The trend of repurposing ailing shopping malls is set to accelerate

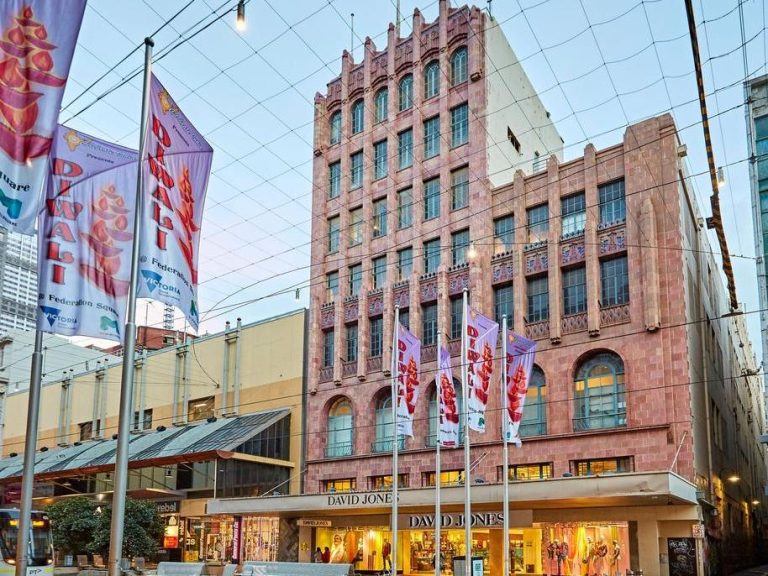

An Artist’s impression of Vicinity Centres’ Bankstown project.

More shopping centres could be turned over to use as last-mile logistics centres or even build-to-rent accommodation, as the retail industry is shaken out in the wake of the coronavirus crisis.

A big shift away from shopping centres is already under way, with Dexus picking up the Homemaker Prospect, a large-format retail centre near Sydney’s Blacktown, with plans to convert it into an industrial property.

The trend of repurposing retail assets is likely to pick up, with big malls perhaps the most likely to take on new uses as they are under most pressure.

Just last month Vicinity Centres and Challenger won approvals to overhaul part of their Bankstown mall in Sydney’s western suburbs into a mixed project. The City of Canterbury Bankstown granted approvals. including for 30,000sq m of A-grade office space across three buildings and ground floor retail with a new “Eat Street”.

An Artist’s impression of Vicinity Centres’ Bankstown project.

Vicinity chief development officer Carolyn Viney said the project showed a aligned vision with authorities to transform Bankstown’s CBD into a business, health and education precinct.

Many centres have large car parks and surrounding areas that could accommodate other uses to boost income while mall operations are down.

JLL senior director of retail research, Australia, Andrew Quillfeldt said there was a range of alternate uses that owners of retail assets could consider to extract value through partial or full conversion. “The type of alternate use will vary significantly between individual properties, depending on the location, demographics of the area, infrastructure and proximity to transport,” he said.

“Last-mile logistics is a current priority, given shopping centres represent a network of sites in metropolitan locations and the scarcity of suitable locations for urban logistics facilities,” he added.

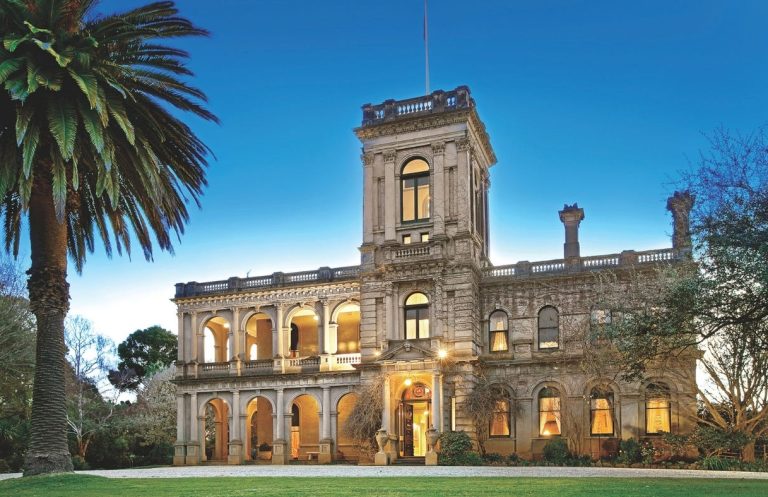

Hotels and offices may also be added to shopping centres, replicating the success of Melbourne’s Chadstone Shopping Centre.

Elsewhere in the city, Scentre Group is overhauling Westfield Knox and will install German discount supermarket Aldi, which will join Woolworths in the centre’s supermarket expansion on the first floor, replacing Myer.

An Artist’s impression of Vicinity Centres’ Bankstown project.

Scentre has pitched the move as part of its shift towards living centres and will also undertake a casual dining precinct, a fresh food market and could put in a new library.

JLL head of capital markets Fergal G. Harris said accelerating e-commerce and consolidation of the traditional tenant base was presenting owners and new investors with significant repositioning opportunities. “However, financing mixed-use or alternate-use development pipelines has been a constraint for major owners of retail. Raising equity is challenging for single-sector retail funds and although some have debt capacity, owners are taking a conservative approach towards pushing gearing in the current uncertain environment,“ he said. Asset sales and capital partnerships would be the preferred methods for forging ahead with redevelopment opportunities.

“We think there will be a series of transactions over the next 12-24 months to raise capital to facilitate development,” he said.

At The Glen in Melbourne last year, Golden Age completed 500 apartments above the Vicinity Centres retail centre. Box Hill Central in Melbourne, also by Vicinity, is another longer-term play.

JLL joint heads of retail investments Sam Hatcher and Jacob Swan also said alternate uses through redevelopment would grow in importance.

“Mixed-use developments provide the biggest value-add opportunity for landlords. They diversify the income stream while not creating additional competition for existing retailers and drive customer engagement and ultimately, asset values,” they said.