Tower bounce: resources capitals lead the way out

240 Queen St in Brisbane.

Investors are backing the recovery of the nation’s office market, with the resources capitals of Brisbane and Perth shifting into gear with major transactions worth more than $600m under way.

The cities were the least affected during the pandemic and by the shift to working-from-home which is slugging offices in the southern states, and their leasing markets are showing healthy signs.

Astute investors are now backing the Queensland capital’s improving leasing fundamentals, with nimble funds management company Elanor Investors Group in talks to secure the Australian Taxation Office headquarters building in the Brisbane CBD for about $180m.

While the deal at a yield of about 8 per cent shows the ongoing repricing of office assets nationally, it also shows the willingness of capital to back well-leased buildings which can be repositioned in future.

Brisbane has been the focus of activity with another funds house, Quintessential, also buying a major tower from Brookfield for about $270m, with a Lendlease fund emerging to back its ambitions.

These transactions and deal-making in Perth, where Charter Hall is offloading the Djookanup complex to a local syndicator for about $126m, show there is demand for office blocks.

Sydney is already seeing activity, with Quintessential and Hong Kong-based private equity house PAG swooping on CBD towers sold by Dexus at discount and with suburban blocks worth about $180m trading.

But Brisbane is leading the way in the latest bout of deals.

The city has gone against the grain of rival capitals that have been hit by rising vacancy rates, as its office landlords have ridden strong economic growth and the tightening space market.

Brisbane is leading the way in the latest bout of deals.

Queensland’s economic growth has outstripped NSW and Victoria, fuelling solid leasing demand, with net absorption of 60,000sq m of space in the past 12 months.

The net supply of office space has been near flat over the last year, with the vacancy rate down from 15.4 per cent to 12.6 per cent, and gross effective rents up by 7.6 per cent in the last 12 months.

Soaring construction costs have also stalled some new office schemes, which could prompt a shortage of space in coming years, and boost returns from existing towers.

Elanor is positioned to launch a new wholesale partnership to back the purchase of the Brisbane tower, partly as it capitalises on its integration of Challenger’s $3.4bn commercial real estate business into its platform.

In the Brisbane play, the funds company is circling 55 Elizabeth St which is being offloaded by a Credit Suisse-run international property trust, and it plans to launch a new fund to back the counter-cyclical acquisition.

Credit Suisse funds paid Grocon about $169.5m for the ATO tower on Elizabeth St in 2011 on a fund through basis. The building was in the early stages of construction and was fully leased to the tax office on a 15-year term from completion in late 2013.

JLL’s Seb Turnbull and Paul Noonan are handling the latest deal but declined to comment.

The sale of the 19,250sq m office purpose-built for the ATO, which occupies the tower’s office space on a first generation lease, is a key marker for the nation’s office market as it shows that capital will chase offices of scale.

The building, designed by BVN, spins off a cash flow with fixed 3.75-4 per cent annual increases across all leases and a five-year weighted average lease expiry.

Brisbane South Bank. Picture: Getty Images

Big capital is already playing a role in other deals.

Lendlease’s funds arm is backing a trust set up by Quintessential to hold a Brisbane skyscraper it is buying from Brookfield for about $270m.

The Canadian funds giant put the block at 240 Queen St on the market earlier this year, but Quintessential first finished its deal to buy a Sydney tower from the listed Dexus, at 16 per cent discount to its December book value. That $293m sale of 1 Margaret St had been months in the making and came with an unconventional twist, with Dexus pouring $50m into the Quintessential trust buying the building.

Quintessential is showing its faith in the future of CBD offices even though the market is at a low point. It believes it canaims to turn around towers and ride their comeback, and it is again likely to partner up to get its deal over the line.

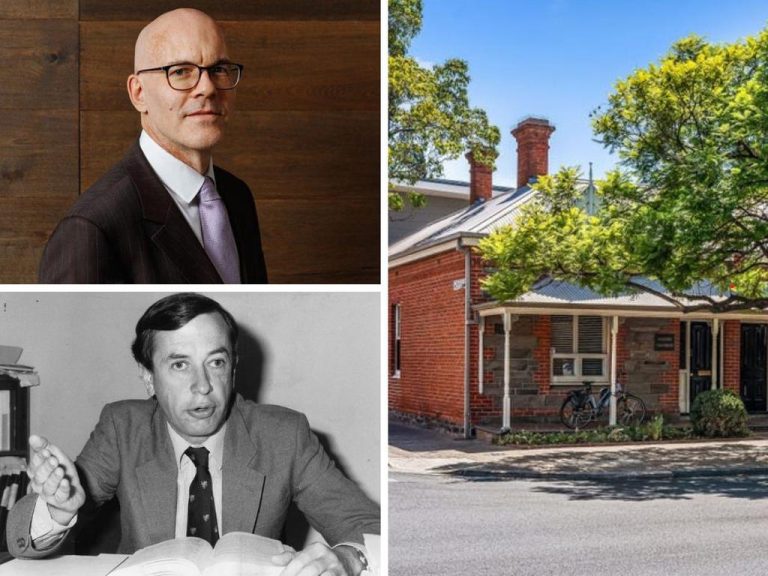

Lendlease’s funds arm has become more active in backing other groups making acquisitions. It teamed with WA-based Realside to acquire the office skyscraper at 108 St Georges Tce in the Perth CBD for $339.75m. That building was developed in the 1980s by entrepreneur Alan Bond.

Lendlease also backed funds manager Marquette Properties when it bought 12 Creek Street, the Blue Tower complex, in Brisbane, in a deal with a headline price of about $420m.

Dexus and its fund partner received a net $391m from the transaction and will put the proceeds back into new projects in the city.

The Lendlease-run fund took a 49 per cent stake in the partnership which bought the tower.

Melbourne’s wealthy Werdiger family also sold two city office blocks to the Lendlease-run fund for about $300m last year. While the parties have declined to comment, Quintessential is considered a savvy buyer with a focus on quality assets, with the building’s long lease to the Commonwealth Bank a key drawcard.

The Brisbane purchases will give Elanor and Quintessential an exposure to the city, which is expected to benefit from further development in the lead-up to the 2032 Olympics.

The funds are following the big, wealthy investors thatwhich were first into Brisbane.

Brisbane last year saw a late run of sales, with tycoons Gina Rinehart and Sam Chong buying buildings and international investment manager Savills Investment Management also forging into the capital.

JLL’s Mr Noonan, Mr Turnbull and Kate Low and Knight Frank’s Justin Bond, Ben Schubert and Neil Brookes are handling the latest sale for Brookfield but did not comment.

The 27-level A-grade building has 27,632sq m of net lettable area, made up of 24,922sq m of offices and 2710sq m of retail space, with 94 car bays. It is on a 2127sq m site at the entrance to the Queen Street Mall and surrounded by Brisbane’s premier luxury retail precinct.

The bank has occupied the three levels of retail space in the building since it was built, and its lease runs until September 2029. It has a weighted average lease expiry of 4.18 years and is about 93 per cent occupied.

With the Queensland capital’s office market running as the strongest in the nation, with strong effective rental growth and record low vacancy underpinned by GDP and population growth, more deals are to come.