Office vacancy rates soar, but not all towers hit equally

The scars of the pandemic continue to deepen among commercial office assets, with vacancy rates rising to the highest levels since the mid-1990s.

But for investors prepared to withstand extended periods of vacancy, it could mark an opportune time to invest in the hard-hit sector with valuations of some secondary assets sitting below replacement costs.

The national office vacancy rate rose to 14.8% over the six months to January according to the Property Council, up from 14.1% in the previous period, marking the highest level in almost 30 years.

Source: Property Council Office Market Report | January 2024

But outcomes vary between asset grades and locations according to Property Council chief executive Mike Zorbas, as hybrid working models prompt tenants to evaluate their needs amid a growing supply of higher quality buildings.

“There is a clear divergence between older, low-quality stock and the new premium office buildings rejuvenating our cities,” Mr Zorbas said.

“The increase in office supply during 2021 and 2022, far surpassing the historical norm, and continued business moves towards high-grade offices explains the results we are seeing.”

The findings of the biannual Office Market Report found vacancy rates increased in almost all capital city CBDs – except Perth – while non-CBD areas saw vacancy rates lift to almost 18%.

However, the vacancy rate for ‘prime’ office space was generally lower than ‘secondary’ assets, the report showed, driving a so-called ‘flight to quality’.

Research by ANZ revealed an estimated 17 office projects valued over $100m were completed last financial year, adding substantial supply, while the potential investment pipeline for the office sector is set to peak in 2024-25.

“The office construction pipeline has defied the structural shift of worker presence in office spaces, as strong employment growth and the flight to quality stimulates new developments,” ANZ senior economist Adelaide Timbrell said.

Tight labour market driving structural shift

The flight to quality is not only driving new construction – with the value of new office building approvals sitting well above pre-pandemic levels – but could mark a structural shift in tenant demand.

PropTrack economist Anne Flaherty said the current conditions were allowing tenants to take advantage of attractive lease terms.

“We have seen effective office rents decrease, which has enabled businesses to move to higher quality spaces, at the same time during the Covid years we were actually seeing the delivery of a lot of new office space,” Ms Flaherty said.

“It’s not just the fact that it’s a good time to be an office tenant and to be negotiating a lease, but the fact is that businesses who do want their staff to return to the office, they now realise that they have to offer more than just a place to sit and work.

“They actually do need to lease high quality spaces if they want their workers to even come into the office.”

PropTrack economist Anne Flaherty.

Speaking to realcommercial.com.au, ANZ’s Ms Timbrell said the low unemployment rate was forcing businesses to find ways to entice workers into the office, rather than force them.

“Because it’s very difficult to force people back in the office, particularly for four or five days a week, employers are finding other ways to increase their office usage,” Ms Timbrell said.

“And one of those ways is to provide newer spaces that have better amenities that fit the current pattern of work and current needs of the workforce, rather than going with whatever they can find.”

Office vacancy rates have lifted to multi-decade highs, but premium grade properties are in higher demand than secondary assets. Picture: Getty

She said the pre-pandemic ‘norm’ saw workers in the office full time, regardless of the space.

“Now with a very low unemployment rate and with our new pattern of hybrid working, people don’t feel as if they have to go, and therefore the offering has to be better than it was before,” she said.

“This is something that also happened in the retail sector during the rise of online shopping, we went from needing to go to a shopping centre in order to buy things to having that option, but not being required to go.

“And so shopping centres had to get a lot more pleasant in order to lure people to continue going. So we’re really seeing that happen now, but in the office sector.”

While the unemployment rate is projected to rise from December’s ultra-low 3.8%, Ms Timbrell said the trend is likely to continue towards better amenities for office sector workers.

“As long as those office sector workers have the bargaining power to not be forced into the office five days a week, and it is very likely that by the time the unemployment rate is sufficiently high that employer bargaining power returns, it will be such a cultural norm that it’s unlikely we’ll see the end of hybrid working.”

Opportunities for countercyclical investors

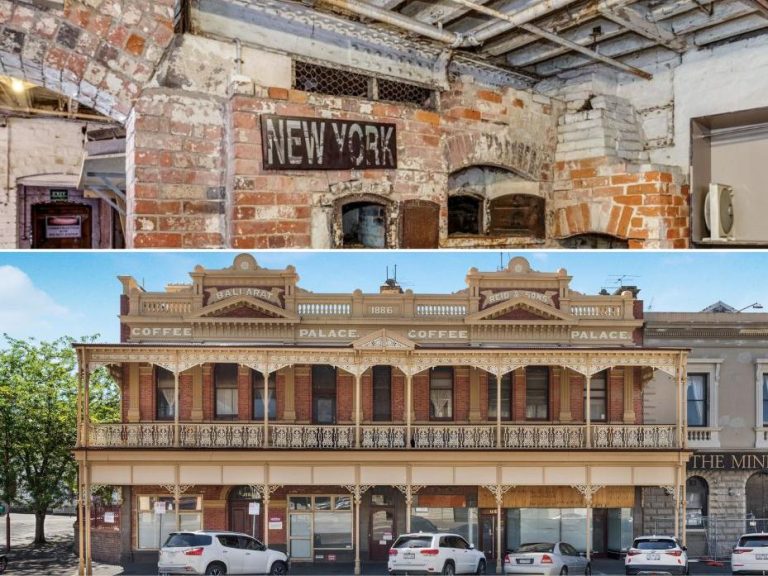

Secondary grade offices have been among the worst performing assets over the past three years, and with more construction in the pipeline, lower grade existing offices will continue to face pressure across valuations and vacancies.

But for those able to withstand these ongoing pressures, Ms Flaherty said it could be an opportune time for countercyclical buyers.

“If you look at the replacement cost of offices, a lot of secondary grade offices at the moment are valued at a level that you couldn’t even build them for,” she said, noting surging construction costs and sharply higher funding costs.

“So I think that for an investor who’s in a position where they can weather an extended period of vacancy, or an investor who is looking for a value-add opportunity where they can refurbish an office building to a higher quality space to attract more tenants, it actually might be a good time to seek out those assets.”

According to CBRE, national office attendance compared to pre-Covid levels remained highest mid-week with attendance between Tuesday and Thursday averaging 76% in the third quarter of 2023.

But offices still need to accommodate the peak number of workers, not the average, across the week.

“I would say there is a countercyclical opportunity at the moment for those investors who are in a really strong position to weather extended vacancy,” Ms Flaherty said.