Tea Tree Plaza play shows mall trades back in the swing

Westfield Tea Tree Plaza, north of Adelaide’s CBD.

The top end of the mall market is in for a big reset with a stake in the second largest Westfield-managed complex in Adelaide trading at around a 20 per cent discount to the value at which the listed shopping centre giant is believed to hold its interest.

In one of the property trades of the year, funds house IP Generation is seeking to pick up a 50 per cent interest in the Tea Tree Plaza mall, under a deal in which it would pay about $308m.

The local owner of the Westfield empire, the Scentre Group, would stay in place as co-owner and manager of the mall, which has already been revamped to capture the rising spending in its catchment in Adelaide’s northern suburbs.

IP Generation is finalising a deal to buy the interest in the centre from a fund run by property giant Dexus, which has been offloading assets in order to meet redemptions from exiting investors.

The parties and agent Simon Rooney of CBRE declined to comment on the transaction.

The sale is but the latest in which a private group has moved on a major asset being sold by an institutional investor. The trend has rippled through the retail property market, with fund managers snapping up once-in-a-cycle bargains ahead of more capital returning.

At the same time, large shopping centres have been trading surprisingly strongly – defying both the consumer spending downturn and fears that specialty stores would be unable to ride the economic bump.

Mall owners are shifting back into favour after years of pressure, as department stores like Myer have stabilised, discount department stores have turned around, and national chains such as JB Hi-Fi are chasing new spaces.

Listed real estate investment trusts which reported in February showed retail was surprisingly strong from an operational standpoint and new leases were being struck at much higher levels, putting the tough times of the coronavirus crisis behind the industry.

But the pandemic and interest rate rises have hit mall values, with the centre trading at a core capitalisation rate of about 7.5 per cent, industry players said.

Sales at such levels have implications for mall owners as values across the industry are being reset, and pricing is likely to cascade to smaller, lower quality malls.

IP Generation is raising $162m in equity for the interest in what it dubbed the landmark retail asset in Adelaide’s northeastern suburbs.

Documents sent to investors say the price reflects a discount of about 20 per cent to Scentre’s current book value but also pointed to the property’s strong operational performance.

The mall is 99 per cent occupied and anchored by Woolworths, Coles and Aldi, as well as Big W, Harris Scarfe and Target department stores, and a Hoyts cinema complex.

The deal will show a fully leased acquisition yield of about 8.3 per cent and a planned unlisted trust to hold the stake will spin off a 10 per cent per annum distribution yield – and even higher overall returns.

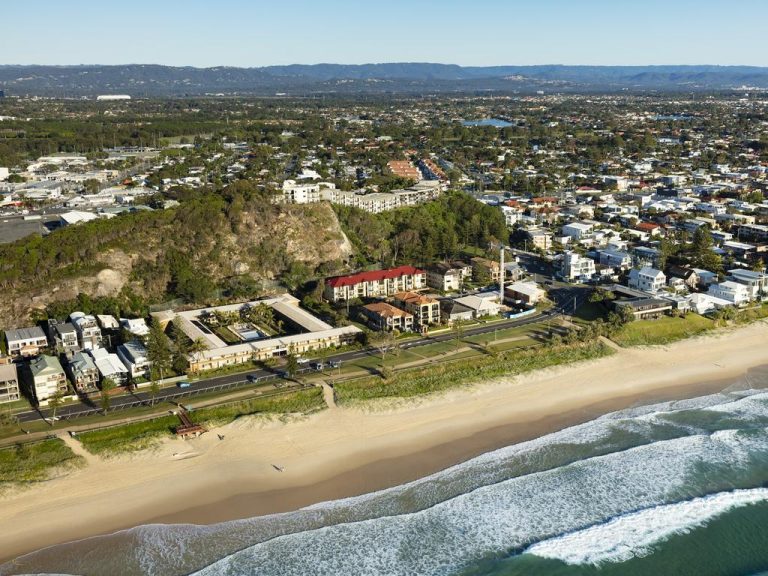

Positioned about 15km from Adelaide’s CBD, Westfield Tea Tree is the largest shopping centre north of the Adelaide CBD and the second largest in SA. It sits on a 22.4ha freehold site and has undergone major redevelopments in 2018 and 2023.

IP Generation is among a small group of private funds managers which are moving while many institutional investors have stalled due to uncertain global monetary policy and economic backdrop.

The manager told potential investors that there was a “significant” decline in domestic property market liquidity, partly as a number of Australian institutional pooled funds were faced with large redemption requests.

It said that the pressure these pooled vehicles are under to meet their capital requirements provided the setting for nimble private equity investors to pick up high yielding, core retail property assets at significant discounts.