Singapore-based Invictus Developments pours millions into hotel economy

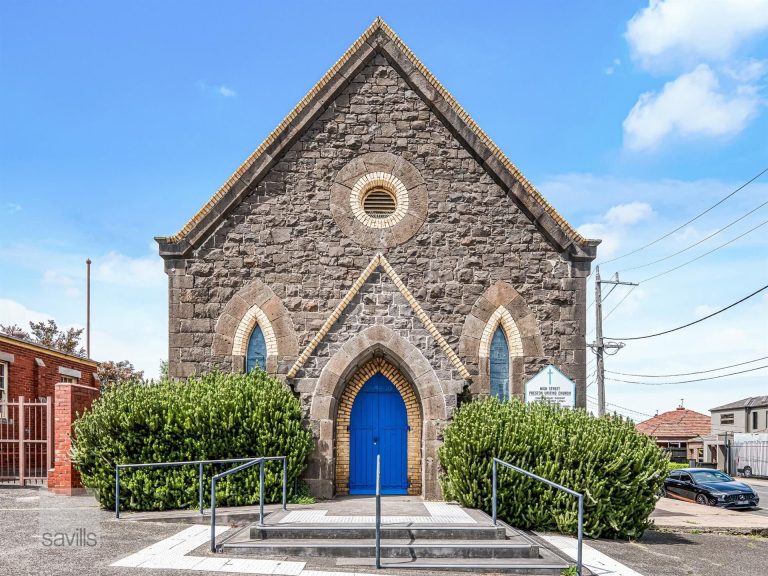

Ovolo Inchcolm Hotel in Brisbane. Picture: Supplied

Singapore-based Invictus Developments has continued to pour millions into the Australian hotel economy, with the $25m acquisition of Brisbane’s five star The Inchcolm by Ovolo Hotel.

The Spring Hill purchase follows Invictus’s $52.5m buy up of the Bank of China building at 39 York Street in Sydney which will be refurbished into a luxury hotel.

The two hotels mark Invictus Developments’ first acquisitions this year following the purchases of Robert Magid’s Harbour Rocks Hotel in Sydney and Quest Woolloongabba in inner Brisbane last year.

The four acquisitions are the first stage of an expected $500m worth of investments in hospitality assets across the East Coast by the Indonesian billionaire family which made their money from the production of palm oil.

Invictus head Chayadi Karim said we are very strong believers in the Australian hotel market as international travel is returning to pre-Covid levels and Australia is seen as an exciting and vibrant destination in the Asia-Pacific region.

“The addition of the two properties, with more planned on the East Coast, adds to our current portfolio of hotels in Singapore and Japan”, he added.

The boutique Inchcolm Hotel has been acquired from TriO Capital, the investment and asset management business of independent lifestyle hotel group Ovolo, according to a statement.

The purchase, which includes a management agreement with Ovolo, will enable TriO to recycle capital to fund the group’s continued growth and expansion.

The luxury hotel has 50 guest rooms and suites, with a restaurant, conference and meeting rooms.

The Inchcolm sale was conducted by CBRE agents Wayne Bunz and Steve Carroll.

Mr Carroll said “hotels continue to be an asset class of choice given the sector’s positive market fundamentals and attractive risk adjusted returns. We are seeing a broad range of investors seeking growth via hotel assets, and with outbound tourism from China recovering we forecast this growth to continue”.

Mr Bunz said “revenue per available room (RevPAR) has risen by 49 per cent in Brisbane since 2019.

With the Olympics coming in 2032, Brisbane is seen as a tier 1 destination for astute hotel investors.

In Sydney, Invictus has plans for a $30m repurposing of the Bank of China office building complete with rooftop bar with the opening towards the end of 2025.

Sydney-based property investment management group, Intergen Property Group, is advising Invictus Developments on the acquisitions.