Take the alternative path for out-sized returns, says US manager Kayne Anderson

Under-invested and overlooked asset classes where investors have some insight are the best areas

A former investment banker turned fund manager, who once reported to investment banker Andrew Pridham and the legendary Ken Moelis when they were all at UBS, believes buying conditions in international property markets were presenting the best opportunities he had seen in years.

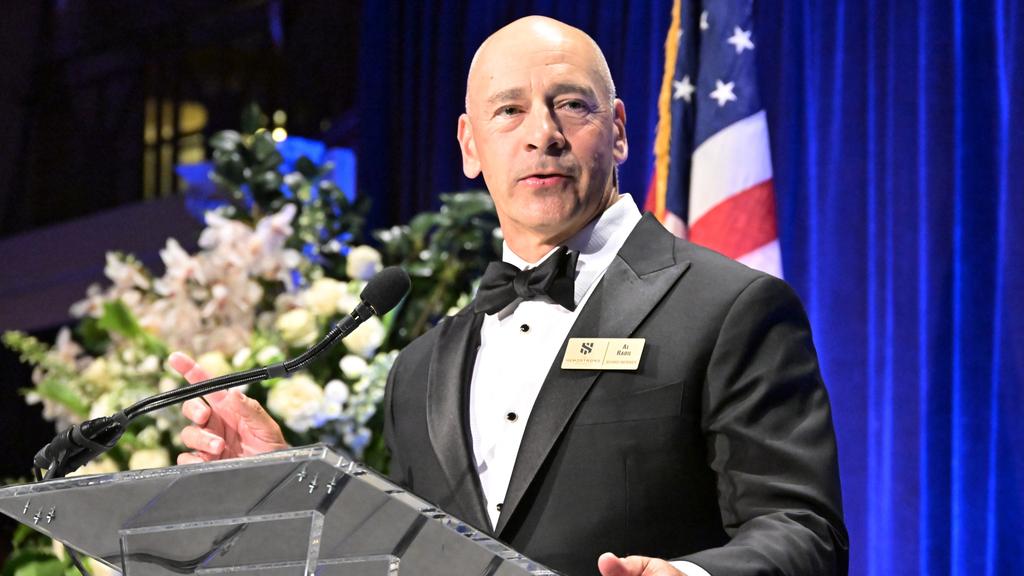

Al Rabil, now chief executive of fund house Kayne Anderson, after reaching the heights of Wall Street investment banking, specialised in buying alternative real estate, years before it became popular.

He said that present conditions resembled the bargain conditions that were on offer in the wake of the global financial crisis, with a combination of tight credit markets and growth prospects for alternative sectors making for an attractive mix.

“We look for long-duration, high- demand assets with the tailwind of supply constraints and outsized operating expertise in what we do,” Mr Rabil said.

“The vast majority of outsize risk-adjusted return opportunities that exist today exist in under-invested, under-appreciated asset classes and under-appreciated opportunity sets.”

Mr Rabil said that under-invested and overlooked asset classes where investors had some intelligence or insight were the best areas.

“In short, you’re looking at non-commoditised investment opportunities,” he said. “You need to create strategic advantages and have some kind of insight into the investment opportunities.”

He called out key areas including medical property, seniors and student housing, multi-family apartments and last-mile logistics, which he said had “demand that is going to continue to escalate, and you’ve got supply limitations”. But some areas – like data centres – were off the agenda due to being highly capital intensive and having powerful rivals like Amazon and Google.

Al Rabil speaks at The Headstrong Project Annual Gala in New York. Picture: Getty Images

There were still plenty of opportunities. Big sectors included medical offices, seniors housing and student housing that had been “massively” under-invested, Mr Rabil said.

Part of the firm’s thesis was confirmed in the pandemic when billions of dollars of value was stripped from traditional office and retail assets.

Alternative real estate had since shot into vogue. But it was only just beginning.

“I think we’re still in the very early stages of that rotation, and that rotation into alternatives will continue for the next decade,” Mr Rabil said.

Striking when rivals are constrained is also critical.

“The last two years, and probably the next two years when you have, not a GFC situation, but at this juncture, liquidity is not readily available,” Rabil said. “There’s some pain – and so you’ve got a dynamic where you’re looking at buying low and ultimately selling high.”

US banks remained under pressure, their balance sheets weighed down by unrealised losses, making many effectively insolvent as about $US1.6 trillion of real estate loans come due over the next two years.

“Even with the recent euphoria post the Trump election and new market highs … and even financials enjoying a massive run-up, the reality is that bank balance sheets, by and large, are in very challenged positions,” Mr Rabil said.

But players with relatively unfettered access to equity and debt capital – and who avoided material hits from interest rates spiking and pandemic disruptions – would have good pickings, he said.

Mr Rabil called it a “trifecta” of demand tailwinds, supply constraints and highly motivated sellers.

“Times like this, where these opportunities exist, come along every 15 years,” he said.

“I think this one will last another 24 to 36 months, because, although the market’s throwing a party and people feel reasonably good today, I think that you’re going to have an illiquid, choppy credit environment for an extended period of time.”