Wealthy families behind Australia’s biggest shopping centres revealed

Chadstone Shopping Centre — Australia’s biggest retail mall — is owned by the Gandel family. Picture: David Crosling

A slew of family-run companies are taking over Australia’s shopping centres, with three of the top 20 owners of the nation’s retail hubs being private offices.

From the Andrianakos family who just snapped up a half stake worth $385m in Melbourne’s Northland Shopping Centre to Perron Group who are behind a pleothora of Perth’s shopping centres, there are a number of influential families making moves in the retail space.

JLL research revealed YFG Shopping Centres, Perron Group and Leda Holdings Pty Ltd — all private offices — were featured in the top 20 owners of Australia’s shopping centres, competing with listed groups, institutional investors and super funds.

RELATED: Justin Hemmes’ Merivale to transform Melbourne car park into hospitality zone

Williamstown: Buyers circling to snag this rare pub and turn it into new home

Frankston Hospital’s $1.1bn redevelopment unlocks prime retail spaces

JLL retail investments head Sam Hatcher said private offices had always been major owners and investors in the nation’s shopping centres because they’d identified their value and suggested there was no better real estate asset class to take a long-term view on.

“Shopping centres are major pieces of infrastructure which are largely irreplaceable,” he said.

“The peak construction of regional shopping centres, so major shopping centres, was in 1977. So we’re almost 50 years past peak construction period.

“There’s zero under construction in Australia currently. So logic says that improving tenant performance and tenant demand with zero supply will result in increases in asset value.”

Nikos Property Group has a 50 per cent stake in Broadmeadows Central in Melbourne.

Mr Hatcher said there were very high net worth families behind some of those private offices.

CBRE retail capital markets head Simon Rooney said buyers were taking advantage of discounts on shopping centres present in the market at the moment.

“The price adjustments occurring today are more a function of shifts in spending habits due to Covid and the ongoing cost of living crisis and less because of the long-run impacts of e-commerce growth,” Mr Rooney said.

Regional malls have taken the biggest hit since the Covid, and had not recovered to pre-pandemic levels.

But Mr Rooney said they still were the most valuable retail assets in Australia and were liklely to hold their value moving forward given their premium locations, connectivity and development potential.

THE ANDRIANAKOS FAMILY

The GPT Wholesale Shopping Centre Fund is selling a 50 per cent interest in Northland Shopping Centre

Nick Andrianakos immigrated from Greece to Australia in 1966 and initially worked as a forklift driver for the Pratt family.

He later purchased a petrol station and after 10 years, had acquired many under the company Milemaker Petroleum which he sold to Caltex Australia in 2017 for $95m.

Mr Andrianakos started buying up large land holdings across the nation in the 1990s and 2000s.

His son, Theo joined the business and now the family office owns office buildings and shopping centres in Melbourne, Brisbane and Adelaide.

John Gandel founded Gandel Group of Companies which owns Chadstone in Melbourne. Picture: Hamish Blair

One of their latest moves was the purchase of a 50 per cent interest in Northland Shopping Centre for $385m in mid-February, which was Victoria’s biggest retail transaction since 2018.

Northland spans about 19ha and houses major retailers like Myer, Coles, Woolworths, Aldi, Kmart, Target and Hoyts Cinemas.

Nikos Property Group has spent a total of $828m since 2022 to acquire half stakes in four Vincinty owned and managed assets including Adelaide’s Elizabeth City Centre, Collonnades Shopping Centre and Melbourne’s Broadmeadows Central.

THE KAREDIS FAMILY

Greg Karedis joined the family business in 1987 and co-founded Arkadia with his father, Theo.

Arkadia co-founder Theo Karedis has been pursuing business ventures across Australia for 70 years.

It all started when Theo and his wife, Helen opened their first milk bar in Neutral Bay, NSW in 1955, later growing into Theo’s Liquor, with 80 stores across Australia at one stage.

The family sold the chain to Coles in 2002 and Theo and his son, Greg began owning and managing shopping centres, hotels and other investments under the company Arkadia.

Today, Arkadia owns Aspley Homemaker City in QLD, Blacktown MegaCentre in NSW and

Nunawading Homemaker HQ in Victoria as well as many other commercial assets outside of shopping centres.

THE DIMAURO FAMILY

Nick DiMauro founded Diamuro Group of Companies and his son, Michael helps run the business. Picture: Michael Marschall

Nick DiMauro went from working as a plumber to ranking as the third wealthest South Australian in 2024.

He purchased his first shopping centre in Adelaide in 1995 and has amassed nearly $1.3bn investing in office buildings including Sefton Plaza Shopping Centre, Craigmore Villa Shopping Centre, Northern Gateway Shopping Centre and Armidale Plaza Shopping Centre, to name a few.

Now, he and his son, Michael manage the DiMauro Group of Companies property portfolio.

THE FU FAMILY

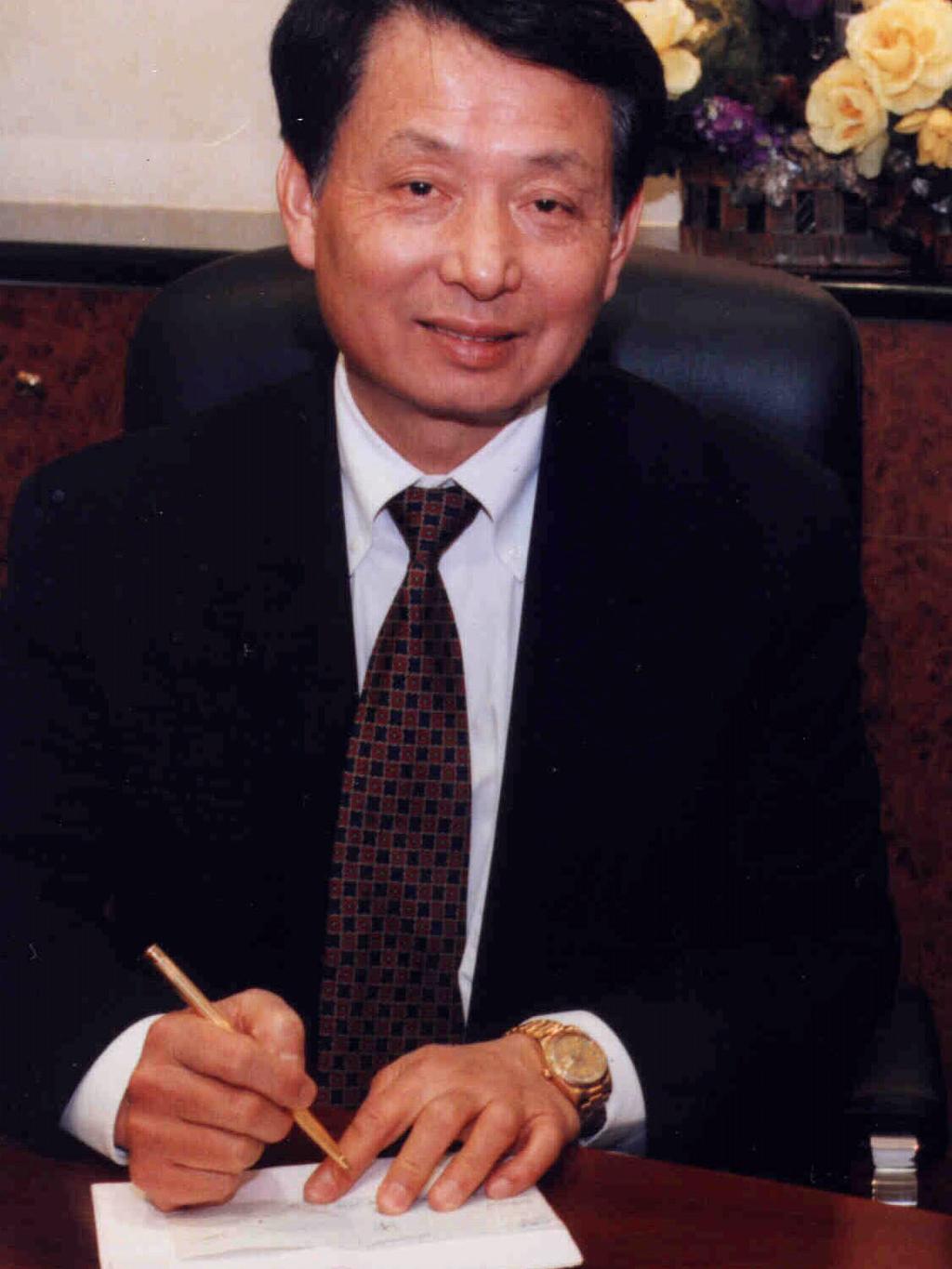

Gordon Fu founded YFG Shopping Centres which owns Australia Fair.

YFG Shopping Centres operates a number of shopping centres across southeast Queensland, founded by Taiwanese-born Gordon Fu.

Mr Fu was the son of a street vendor who worked his way up from painting cinema posters to building his real estate development empire in Taiwan before moving to Queensland in 1992.

The private company owns many shopping centres especially in southeast Queensland including Australia Fair, Strathpine Centre, Sunnybank Plaza and Toowong Village.

Their largest shopping centre is Mt Ommaney Centre, in Brisbane’s southwest.

THE PERRON FAMILY

The late Stan Perron founded Perron Group and passed away in 2018.

Another one of the biggest names in Australia’s retail sector is the late Stan Perron who established Perron Group.

Perron founded the trucking and earthing business Perron Brothers with his brother, Keith, and sold it to Thiess in 1961.

One of his greatest investments was just 500 pounds into the Pilbara in Western Australia with Lang Hancock and Peter Wright, entitling him to 15 per cent of all future royalties.

Westfield Geelong.

He was paid millions of dollars in royalties from iron ore and tantalite found in Brockman 2 mine.

Later, he began investing in real estate, and one ofhis biggest investments was his half stake in Perth’s Central Park skyscraper as well as eight shopping centres across the nation.

Some of the shopping centres Perron Group have major interests in are The Glen and three Westfield’s in Victoria, Broadway Sydney in New South Wales (NSW), and Galleria, Cockburn Gateway and Belmont Forum in Western Australia (WA).

THE ELL FAMILY

Bob Ell was a former carpenter and is executive chairman of Leda Group.

Another property empire with stature in the retail game is Leda Group, founded by Bob Ell, a former carpenter turned business bigwig from Merriwa, NSW.

Ell founded the company in 1976 and is understood to have developed properties worth more than $3bn since the company’s inception, with retail investments totalling about $1.2bn.

Bob Ell’s son, Robert Ell in 1997.

This includes shopping centres Ipswich Riverlink, Victoria Point and Morayfield in QLD as well as South Point in NSW.

His son, Robert Ell has been managing director since 1993 with Bob as executive chairman.

THE GANDEL FAMILY

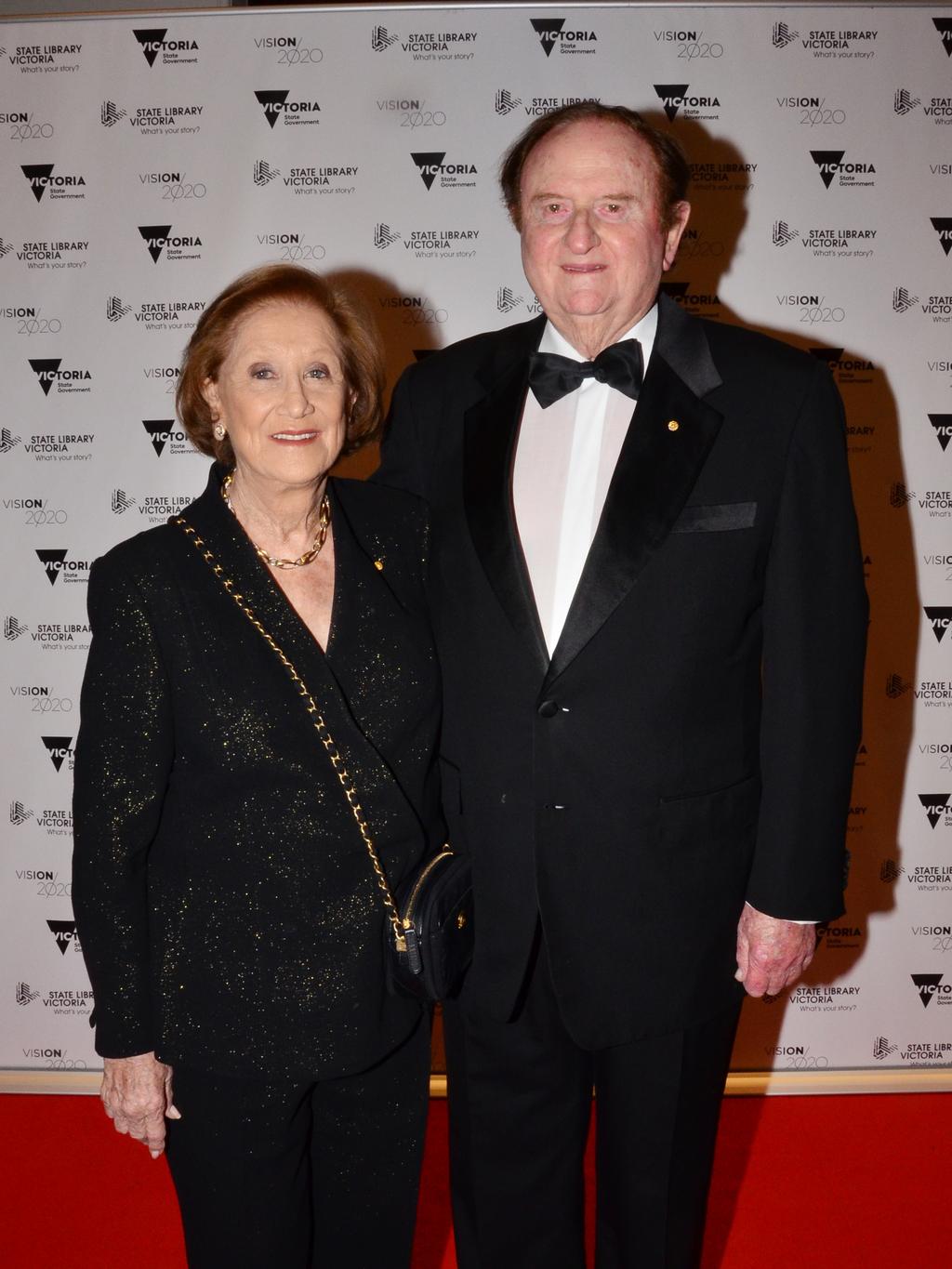

Pauline and John Gandel.

Business tycoon John Gandel grew Chadstone Shopping Centre into Australia’s biggest shopping mall, and also has major stakes in property companies like Vicinity Centres and Charter Hall.

When Gandel took over his parent’s clothing brand Sussan in the 1950s with his brother-in-law Marc Bensen, the pair grew the business into more than 200 stores.

Mr Gandel bought Chadstone Shopping Centre from Myer for $37m. Picture: Ian Currie

He then sold his half of Sussan to Mr Bensen in 1983 and bought Chadstone Shopping Centre from Myer for $37m, now valued at more than $3bn.

It’s understood Gandel is one of the richest people in Melbourne, and has since curtailed his involvement in Gandel Group putting Peter Bird as chief executive.

TOP 20 OWNERS OF AUSTRALIA’s SHOPPING CENTRES

Rank – Company Name – Buyer Type

1. Scentre Group – Listed Group/Institutional

2. Vicinity Centres – Listed Group/Institutional

3. ISPT – Super Fund

4. Stockland – Listed Group/Institutional

5. QIC Real Estate – Queensland Government Investment Fund

6. The GPT Group – Listed Group/Institutional

7. DEXUS Property Group – Listed Group/Institutional

8. Charter Hall – Listed Group/Institutional

9. SCA Property Group – Listed Group

10. Lendlease – Listed Group/Institutional

11. Aventus Property – Listed Group (HomeCo)

12. AMP Capital Investors – Unlisted Group (Dexus now)

13. YFG Shopping Centres – Private

14. Perron Group – Private

15. Primewest Management Ltd – Listed Group (Centuria)

16. Challenger Ltd – Listed Group/Institutional

17. Mirvac Group – Listed Group/Institutional

18. Sentinel Property Group – Syndicate

19. Leda Holdings Pty Ltd – Private

20. Harvey Norman – Listed Group

Source: JLL

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: How $35m Bendigo investment is changing regional housing for health workers

New $70m Tarneit shopping centre revealed: retailers set to boost property, retail and lifestyle

Prime opportunity to grab a holding in heart of Pakington St, Geelong West

sarah.petty@news.com.au