its strength as Brisbane’s vacancy decreased from 11.7 per cent to 9.5 per cent, the first time its vacancy rate has been under 10 per cent since 2013.

Sydney’s CBD office vacancy rate also fell, from 12.2 to 11.6 per cent. And Adelaide witnessed a drop from 19.3 to 17.5 per cent.

However, in a sign that weaker states remain tough, three CBD markers had rises in vacancy, which was partly driven by supply.

Melbourne’s vacancy rate rose from 16.6 to 18 per cent as the city was slugged by the shift to working-from-home and empty blocks in the Docklands.

“Melbourne still faces stiff challenges. The Victorian government simply has to get some of its workforce back a few days a week to support what must again be a thriving city,” Property Council of Australia chief executive Mike Zorbas said.

Canberra’s vacancy rate increased from 8.3 per cent to 9.5 per cent, and Perth’s lifted from 14.7 per cent to 15.5 per cent, as new offices came online.

Mr Zorbas called the latest figures “encouraging”. “It is pleasing to see vacancy levels fall in half of Australia’s CBDs,” he said.

“There is room for very cautious optimism in parts of the office market,” he added.

He pointed to new towers coming online as boosting the overall availability of space. “In our CBDs, office supply is continuing to be a driving force for vacancy levels as demand for office space has been positive,” Mr Zorbas said.

“This demonstrates businesses still see a CBD location as the best place to do business,” he said. “In the last three years, four of the six reporting periods have recorded positive demand for office spaces in our CBDs.”

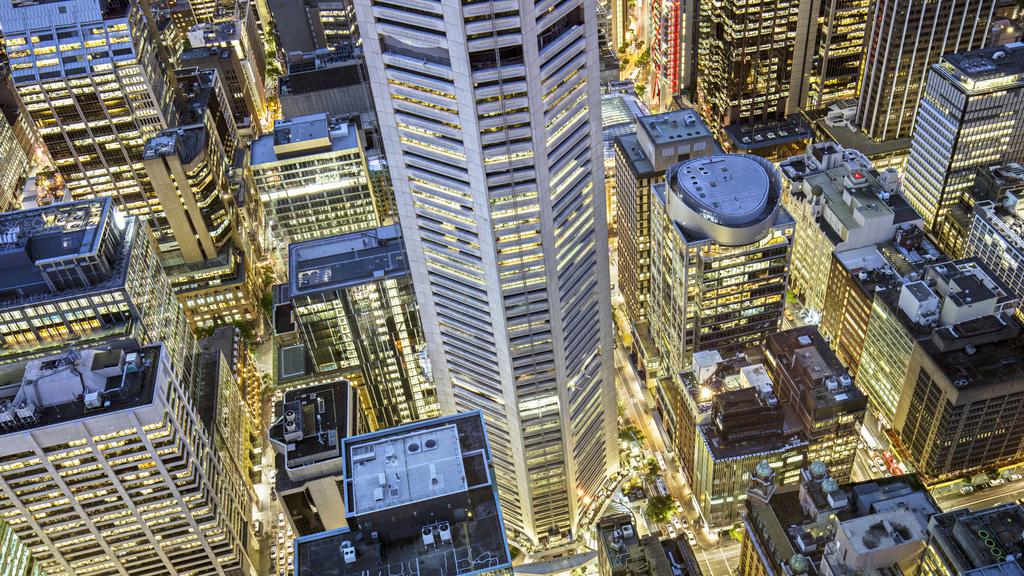

Downtown Sydney at night. Picture: iStock

Mr Zorbas called out the big split in the market between old space, which is struggling, and demand by tenants for new towers. “We continue to see a preference for high-quality office spaces, with Sydney and Adelaide being the only capitals to record higher prime vacancy than secondary vacancy,” Mr Zorbas said.

He pointed to the long-heralded growth of conversions in cities, where alternative uses are becoming more lucrative. “Some of the older, lower-grade office buildings that are in lower demand are now being withdrawn from the market to be repurposed through refurbishments or converted into residential spaces or hotels,” Mr Zorbas said.

Sublease vacancy, a measure of business confidence reflected by businesses renting out parts of their office space, fell in both the city and metropolitan markets as Adelaide, Sydney and Melbourne had sublease vacancy decreases.

Sydney will accommodate most of the nation’s additional new supply of towers for the remainder of this year, with close to 300,000sq m of office supply to come online through to 2026, with 61.4 per cent of that supply already pre-committed.

Nearly 250,000sq m is forecast to come online in Melbourne by 2026, with 20 per cent of that space already committed to by future tenants.

In a pointer to continued pressure from new towers that were started during boom times rising in our cities, the supply of office space in CBDs is projected to stay above the historical average until January 2026. Supply in non-CBD markets is expected to follow suit.

CBRE’s head of investor leasing, Pacific, Tim Courtnall, said the office sector was recovering, with strong inquiry and transaction volumes led by the professional services, mining and government sectors.

“Despite economic challenges from inflation, labour shortages and rising construction costs, one of the most pleasing observations is the desire from all occupiers to improve their workplace and relocate to better quality offices. However, for some occupiers, especially SMEs, translating that desire into action has been harder in 2024 given the focus on maintaining costs with favourable renewal terms.”

Mr Courtnall said leasing deals had been strong in Perth and Melbourne where some of the country’s largest lease commitments were struck. “Despite upward pressure on incentives in some markets, it’s pleasing to see effective rental growth across nearly all prime grade assets,” he said.

The firm expects improving conditions in all markets, with sublease vacancy rates decreasing everywhere except Melbourne. “Having said this, it will be somewhat of a bumpy ride given the US election, unpredictable interest rates, and record sharemarket levels,” he said.

CBRE said big companies were encouraging staff back to their offices and argued that much of the tenant right-sizing appeared to be complete, with tenants likely to return to expansion mode in coming years. It said some new supply was being delayed due to construction costs, high economic rents and valuation uncertainty, and it expected national vacancy to peak in 2024 before a steady decline from 2025 onwards.

Higher construction costs have forced developers to shelve projects in major capitals as they are unable to secure precommitments at rents that make their projects stack up. This is expected to help bring high vacancy back into check in coming years.

JLL estimates that the rental cost for developing a new asset is now 20 per cent higher than it was two years ago, so the only projects that go ahead will be at significantly higher price points, cutting into new construction over the medium term.

JLL head of office leasing, Australia, Tim O’Connor said the Australian economy had slowed this year, resulting in softer labour market conditions, but he said office markets were holding up. He also called out the split in the market.

“In terms of office quality, demand for prime-grade assets remains robust, while the secondary grade market poses challenges with slower activity and fewer inquiries,” he said.

Big companies are also settling on their space needs. “A positive indicator is the significant reduction in sublease availability across most office markets, suggesting that large organisations believe their existing office spaces align with evolving workplace practices.”

Hot air balloons soar over the Melbourne skyline ahead of a track work session at Flemington Racecourse in Melbourne. Picture: Vince Caligiuri/Getty Images

Colliers managing director, office leasing, Australia, Cameron Williams, said there were some positive signs emerging across office markets, with vacancy declines more prolific than increases over the first half of 2024 in CBD and metro office markets.

He said some occupiers were chasing higher-quality offices, allowing the vacancy rate to dip.

“Relocation opportunities across Sydney and Melbourne’s CBDs have contributed to stronger leasing activity over the second quarter within these markets,” Mr Williams said.

But supply trends will be critical.

“Beyond 2024, more mooted supply pipelines will continue to have an impact on the recovery of Australia’s office markets. From 2025 the pipeline is scarce with development feasibilities under pressure as construction costs remain elevated and the required precommitment level harder to achieve,” Mr Williams said.

Knight Frank national head of leasing Andrea Roberts said that over the past 12 months there was a relative improvement in tenant demand across all markets, with inquiry and inspection levels up in Sydney and Melbourne.

“There is, however, a continuing pattern in leasing performance based on location of an asset,” Ms Roberts said.

“Again, this is most measurable in Sydney and Melbourne, with the vacancy and incentive disparity between office buildings located in the core and east end of these cities respectively. It is very much a tale of “the best and the rest”, coming back to the fundamentals of real estate – address and amenity is everything.”

Cushman & Wakefield head of office leasing, Australia and New Zealand, Tim Molchanoff, said tenant demand had remained strongest for high-quality properties as occupiers were now vying for better locations. But he cautioned that outer core, fringe, and metro assets were grappling with higher vacancy rates.

This is making the offices very much a local game even as a recovery takes hold.

“Looking ahead, vacancy across Australian office markets will vary by city and driven by factors such as new supply, employment growth, and a tight labour market. We believe Brisbane and Perth will continue to stand out, while larger markets like Sydney and Melbourne will see strong performance in core locations but face challenges with fringe assets,” he said.