SA billionaire’s first Tas shopping centre buy

Kingston’s Channel Court Shopping Centre has been sold for a record-breaking sum.

THERE is a simple reason why shopping centre magnate Nick DiMauro decided to spend over $82m in Tasmania.

Mr DiMauro said: “I just believe it is a great asset.”

In a deal that has eclipsed all others of its kind, Mr DiMauro purchased Kingston’s Channel Court for the record-breaking price of $82.5m.

Mr DiMauro confirmed that it was the first Tasmanian asset bought by his DiMauro Group.

While he is now an annual Rich List fixture, Mr DiMauro’s business career started from humble beginnings owning deli and plumbing businesses.

Today, the DiMauro Group’s multiple retail and commercial properties are based locally and internationally.

“This is our first purchase this year, however, the DiMauro Group owns 22 shopping centres in Australia and New Zealand, and a number of high rise buildings,” Mr DiMauro said.

MORE: Swoon-worthy farmhouse grabs attention far and wide

Rare chance to buy ‘unicorn’ Tassie childcare property

Nick DiMauro. Picture: Michael Marschall

Channel Court was previously owned by Challenger Group and agency JLL brokered the sale.

Challenger Group purchased the property from Hobart’s Behrakis family in 2015.

The shopping centre is anchored by Big W and Woolworths alongside dozens of speciality stores and national brands, including Australia Post, Banjos Bakery, BWS, Centrelink, Commonwealth Bank, EB Games, Flight Centre, Hobart Eye Surgeons, Intersport, Just Cuts, Medicare, Minimax, Nextra Newsagency, Platypus Shoes, Priceline, Redbill Surf, Salamanca Fresh, Simmons Wolfhagen Lawyers, Specsavers, St Lukes, Telstra and Yeltuor.

MORE: Mega-deal: Tassie shopping mall sold for record-breaking price

Inside the gold medal homes of our Olympic champions

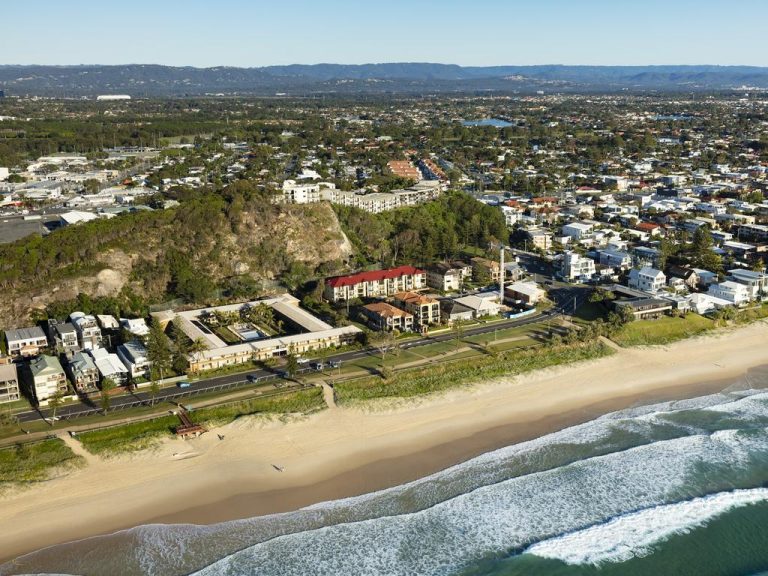

Channel Court.

JLL’s Nick Willis and Sam Hatcher said Channel Court is the only subregional centre south of Hobart comprising over 25,000sq m and generating over $150m in moving annual turnover.

They said the sale came amid a reduction in retail sales compared to the previous year.

The reduction in transaction volumes is being attributed to the limited availability of investment supply, the agents said.

“This year, we have entered a phase of supply and investor demand imbalance in the sector,” JLL’s head of retail investments, Sam Hatcher said.

“In the subregional and large format retail sub-sectors, volumes are down by about 13 per cent as at 30 June, from the prior 12 months.

“As major institutions enter the tail-end of their disposal programs and the fundamentals of the sector continue to improve globally, the sector is again receiving resounding positive engagement, driving renewed interest and competitive bidding.

“While the first half of the year has seen a significant reduction in available supply, we do anticipate increased supply offering in the second half of the year.”

Nick DiMauro. Picture: Michael Marschall

Channel Court.

JLL senior director, Mr Willis, confirmed there was interest in the Kingston complex from multiple potential buyers.

He said there were seven formal bids, which “reaffirms the continued market demand for dominant convenience-based subregional centres”.

The Mercury reported that this $82.5m sale eclipsed Channel Court’s $76m sale in 2015 and Northgate in Glenorchy, which sold in 2009 for $70.1m.