Optimism in hotels sector missing as Bright Ruby looks to sell Hilton Sydney

The entrance of Sydney’s Hilton Hotel, which has been put on the market for $600m.

Singapore-based investment house Bright Ruby is following in the footsteps of Chinese group Greenland, attempting to sell its largest Australian centrepiece investment, the opulent Hilton Hotel, Sydney.

Bright Ruby paid $442m for the four-and-a-half star George St hotel back in 2015, and as hotel occupancies plummet to lows of 15-20 per cent across the nation due to Covid-19 restrictions, it has now put a $600m price tag on the 570-room property, through JLL Hotels.

Rival hotelier Accor Asia Pacific is openingly discussing the hibernation of some of its 400 plus hotels across Australia and New Zealand, chief executive officer Simon McGrath told The Australian last week. Mr McGrath said the hotels in CBDs would be affected, along with leisure hotels in regional locations.

The chef in the Hilton’s Glass Brasserie.

Hotelier Jerry Schwartz has sold one of his privately owned hotels and last week shut his Rydges property near Sydney’s Central Station given low occupancies due to covid.

Singaporean tycoon CK Ow has also recently listed his Sir Stamford Hotel in Sydney’s Macquarie St, which is in hot demand given its prized position near the Opera House and Hyde Park. CK Ow wants $1bn for the Macquarie St property, as well as several other assets long held within his Australian and New Zealand portfolio. Given the developer interest in the Sir Stamford, it is likely the hotel will be split off from the remainder of the portfolio, which comprises more than 1500 rooms, even though Mr Ow was initially intent on selling the whole portfolio in one line.

Almost all of the Chinese developers from Greenland to Starryland who aggressively expanded into Sydney, Melbourne and the Gold Coast have either sold down their Australian assets or are attempting to as the Chinese government crackdowns on mainland companies that thrusted into disparate global real estate markets.

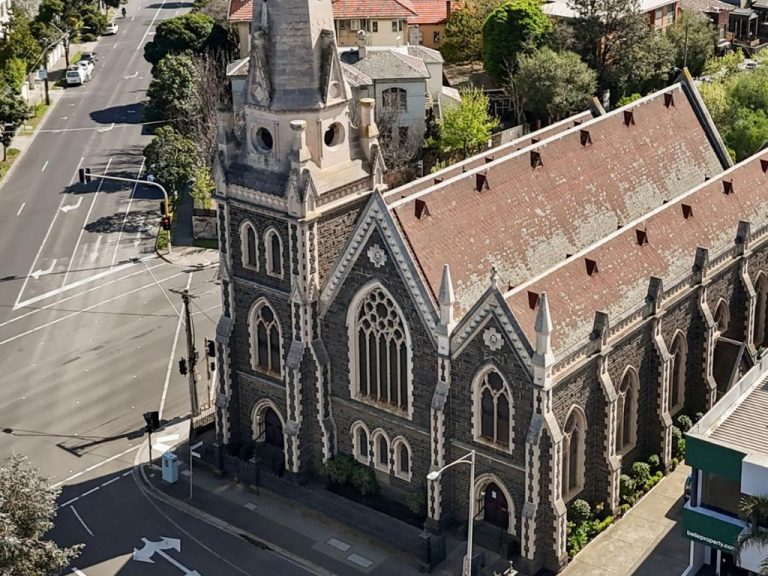

Bright Ruby paid $442m for the four-and-a-half star George St hotel back in 2015.

Chinese developer Greenland all but started the Chinese property boom when it forged into the Australian market in 2013, spending millions of dollars converting old public infrastructure in Sydney’s Pitt St into the five star 172-room Primus Hotel which it sold this year, initially wanting $170m for it. The Pro-Invest Group picked it up for $132m. While Greenland has a couple of other projects on the go, experts say it has cooled in Australia.

Apart from facing a tough industry, a toxic mix of bad political relations, the Chinese developers also faced China’s crackdown on capital going offshore for luxury projects.

Bright Ruby’s founding Du family is well-versed in Australian real estate, particularly commercial office assets in the Sydney CBD.

Bright Ruby’s 2015 purchase of the Hilton came as Chinese investors swarm over Sydney’s other hotel assets such as the luxury Westin Hotel nearby.

Australian hotels were once a key target for Chinese capital with noticeably increased competition for Australia’s prime hotel assets. But those days are clearly long over.