QIC backs return of regional shopping centres as malls mix it up

Funds management heavyweight QIC says major shopping centres like Sydney’s Castle Towers are coming back into the sun.

Funds management heavyweight QIC says major regional shopping centres are coming back into the sun as investment markets catch up to their stronger-than-expected operational performance.

The Queensland government-backed company, which manages about $10bn worth of super-regional suburban malls, says the centres are performing well in the wake of the coronavirus crisis and could even beat office and industrial property as they recover.

The firm’s research shows that large centres have bounced back in the wake of lockdowns and their longer-term potential for mixed use repositioning is also coming to fruition.

QIC owns centres along the eastern seaboard in major suburban locations, which are recovering faster than CBDs, and many retailers are seeking more space as traditional anchors like department stores give back space.

QIC Global Real Estate managing director Michael O‘Brien says that assets like Eastland in Melbourne’s suburbs were affected by lockdowns but had strong sales whenever lockdowns were lifted.

He cited their 7 per cent overall sales growth even while restrictions applied to cinemas, cafes and restaurants, while apparel and jewellery were incredibly strong. Visitation may be down but consumers are targeting their buying and spending more.

“People know what they want, they have the money to spend, and there’s this pent-up demand,” he said. “That really points to a very strong Christmas trading period.”

Mr O’Brien said the “significant” correction in values last year as the industry entered the pandemic now put it in good stead.

Capitalisation rates went out 50 to 75 basis points but high-quality regional centres still have good growth potential and mixed-use plans.

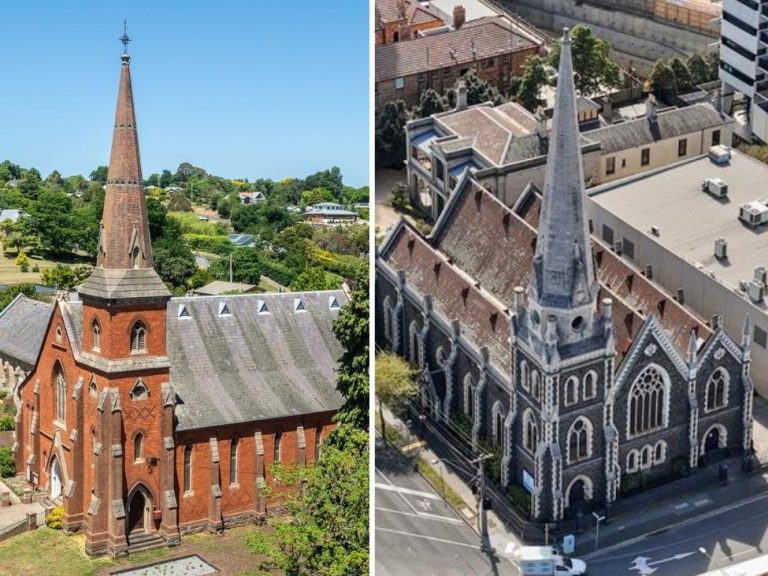

QIC alone has longer-term master plans for the Gold Coast’s Robina Town Centre, Eastland and Sydney’s Castle Towers, where it pulled back from major plans last year.

Eastland shopping centre in Ringwood, Melbourne.

“We can do very strong numbers out of those assets, without really taking on a lot of development risk,” Mr O’Brien said.

He said the era of huge expansions had passed in favour of developers pursuing longer-term masterplans. This could see projects like pre-committed office towers like the $100m Victorian government tower QIC has developed at Eastland.

He flagged a combination of office, residential, healthcare and hotel add-ons that would complement the retail core of centres and take advantage of infrastructure.

“There’s a lot of existing opportunities within the footprints. But then if you’ve got adjoining land parcels, there’s a lot, a lot more you can do,” he said.

Mr O’Brien said retail was immediately hit coming into the pandemic, prompting concerns about the structural impact of online spending. QIC forecasts that e-commerce penetration rate will rise to around 18 per cent over the next decade.

But he argues that retailers have embraced the omnichannel business model, where they require a strong online presence to complement their physical store network.

“The good retailers that we’re talking to are looking for more space,” he said. “They’re very committed to physical retail but they want to be in the best assets.”

Super fund UniSuper and Cbus Property last week poured $2.2bn into buying stakes in Pacific Fair and the Macquarie Centre Mr O’Brien said this bode well for the industry as investment activity caught up to operational performance. “I really think the moons are aligning and the pathway out of this pandemic is pretty clear now,” Mr O’Brien said.

QIC’s analysis shows that big retail centres will outperform industrial and office buildings.

“Some of the other sectors are looking a little bit expensive,” Mr O’Brien said, adding that some institutions would take another look at quality retail due to the upside in the landmark assets.

EastCo, an A-grade building being built next to Eastland.

The firm expects that as vaccination rates climb retail sales will grow at around 3.5 per cent per annum over the next decade, and it projected a 10-year return outlook for the retail real estate sector at around 6 per annum. But it says the best assets with mixed-use development potential should generate even higher returns.

These returns are ahead of both the office and industrial sectors, which QIC expects to provide total returns of 5 to 6 per cent per annum over the same period.

In an investment paper, QIC said its centres not located in Victoria, which avoided extended lockdowns, outperformed pre-Covid-19 sales results, with solid turnover growth of 7 per cent. Victorian assets also bounced back quickly.

QIC expects positive consumer spending behaviour and strong retail sales in the wake of lockdowns to be replicated as the country again re-emerges.

It is forecasting that retail sales will recover over 2022, but the rebound is not expected to be as strong as last year due to smaller government stimulus packages.

But good news is that the share of consumer spending dedicated to retail is expected to remain above post-Covid-19 levels until 2026.