Seven Tasmanian car dealerships to be auctioned within minutes

One of the largest Tasmanian property portfolios in history will be put up for sale next month, at a time when the state’s property market has never been hotter.

Seven sites leased as car dealerships – and with a combined value of around $50 million – will be auctioned individually at Burgess Rawson’s next Investment Portfolio Auction at Crown Casino on Wednesday, April 3.

The dealership sites, owned by Melbourne automotive baron Marcus Birrell, are spread across the state in Hobart, Launceston, Devonport, Burnie, Invermay and Glenorchy.

Commercial Insights: Subscribe to receive the latest news and updates

Among them are Hyundai, Nissan, Holden, Honda and Volvo dealerships, ranging in size from 2919sqm to a major 30,270sqm site.

All of the properties are leased to the ASX-listed AP Eager Group, which bought the Birrell Motor Group in 2016. AP Eager Group has more than 145 dealerships nationwide, with annual sales exceeding $4.1 billion.

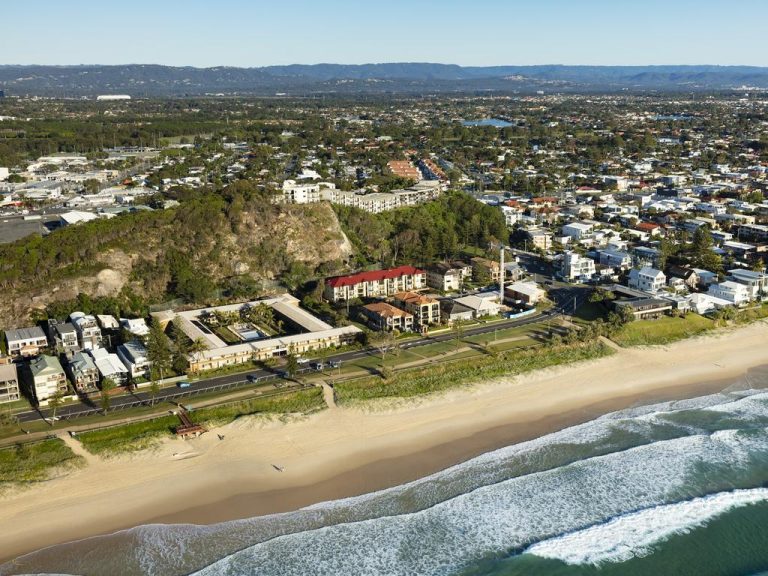

The large Holden dealership at Devonport.

Burgess Rawson directors Billy Holderhead, Darren Beehag and Scott Meighan, who are marketing the properties in conjunction with Knight Frank Hobart, say the upcoming sales come at a time when demand for Tasmanian property is soaring.

Launceston, which is home two of the dealerships, is the best performing regional centre in the country, according to CoreLogic data.

“As evidenced by the 49 bidders and recent 3.13% yield record for the Bunnings Warehouse freehold in Glenorchy, just 150 metres from the Derwent Park asset, investor interest in the Apple Isle has never been more intense and we expect that the Honda, Hyundai, Nissan, Holden, Volvo trucks, UD trucks, Isuzu and Mack dealerships will appeal to a similar investor base,” Holderhead says.

He adds that the sites represent outstanding value, with many likely to be bought at well below what it would cost to replace them.

The Holden and Hyundai dealership in Hobart.

Each of the dealerships are leased through to 2026, with attractive net leases and the tenant paying all the usual outgoings.

Beehag says an automative property portfolio of this caliber has rarely been seen before.

“Burgess Rawson is thrilled to bring these outstanding investment opportunities to the market. Rarely do we see such a broad range of triple-A tenant-anchored opportunities of this caliber offered for sale, so we’re particularly looking forward to receiving strong levels of interest and serious bidders come auction day,” Beehag says.

“The tenant has a $1.4 billion market cap and has been successfully trading for more than 16 years – two factors that will attract buyers seeking a secure, long-term investment.”

The properties attract annual rental incomes of between $186,151 and $972,641.

The auction will be held at Crown Casino’s River Room at 11am on Wednesday, April 3.