Opportunity Fund to finance Waterloo apartment project

The Schwartz family-linked real estate private equity firm Qualitas has unveiled an apartment project in inner Sydney Waterloo as the first asset to be financed by its flagship Opportunity Fund.

The move comes as banks crack down on lending to new apartment projects in areas they see as oversupplied and developers turn to new funding sources.

The firm, which is part-owned by Besen family heir Carol Schwartz, will provide mezzanine finance for the $107 million Iconic Waterloo apartments and associated retail space.

Richlister: Seymour Group sets sites on mezzanine finance

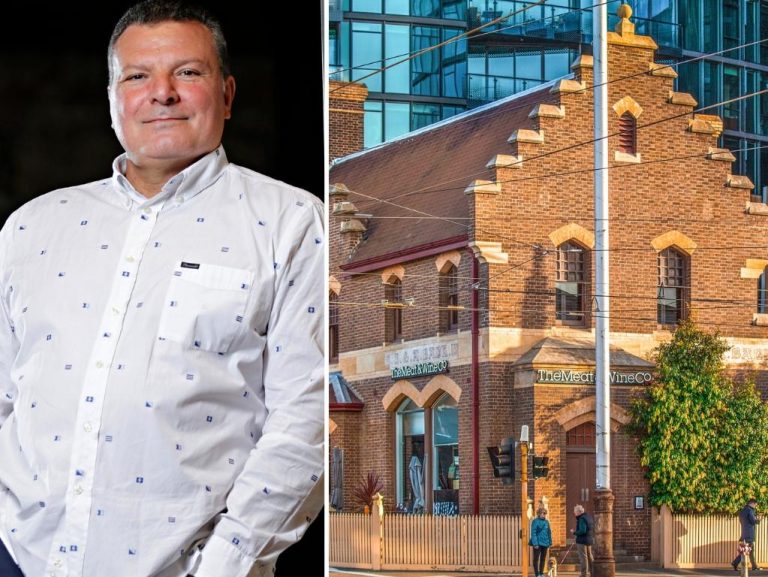

The joint venture scheme between developers Thirdi and Milligan Group involves the conversion of the heritage Chubb building in Waterloo and it has strong presales.

Qualitas will pour mezzanine finance into the project alongside the senior lender, NAB, to facilitate the purchase of the site and its ultimate development.

Tim Johansen, managing director of real estate finance at Qualitas, says the project is a high-quality, smaller development in an area where most rival offerings are large high rises.

Johansen adds that the firm’s partnership with Thirdi and Milligan Group ticks all the boxes for the Opportunity Fund, including strong, risk-adjusted returns.

Opportunity Fund will finance Sydney’s Iconic Waterloo apartments.

Sydney-based developer Thirdi was founded 10 years ago and specialises in developing in-fill residential projects in inner-city areas.

Milligan Group has also been active in apartment projects across the city.

The Qualitas Opportunity Fund is funded by offshore and domestic investors and pours both equity and mezzanine debt into quality commercial, retail and residential projects.

Qualitas group managing director Andrew Schwartz says that the private capital space is quite localised and relationship-based, which means local investment firms can reap better risk-adjusted returns.

Property lending specialist Stamford Capital said earlier this month that credit tightening was playing out across the board, particularly for construction funding.

“Not only is the cost of funding increasing but the banks are also taking a more conservative approach to project funding, which has resulted in gearing levels decreasing,” the group said.

This article originally appeared on www.theaustralian.com.au/property.