T&G: Buy one, two or all three

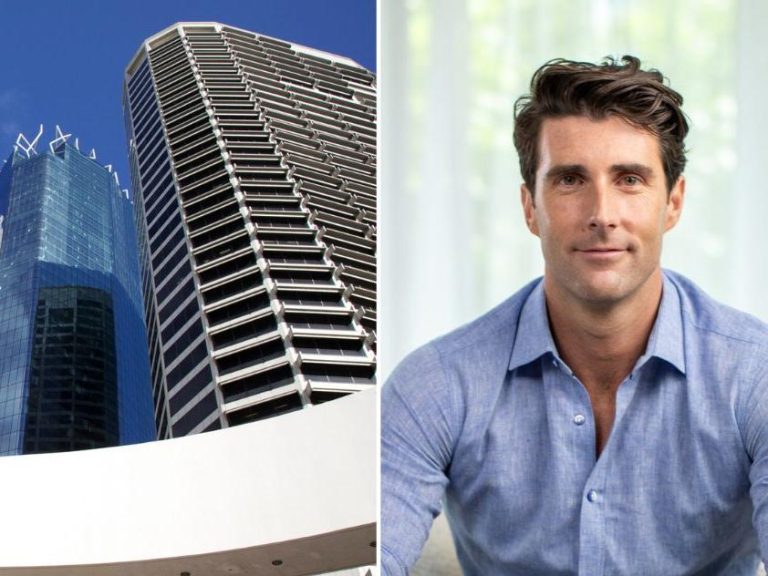

T&G Building. Hobart. Picture: Supplied

COMMERCIAL property assets in the centre of the city are typically tightly held. But an opportunity like this one? That’s even more unusual.

At No.117 Collins St, there are multiple assets on the market in the prestigious, historic T&G Mutual Life Building.

Commercial sales and leasing representative at Knight Frank, Tom Balcombe, said there had been good interest in each property through the first week on the market.

On Level 3, Unit 31 has caught the eye of investors who are attracted to this fully-leased asset, with the tenants being the CPSU and Collins St General Practice.

Mr Balcombe said the ground floor properties were retail tenancies with excellent street frontage. Unit 1 is leased by Medibank and Unit 7, 8, 28 by Icon Footwear.

“With both assets there is some value-adding opportunity,” he said.

“We are looking for someone with a bit of creativity, and vision to either seek tenants or install a fresh fit out of the available space that these sites offer.”

T&G Building, Collins St, Hobart.

T&G Building, Collins St, Hobart.

T&G Building, Collins St, Hobart.

Mr Balcombe said most of the inquiry so far had been specific to one of the three opportunities, which was not surprising given that they are “three very different assets”.

“However, there are a couple of people that are looking at purchasing all three as a portfolio,” he said.

“It’s uncommon to have the chance to acquire this much property in the CBD. And in such a beautiful building, too.

“The T&G Building is a trophy asset in one of Hobart city’s main corners. It presents really well.”

The 361sq m lease to the union and doctors, Unit 31, is described as well presented, high quality and low maintenance.

Access is via a central lift and stairwell.

T&G Building, Collins St, Hobart.

T&G Building, Collins St, Hobart.

With the current leases expiring in 2023 and 2024, there will be opportunity for future rental upside or for owner occupancy, if desired.

Downstairs, Icon Footwear has a three-year lease of Unit 7, plus options. Unit 8 and 28 currently consist of basement storage but with development opportunity, STCA.

Unit 1 is partly tenanted by national health insurance provider, Medibank. It has almost three years remaining on its lease.

Medibank has a retail space with 10m of Collins St frontage, plus a board room and staff amenities.

T&G Building, Collins St, Hobart.

T&G Building, Collins St, Hobart.

There is an additional 244sq m of vacant space at the rear comprising a reception, meeting rooms, and amenities. It could suit fitness, service retail, medical or offices, STCA.

Mr Balcombe said inquiry had come from local and interstate buyers — Melbourne and Sydney-based — which is the norm these days, as Hobart and Tasmania remain in the spotlight.

“For an investment type of purchase, it would be extremely rarer if we did not have national interest,” he said.

“These types of buyers are definitely active in our market and often successful in securing Tasmanian assets.”

The T&G assets are listed with Knight Frank and for sale by expressions of interest closing on November 3 at 4pm. Inspections are available by appointment only.