Vicinity takes full control of Sydney mall with hopes of building $1.5bn luxury destination

Chatswood Chase

Shopping centre owner Vicinity Centres is doubling down on its exposure to the still booming luxury retail market and has snapped up a near-half stake in Chatswood Chase in Sydney for $307m and will pursue a major redevelopment.

The move comes as luxury retailers seek to expand even amid broader weakness in consumer confidence and rising interest rates biting into spending.

It is a rare bet on expanding a shopping centre in the wake of the pandemic, which saw a big shift towards e-commerce and a jump in construction costs. Mall owners have been dealing with department stores handing back space and pressure on weaker chains but have insisted that top end spending is holding up.

The ASX-listed company is already backing both destination shopping and mixed use development at Melbourne’s Chadstone Shopping Centre, which it co-owns with billionaire John Gandel, as well as riding the recovery of its city portfolio.

Chatswood Chase entrance.

Across the CBD portfolio retail sales growth was strong in the second half, underpinned by a 30 per cent uplift in visitation, with the steady return of office workers to CBDs and the continued recovery of international tourism, now at 77 per cent of pre-Covid-19 numbers.

Vicinity chief executive Peter Huddle said that premium retail assets such as Chatswood Chase were a key pillar of the company’s strategy and were an important enabler of resilient income growth through cycles.

“While we retain the right to nominate another purchaser prior to settlement, we are nonetheless pleased to take full control and expedite our board-approved redevelopment of the asset,” he said.

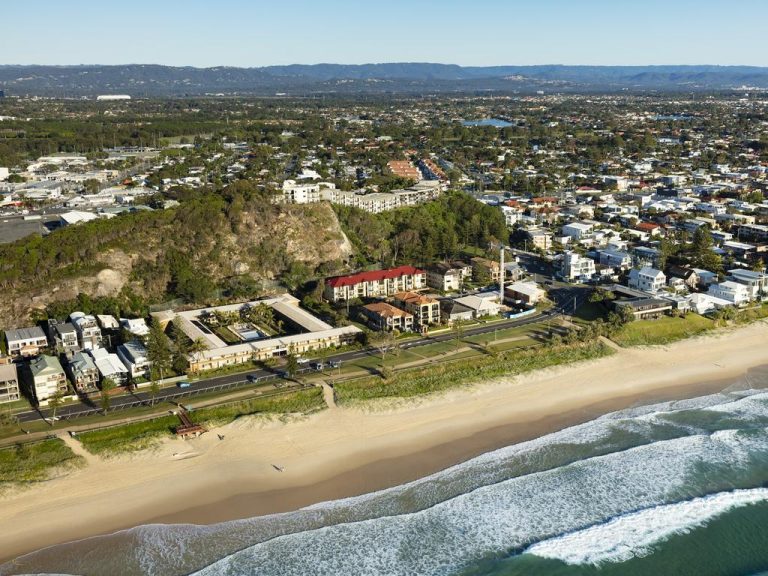

Chatswood Chase is a regional shopping centre on Sydney’s wealthy north shore and is set to undergo a major expansion. Vicinity faces a major outlay on the centre, with the redevelopment to cost $620m and kick off next March.

The centre will be worth $1.5bn when finished, generating a development profit of more than $200m, and pre-leasing is already well progressed.

The move marks Vicinity taking back full control of the centre after six years of co-owning it with Singapore’s GIC. In 2017, Vicinity Centres and GIC had agreed to swap a series of assets worth a combined $1.1bn.

The groups exchanged a 49 per cent stake in Vicinity’s Chatswood Chase in Sydney – then worth $562.3m – for a 50 per cent stake in GIC’s Queen Victoria Building, The Galeries and The Strand Arcade, then worth $556m.

That swap gave Vicinity a greater exposure to the Sydney CBD centre. But GIC has exited some of its large local malls and in 2021 sold its stake in the three central business district properties for $538.2m to Hong Kong‘s Link REIT.

Mr Huddle said the redevelopment plans were one of the most transformational projects to be undertaken in Australian retail property, amid expectations that there will be a shortage of stock.

Vicinity also sold the Roxburgh Village in Victoria to an Asian investor, JY Group, for $123m. The deal, brokered by CBRE‘s Simon Rooney and James Douglas, was notable as it was struck at an 8.8 per cent premium to its June book value.

Roxburgh Village is a single level subregional shopping centre in Melbourne‘s northern suburbs that is anchored by ALDI and Coles and has more than 40 specialty stores.

Vicinity earlier this year sold a 50 per cent interest in the shopping centre at Broadmeadows Central in Melbourne for $134.5m, which showed a 5.2 per cent premium to December 2022 book value. It has also sold off more than $40m worth of land.

Mr Huddle said the company was putting the capital into value-accretive developments and acquisitions of premium assets which were aligned with its strategy.

Vicinity reaffirmed its earnings guidance.