Offices and logistics to lead the way in 2020: AMP Capital

On balance, last year was a positive one for real estate investors. The risks and rewards became clearer as central banks responded to sluggish growth and improving capital values benefited from low interest rates. We also saw risks on the demand side rising as consumer and business confidence hit record lows. With this in mind, where next for the new year?

Residential is benefiting the most from the immediate effects of falling interest rates, encouraging home buyers back to the market.

With the prospect of more rate cuts this year, Sydney and Melbourne are the firm favourites to deliver the most stable growth over the medium term, but recovery markets such as Perth and Brisbane will offer investors more affordable entry points, with higher growth upside.

While office was the market leader for total returns, slowing economic growth created a drag on rental growth, particularly in Sydney and Melbourne.

While tenant demand is expected to decrease this year because of slowing growth, rents should remain solid as there are no signs of a supply breakout before 2022. Pricing in all office markets also is expected to rise as global investor demand for Australian office product remains strong.

Beyond the core markets of Sydney and Melbourne, which still will deliver strong but slowing returns, the resource states of Brisbane and Perth remain on track for recovery-led growth in the short to medium term.

Logistics is expected to outperform all commercial real estate sectors this year, in both capital and income growth. This will be driven by global demand for logistics assets as portfolios are re-weighted away from retail, rental growth benefiting from a more sophisticated, tech-enabled tenant pool, and with average prices typically 80 to 90% lower than a retail or office asset, resulting in a highly liquid market.

Because of high demand for assets, accessing logistics will be challenging. Investors may consider infill sites or repurposing property such as well-located bulk goods or smaller shopping centres for logistics use, but careful site selection and tenant vetting will be critical to minimise risk.

While pricing for retail on the whole will show some softening this year, it won’t be as much as we previously anticipated. Online sales will continue to challenge the bricks-and-mortar sector, but with Australian Bureau of Statistics data showing 93% of consumer spend is still in store, we still expect plenty of shopping to be done in shopping centres and the war for the consumer to continue to play out between convenience (supermarkets, food services and other essential services) and experience.

Overall, the outlook for real estate is bifurcating — on the one hand, pricing growth will accelerate across most sectors this year, as the benefits of cheap debt and attractive returns keep investor demand levels high. However, this optimism needs to be measured with a sober reflection on the weak fundamentals of the Australian economy, which continue to amplify the risks on the demand side.

The good news is the picture is a lot clearer than last year and, despite a record growth cycle, the evidence suggests there is more upside for real estate investors this year and plenty of opportunities across sectors to find solid returns.

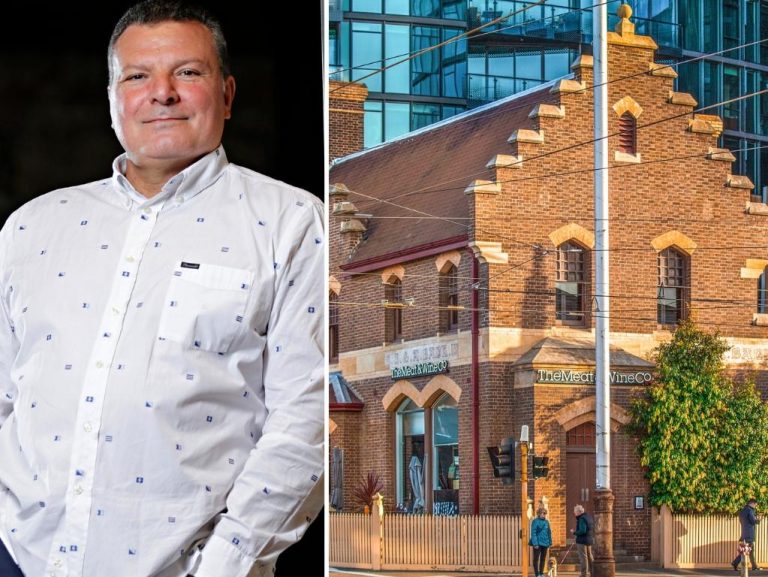

Luke Dixon is AMP Capital’s head of real estate research.

This article originally appeared on www.theaustralian.com.au/property.