Shock price LDS church paid for 26,000ha to trigger big guns

The Stathams now have their Far North Queensland farm holdings up for sale, which could fetch over $80m.

The Mormon church is playing for Aussie sheep stations, with the eye-watering sum it paid for 26,000 hectares set to trigger the floodgates as more family farms go up for sale.

The Utah-based Church of Jesus Christ of the Latter Day Saints – whose for profit investment arm alone is estimated at over $200 billion – is the funding powerhouse behind its Australian business Alkira Farms’ $300m foundation entry into prime Queensland cotton country.

Australian farming families with decades on the land are among those listing landholdings for sale as the strong US dollar and lower prices here make local agricultural, real estate and other ventures very shiny – with latest Australian treasury figures showing American investors dominating approved investment proposals in both number and value – at 146 and $7.6b respectively for December quarter alone.

Australia’s richest person Gina Rinehart is among the biggest local owners and buyers of farmland packing a wallet big enough to compete with the church.

Alkira Farms, a subsidiary of Farmland Reserve – the agricultural investment arm of the Utah-based Church of Jesus Christ of Latter-day Saints – bought the 26,000ha Queensland property. Picture: Evan Hurd/Sygma/Sygma via Getty Images.

Alkira, which operates under the LDS church’s agricultural acquisition firm Farmland Reserve, has been greenlighted by the Foreign Investment Review Board to take over ownership of a 30-year labour of love by renowned Queenland cotton farmers Robert and Jenny Reardon – writing an estimated $300m cheque for the property as an ongoing concern.

The sale of Worrall Creek was handled by JLL agribusiness directors Clayton Smith, Chris Holgar and Geoff Warriner along with Ben Craw of Oxley Capital Partners as transaction advisor.

The exact sales figure has not been revealed, but the Reardons had been trying to sell their substantial Worral Creek holdings in Queensland’s border country – an hour from Goondiwindi – for almost two years so they can retire.

NEWS: Thousands of homes in as little as 75 days

Sizzling Hungry Jacks site sells after whopping 700 enquiries

Billionaire Clive Palmer to reveal controversial $150m reno

The Reardon’s Worral Creek aggregation covers a massive 26,000hectares. Picture: JLL.

One of the few public images of Rob and Jennie Reardon (left), seen here with Tristram Hertslet (right) and special guest speaker Nathan Sharpe at Worral Creek in 2016. Picture: Facebook/MacIntyre Valley Cotton Field Day Committee.

When the farm first hit the market in 2022, there were estimates it could fetch as much as $400m due to the couple’s efforts since 1990 to build up the Worral Creek Aggregation into over 26,855 hectares across multiple properties between Talwood and Mungindi – including “a rare and strategically valuable water portfolio”.

Their efforts were hailed by incoming manager Adrian Goonan of Warakirri – the Australian asset management firm that handled the Worral Creek transaction for Alkira.

LDS’ Farmland Reserve global CEO Doug Rose said “we’re pleased to be working with Warakirri, a premier, respected leader in Australian agriculture. We look forward to a productive association with them in the years ahead”.

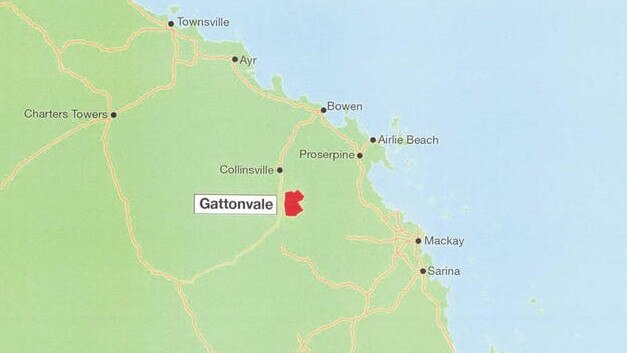

Gattonvale Holding in Collinsville was sold by the Cox family for $77.75m in August by Shepherdson & Boyd (Qld).

It is not too far away from major ports and was for sale for the first time since 1962.

A marketing image taken on the Reardon’s farm. Picture: JLL.

But the Reardons are not the only Australian farmers choosing to downsize their mega landholdings this year, with the Cox family putting their 31,474ha Gattonvale Holding estate on the market which settled for a massive $77.75m five weeks ago.

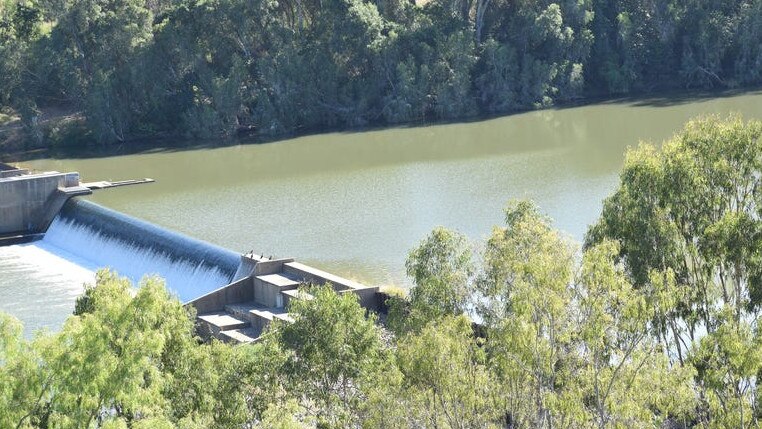

The family had held Gattonvale Holding since 1962, and threw in their HK1 stock brand as part of the sale, along with three homes, workers quarters, machinery and storage sheds, workshops, hay sheds, two dongas, 300-tonne molasses storage, three sets of cattle yards with plunge dips and vet facilities, 34 grazing paddocks and with frontage to the Bowen river, 20 dams and much more.

It’s unclear as yet who the purchaser was, but cashed-up international buyers seem a natural go-to – especially for larger groupings of agricultural stations coming to market due to unexpected events.

One of the biggest deals so far this year was the NASDAQ-listed Agriculture and Natural Solutions Acquisition Corporation’s enormous $780m purchase of 225,000ha across stations in the Deniliquin, Hay and Coonamble districts plus massive water rights.

The stations were part of the New South Wales-based Bell family selling off their interests in the Australian Food & Agriculture Company after the death of founder Colin Bell two years ago.

The Cox family’s property has frontage to the Bowen River and 20 dams among its water assets.

Three homes were part of the Gattonvale Holding sale.

Another family making moves on their large landholdings are the Stathams of Sundown Pastoral Co, whose 44,000ha St Ronans station at Mount Garnet in the Tablelands in Far North Queensland is now up for grabs.

David and Danielle Statham had bought St Ronans in 2019 after they found themselves flush with cash off the sale of two of their New South Wales stations – the 17,800ha Sundown Valley grazing property west of Armidale and 1,600ha Gunnee Farm and feedlot north of Inverell – to Gina Rinehart’s Hancock Prospecting for an undisclosed sum.

David and Danielle Statham sold two properties for an undisclosed sum to Ms Rinehart.

Ms Rinehart had her eye on the properties to grow her wagyu business which at the time (2018) stood at 20,000 head of cattle, saying “the farms are located in a renowned cattle region in NSW that has a long history of producing high quality cattle”.

“They are located in between our high quality wagyu breeding properties near Dubbo and Roma, adding further growth opportunities and scale benefits for management,” Ms Rinehart said in a statement.

It’s unclear how Australia’s richest person feels about buying the Stathams’ FNQ property as well, though she has expressed a desire to beef-up “high quality east coast pastoral and cropping properties”.

David and Danielle Statham have put St Ronans station in the Tablelands on the market.

The Stathams are cotton growing experts.

The cashed up Stathams were just thrilled to sell to someone loyal to agricultural Australia, and promptly put $18m into buying St Ronans in 2019 off High Country Pastoral’s Cameron Burtenshaw and Sasha Bucknell – who themselves had put significant effort into droughtproofing the property, sinking boreholes, running pipelines, to ensure it was “perfect for farming”.

The Statham’s expressions of interest campaign for St Ronans is being run by Lawd’s Danny Thomas, Simon Cudmore and Elizabeth Doyle – closing October 31. They listed it as an “unprecedented large scale cropping and cattle backgrounding operation”.

They have made significant improvements around the large station.

David Statham in a file image off Sundown Pastoral Co.

Recent estimates put the farm price at more than $70m now given significant upgrades including numerous dwellings, high quality infrastructure, substantial grain storages and dryer, licenced approval for a 10,000 standard cattle unit feedlot (currently developed to 2,000), and future options such as conversion to intensive horticulture and wind farm development.

Among the reasons why Worral Creek drew Alkira’s attention was it was “a turnkey large-scale enterprise, with exceptional irrigation infrastructure and water security via a large number of water entitlements and storages, making it an ideal foundation asset for Alkira’s investment in Australian agriculture”.

The Worral Creek sale was as an ongoing concern and included a full suite of plant and equipment.