Ross Pelligra: ‘Australia has not seen development yet’

Ross Pelligra in Adelaide. Picture: Matt Turner.

When Ross Pelligra was revealed as the buyer of the former Holden factory in Adelaide five years ago, few outside of property circles had heard of the Melbourne developer and the company his family had built up over three generations.

The family-run Pelligra group arrived in the South Australian capital in 2017 with grand plans to transform the iconic site, which had for six decades been the centre of manufacturing in Adelaide’s industrial north.

Five years on and it is delivering on that $250m promise, attracting a mix of industrial and hi-tech manufacturers to the precinct – now known as Lionsgate – including Levett Engineering, Genis Steel and solar battery manufacturer Sonnen.

The project was the start of Pelligra’s love affair with South Australia, where it has amassed a bulging property portfolio ranging from office, industrial and apartment developments to local sporting clubs, community infrastructure projects and even a golf course development on Kangaroo Island.

And Covid-19 has failed to dent the company’s investment appetite.

Developer Ross Pelligra at the former Holden factory site in Adelaide’s north. Picture: Dean Martin

The developer is spearheading a string of projects across the country including a $480m hotel and superyacht marina at Main Beach on the Gold Coast and a mixed-use redevelopment of the recently acquired $145m Dandenong Plaza shopping centre.

Both are redevelopment plays and the Queensland project looks set to become the first to be overhauled.

Marriott has just unveiled an agreement with Pelligra and partner Giannarelli Group, to bring Australia’s third Ritz-Carlton hotel to the property Gold Coast by 2026.

The hotel will be part of a $480m new waterfront development at Mariner’s Cove, set to reinvigorate Australia’s sixth largest city as a luxury travel destination and deliver the brand’s unparalleled service and refined elegance.

Mr Pelligra said the luxury hotel development will draw in more tourism spending from across the globe and fuel the local economy.

“The Ritz-Carlton, Gold Coast is set to be an iconic landmark not only for the Gold Coast, but for Australia’s hospitality sector,” he said.

In June, Pelligra swooped on a long empty office block on Spring St in the Melbourne CBD for about $130m and plans to refurbish the complex as workers return to cities.

Unfazed by surging interest rates, the lingering impact of the pandemic and global economic uncertainty, Mr Pelligra says his company is forging ahead with projects in areas where there is a desperate need for modern places to work, live and play.

“Australia has not seen development yet,” he says.

“The economy is growing but we don’t have the property infrastructure to support it. We’ve got a housing shortage, we’ve got a retail shortage, we’ve got a factory shortage, we’ve got a warehouse shortage, we’ve got an office shortage. We have shortages in areas where assets are not properly maintained.

“I do a lot of analytical work to figure out where the population is growing, where they’re spending their money and where they need infrastructure. And then I focus on what’s lacking in those areas.

Artist’s impression of the $480m hotel development on the Gold Coast.

“Interest rates will go up and down but need is not something you can change. The usual phrase I use is ‘build it and they will come’ – that’s what I’ve always focused on. If they don’t come 100 per cent today they will come tomorrow, or the following week.

“I want to inspire other families, other developers, other institutions to do more.”

Pelligra is very much a family affair.

The business was started by Ross’s grandfather, also Ross, who arrived in Melbourne from Sicily in 1958. He started in fruit shops and convenience stores, and moved into property development and construction during Melbourne’s population boom in the 1960s.

Today, Ross junior and his three younger brothers Paul, Anthony and Michael run the day-to-day operations, while parents Luigi and Josephine join them as directors on the board.

As executive chairman, Mr Pelligra says part of his role is to keep a close eye on every project, making sure each one stacks up financially.

“I do work an average of about 100 hours a week so I’m on top of everything that’s going on,” he says.

“Everything we do is calculated off the back of a balance sheet, and if it doesn’t work then the balance sheet screams, it comes on my radar and then I’ll go and physically help fix it.

“We set up our balance sheet over a five, 10, 20-year horizon, and then we pick our finance partners that have the same vision. I only deal with the major banks.”

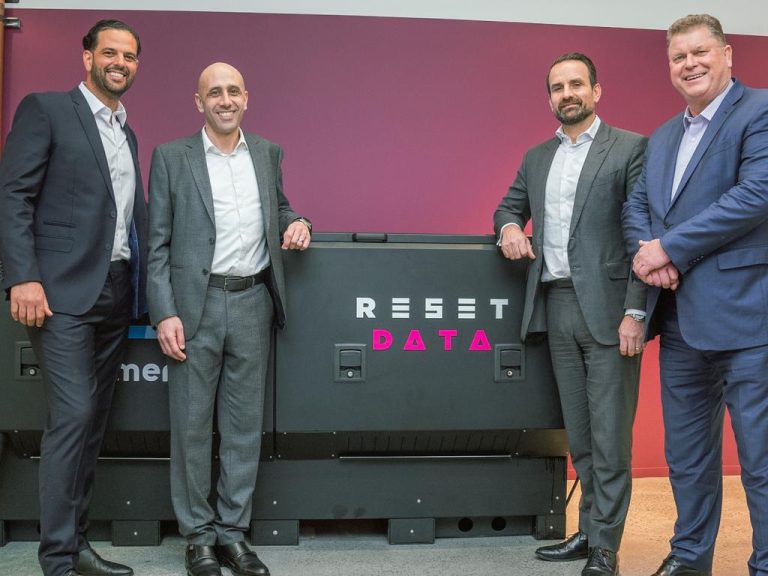

Adelaide Giants’ Alice Prokopec, Adelaide Crows chief executive Tim Silvers, Ross Pelligra and Adelaide Giants’ Jordan McArdle. Picture: Sarah Reed.

Pelligra has also joined forces with real estate fund manager Valore Investment Partners, seeding its first ‘Opportunity Fund’ with up to $500m in industrial and mixed-use developments.

The Gold Coast marina project and a $105m luxury apartment development in Adelaide’s Rundle St are two of the assets in the Valore pipeline.

While traditional office, industrial and retail projects are Pelligra’s bread and butter, Mr Pelligra also believes he can make money, or at least break even, in the notoriously difficult financial world of sport club ownership.

He recently acquired the Adelaide Lightning women’s basketball club and Adelaide Giants baseball franchise, and is also rumoured to be closing in on a deal to take over the Adelaide United soccer club.

His strong connection to his Sicilian roots also inspired the recent purchase of the financially-stricken Calcio Catania soccer club, based in the ancient port city of Catania on the island’s east coast.

Like many of Pelligra’s property projects, he believes he can succeed where others have failed.

“All sports clubs lose money – traditionally they’ve always lost money,” he says.

“And the reason they lose money is because they’re top heavy on costs, on management, and also they don’t grow their own talent.

“We’re going to develop the players ourselves and then these clubs need assets – they need training facilities, they need medical facilities, they need accommodation. So that’s where we’ll start creating that infrastructure, which the clubs then lease back.

“Yes, the next five years is going to be painful because we lose a little bit of money, trying to get them to turn around and bring our own talent through.

“But this is a 10, 20-year legacy strategy for me. The long-term plan is no different to any other business.”